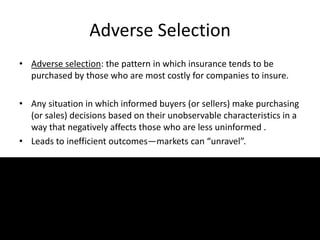

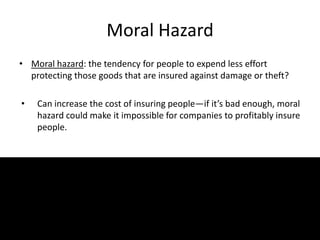

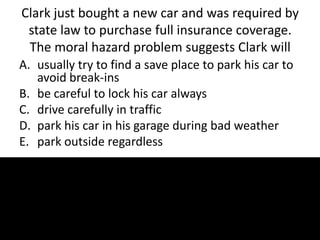

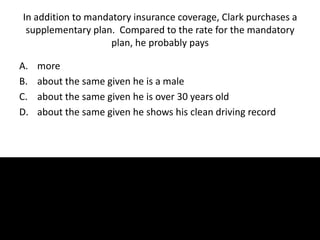

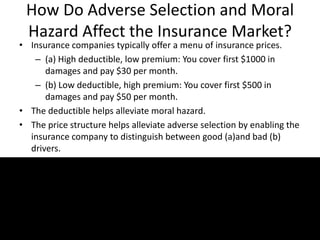

Adverse selection and moral hazard affect insurance markets. Adverse selection occurs when high-risk individuals are more likely to purchase insurance, leaving insurers with a riskier, costlier pool of policyholders. Moral hazard arises when insurance reduces incentives for careful behavior, raising costs. To address these issues, insurers offer different coverage options. High deductible plans with lower premiums alleviate moral hazard by requiring more out-of-pocket costs. A menu of prices also helps insurers distinguish between low and high-risk individuals, reducing adverse selection.