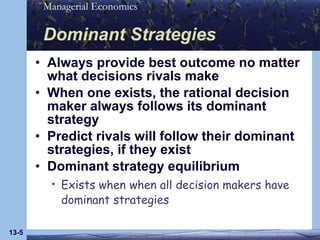

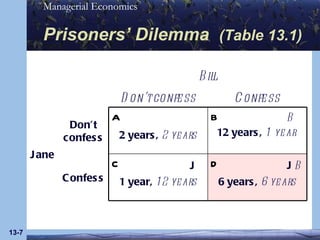

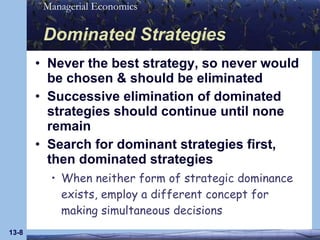

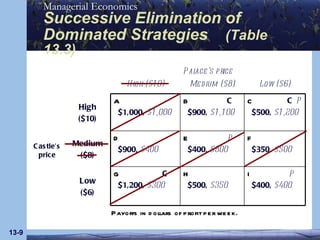

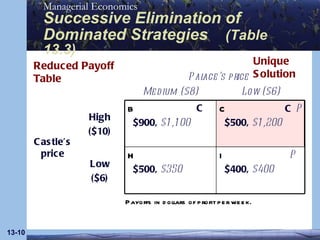

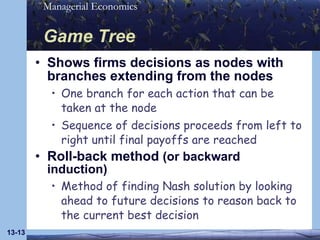

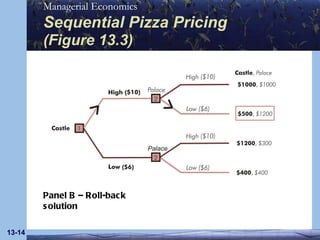

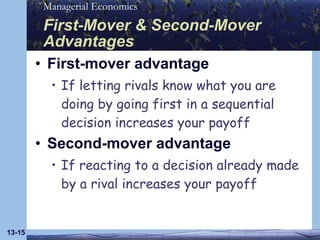

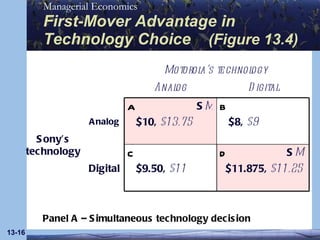

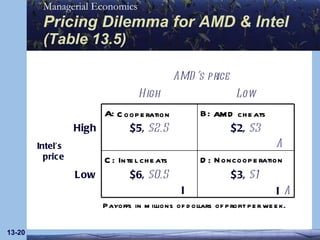

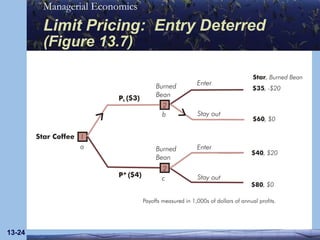

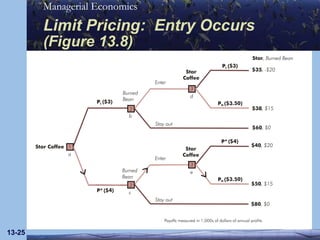

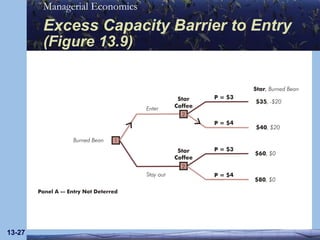

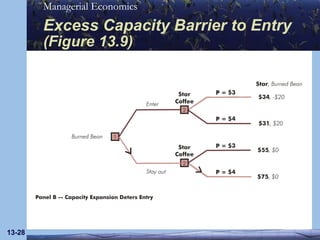

This document summarizes strategic decision making in oligopoly markets. It discusses key concepts such as interdependence between firms, game theory, dominant and dominated strategies, prisoners' dilemmas, Nash equilibria, and sequential decision making. Strategic moves like limit pricing and capacity expansion are also covered as ways for established firms to deter entry by new competitors.