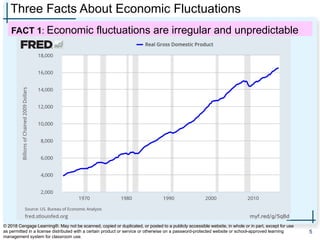

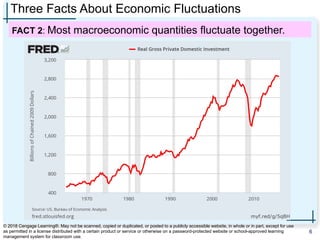

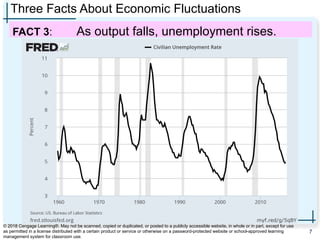

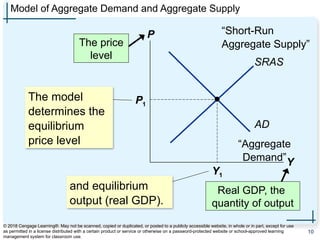

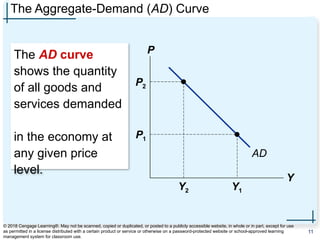

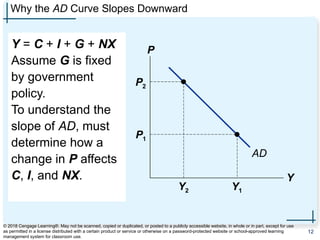

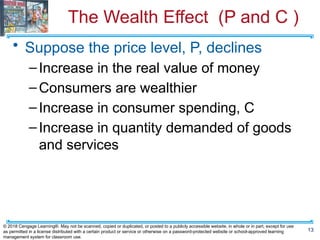

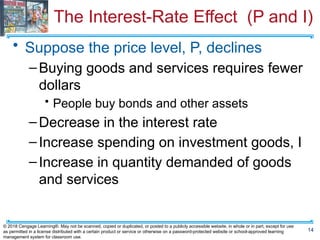

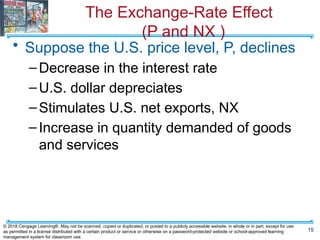

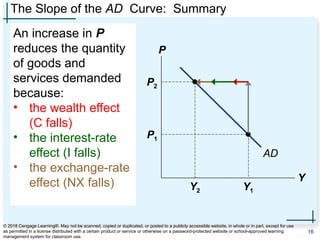

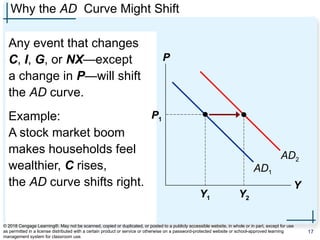

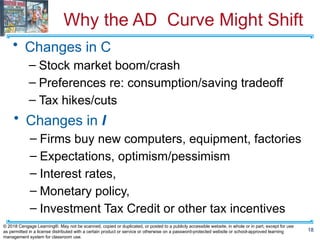

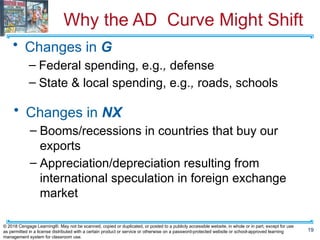

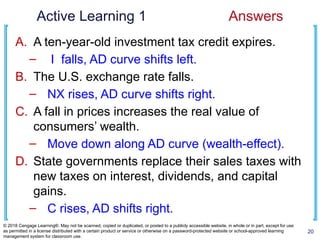

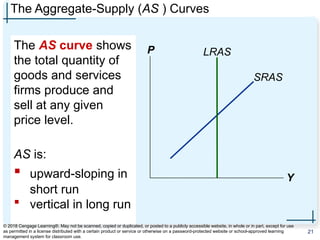

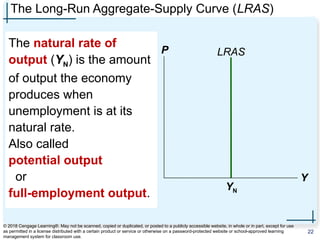

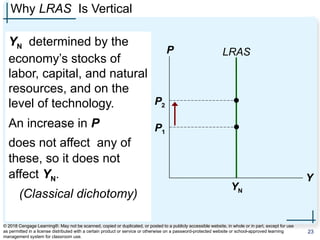

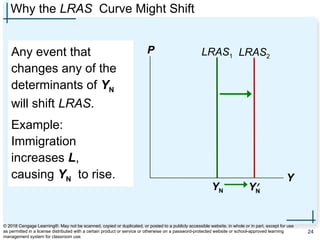

