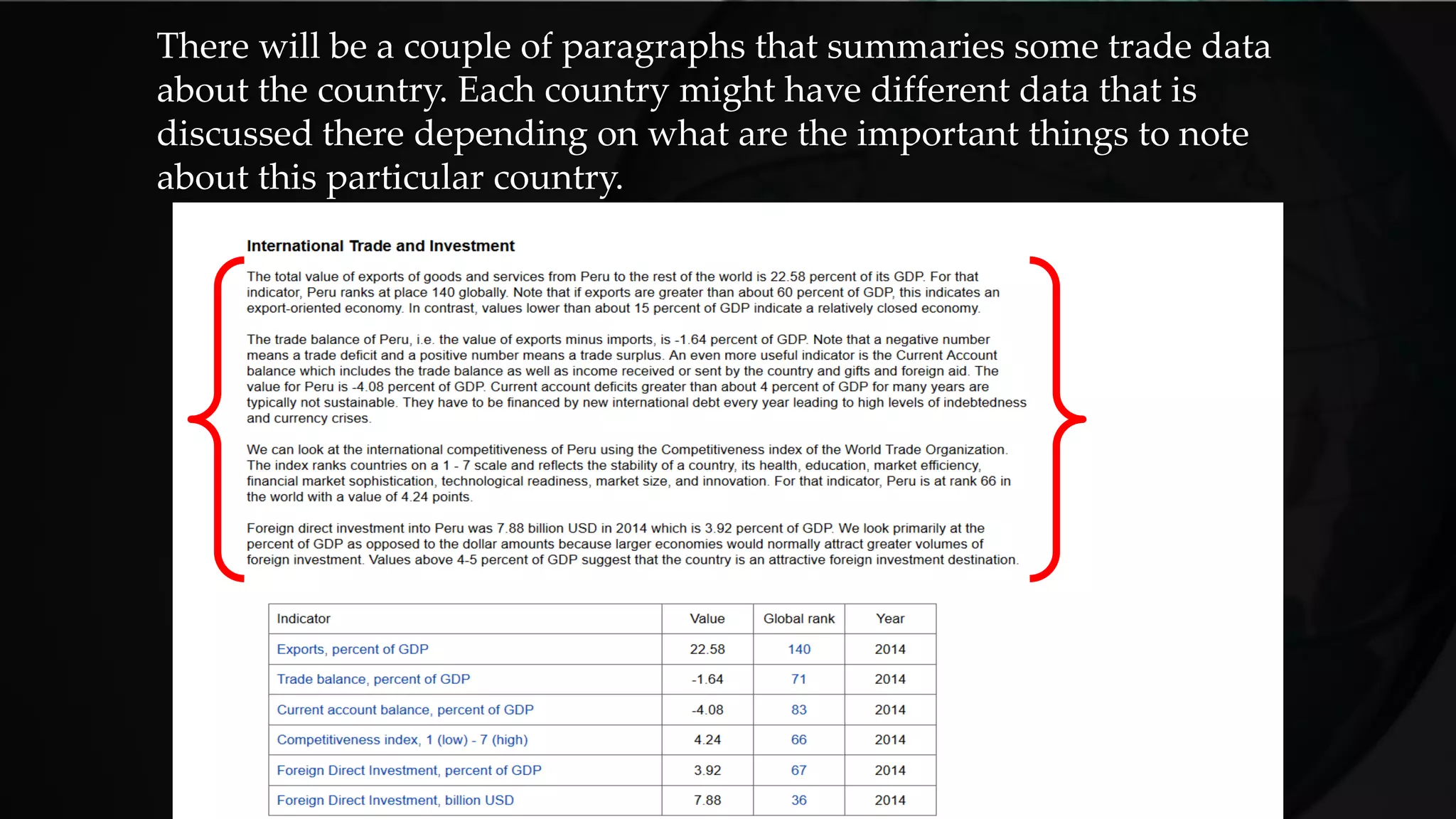

