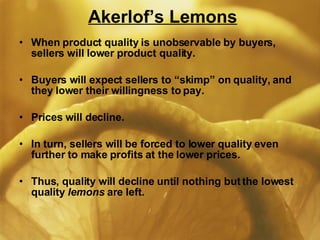

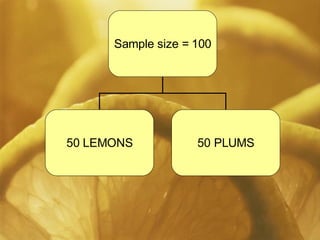

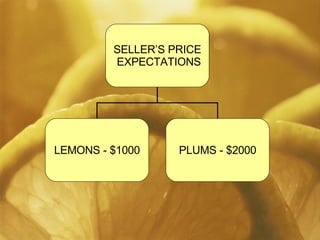

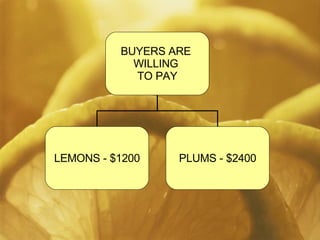

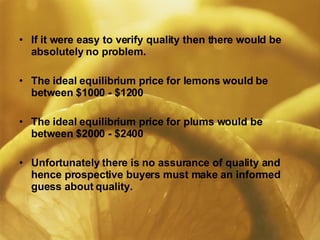

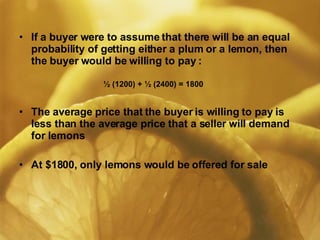

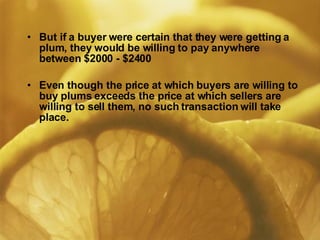

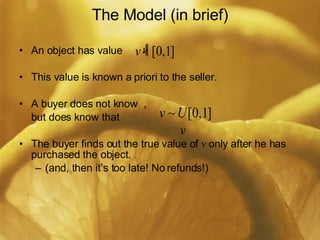

Akerlof's market for lemons theory describes how asymmetric information between buyers and sellers in a market can cause market failure. When buyers cannot reliably assess the quality of goods for sale, they will assume the average quality is lower and be unwilling to pay high prices. This forces sellers to lower prices which then incentivizes them to lower quality further. The market may reach a point where only low quality "lemons" remain for sale, even though buyers would pay more for higher quality goods if quality could be verified.