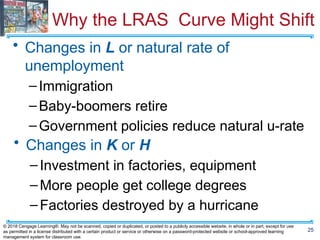

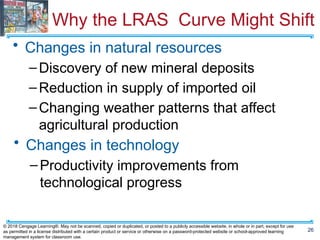

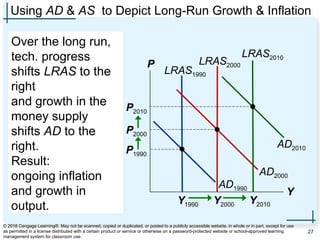

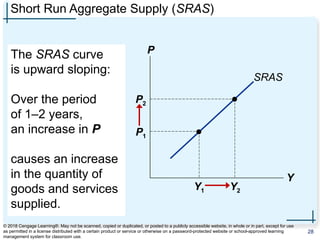

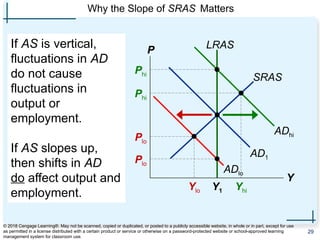

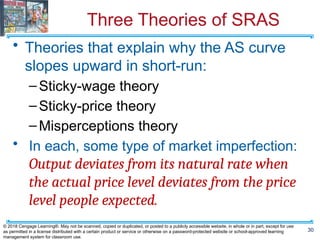

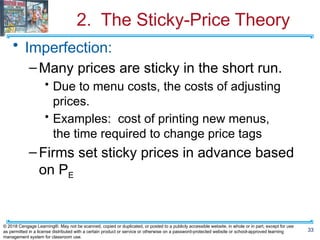

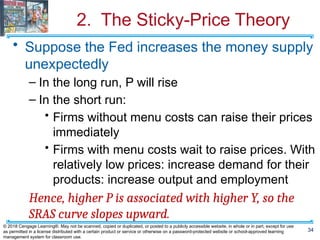

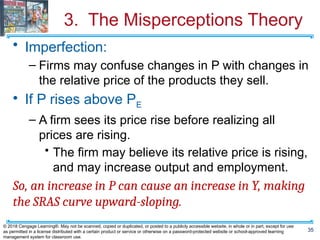

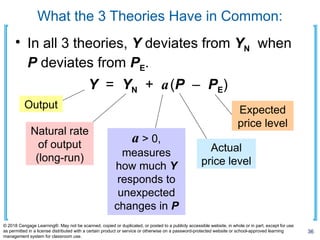

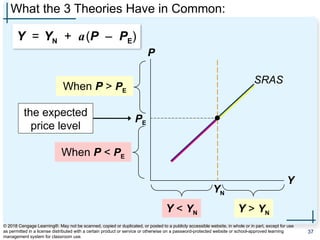

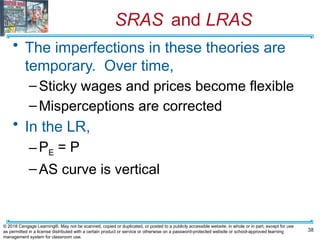

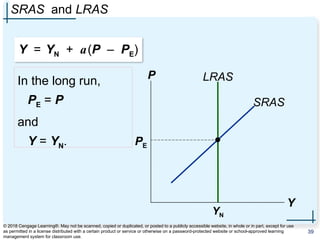

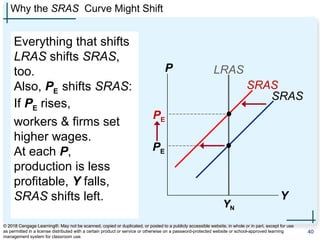

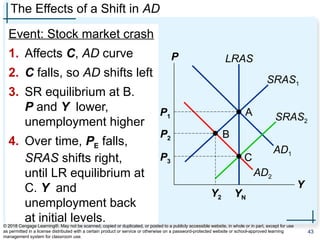

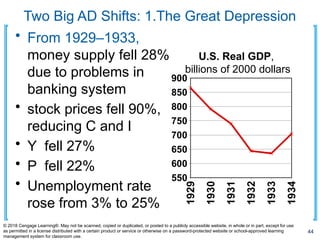

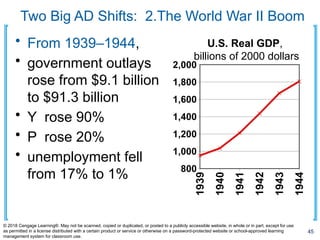

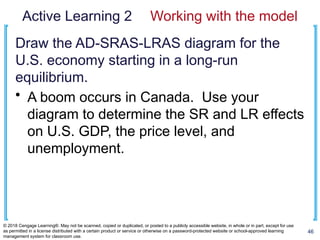