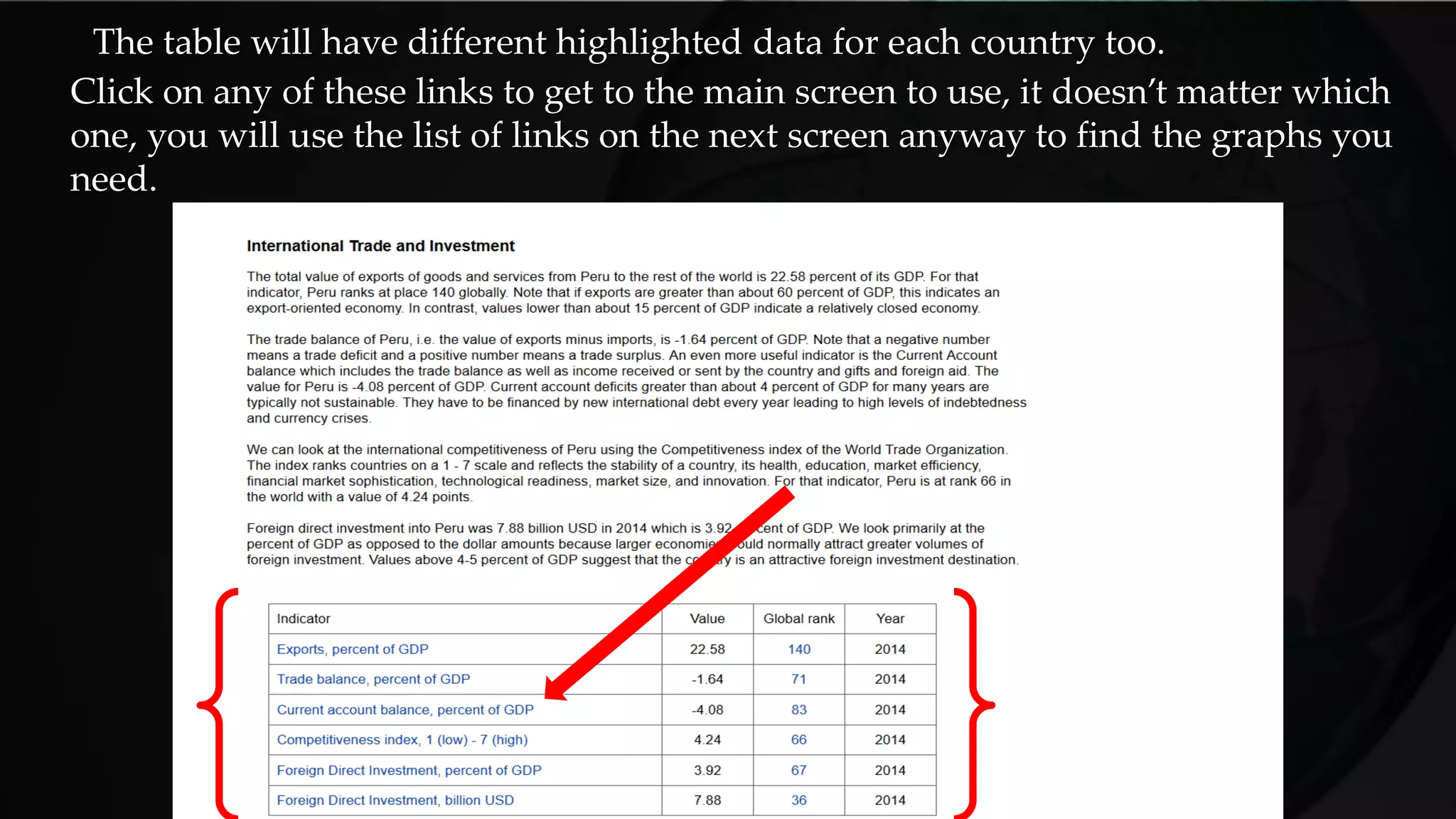

