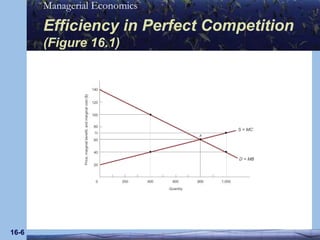

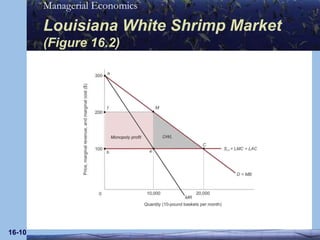

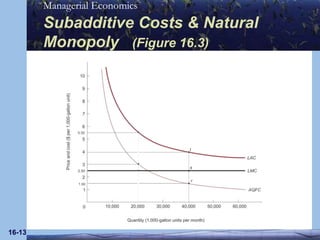

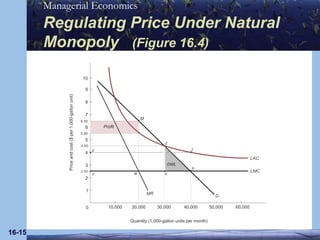

This document discusses different types of market failures that can prevent competitive markets from achieving social economic efficiency. It describes six main forms of market failure: monopoly power, natural monopoly, negative and positive externalities, common property resources, public goods, and information problems. For each type of market failure, the document explains how it undermines efficiency and decreases social surplus. It also discusses how government regulation may be needed to correct for market failures and help markets allocate resources efficiently.