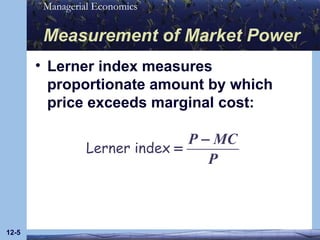

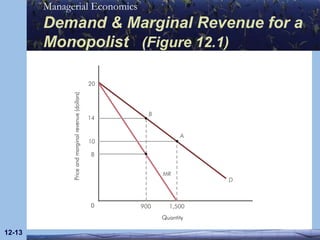

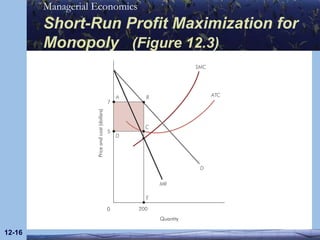

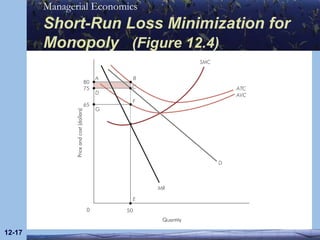

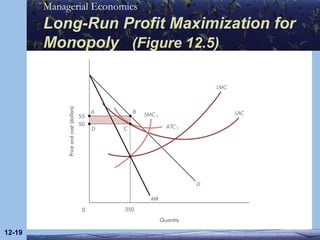

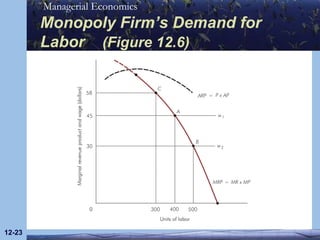

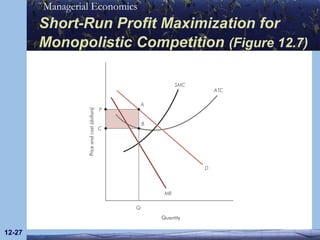

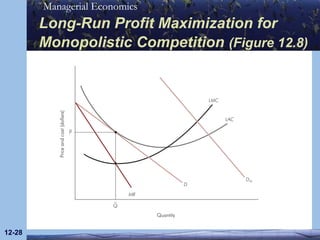

This document discusses market power and profit maximization for firms with market power. It defines market power as the ability to raise prices without losing all sales. Firms have market power if they face downward sloping demand curves. The degree of market power depends on price elasticity of demand and availability of substitutes. The Lerner index measures the proportion by which price exceeds marginal cost. Entry of new firms erodes market power by increasing substitutes. In the short run, monopolies and firms with market power maximize profits where marginal revenue equals marginal cost. In the long run, these firms adjust plant size to equalize long run average cost and price.