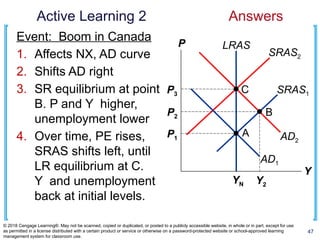

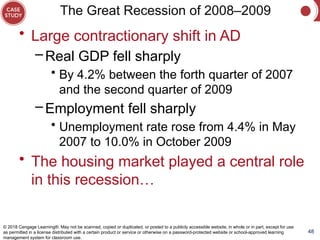

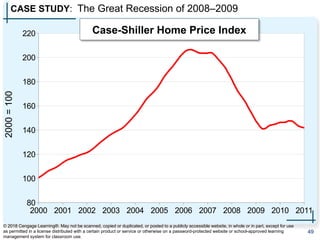

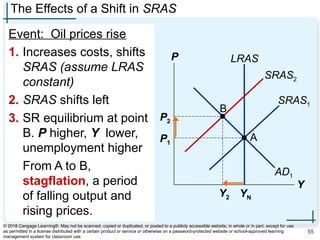

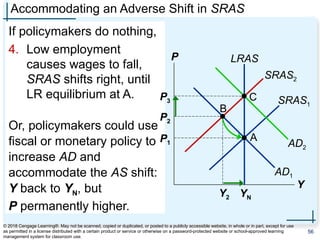

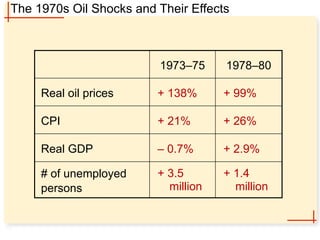

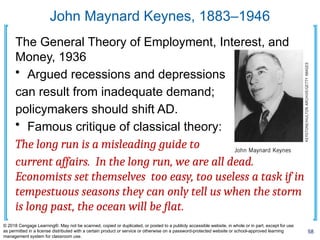

This document outlines the concepts of aggregate demand and aggregate supply, focusing on their roles in explaining economic fluctuations. It discusses key characteristics of economic fluctuations, the downward slope of the aggregate-demand curve, and the factors influencing shifts in both aggregate demand and supply. The chapter emphasizes the implications of these models for fiscal and monetary policy and the interaction of real GDP with economic trends.