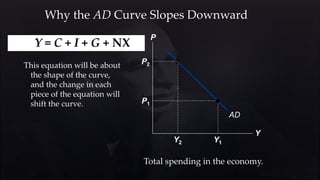

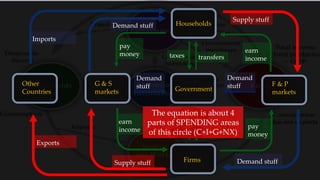

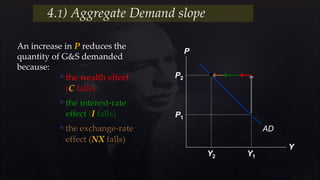

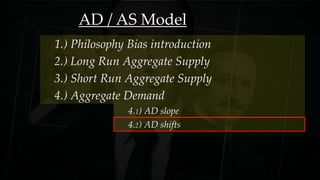

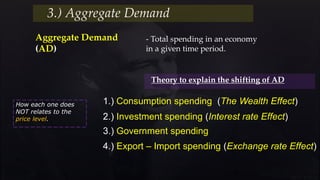

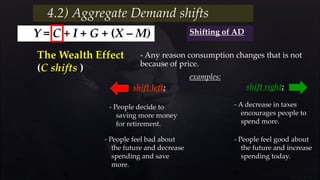

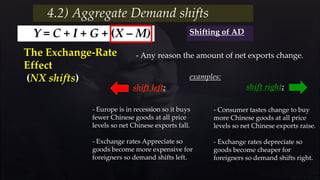

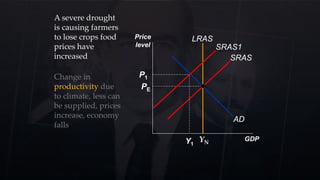

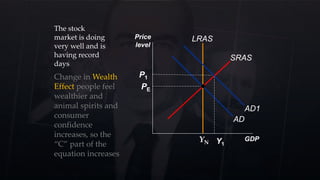

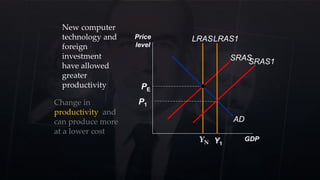

This document discusses aggregate demand and aggregate supply models. It begins by introducing the AD/AS model framework and its four components: long-run aggregate supply, short-run aggregate supply, long-run aggregate supply, and aggregate demand. It then focuses on aggregate demand, explaining the downward slope of the AD curve through the wealth, interest rate, and exchange rate effects of price level changes on consumption, investment, and net exports. It also discusses how shifts in consumption, investment, government spending, or net exports from non-price factors change the AD curve. The document provides examples and diagrams to illustrate these concepts.