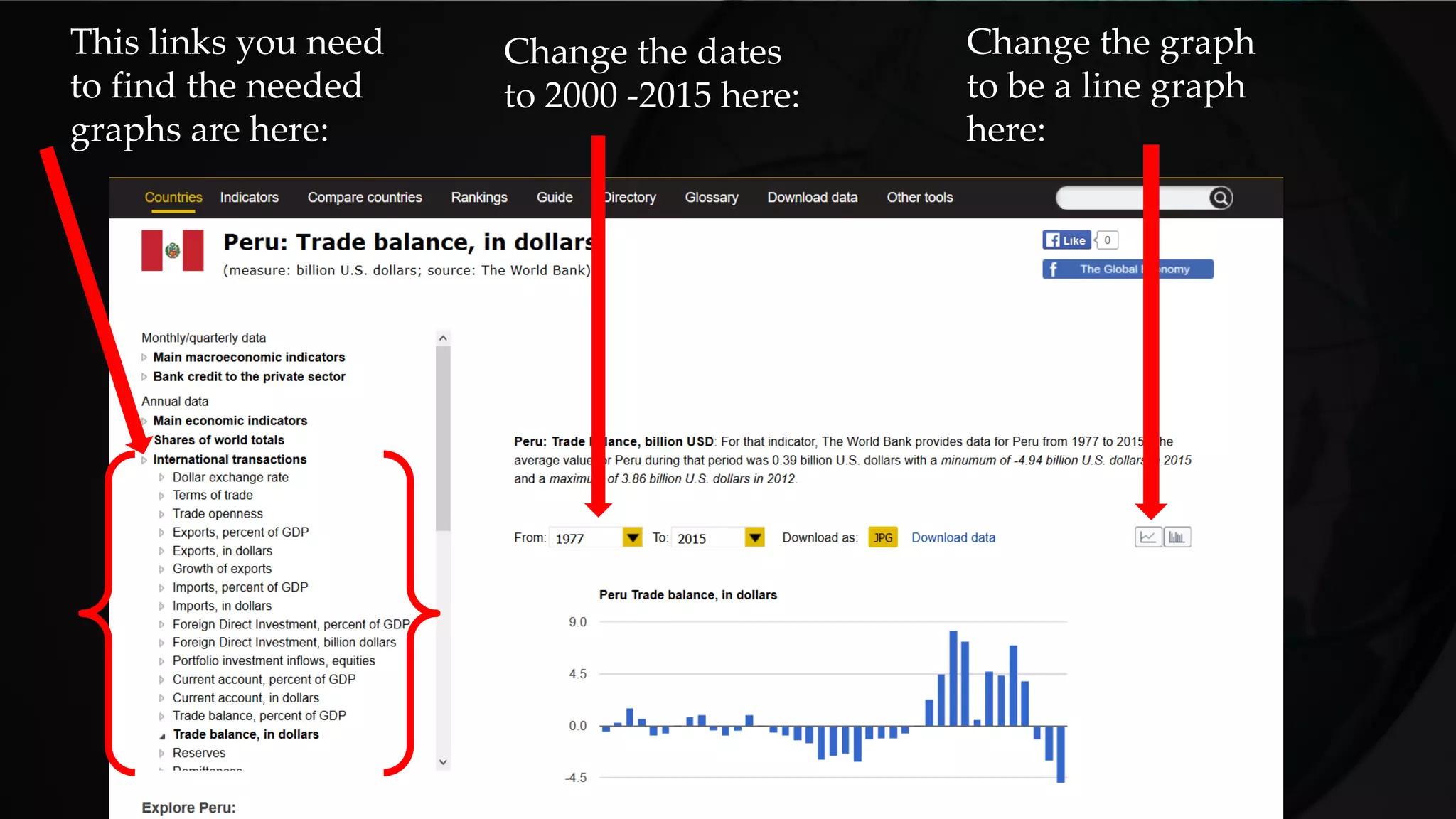

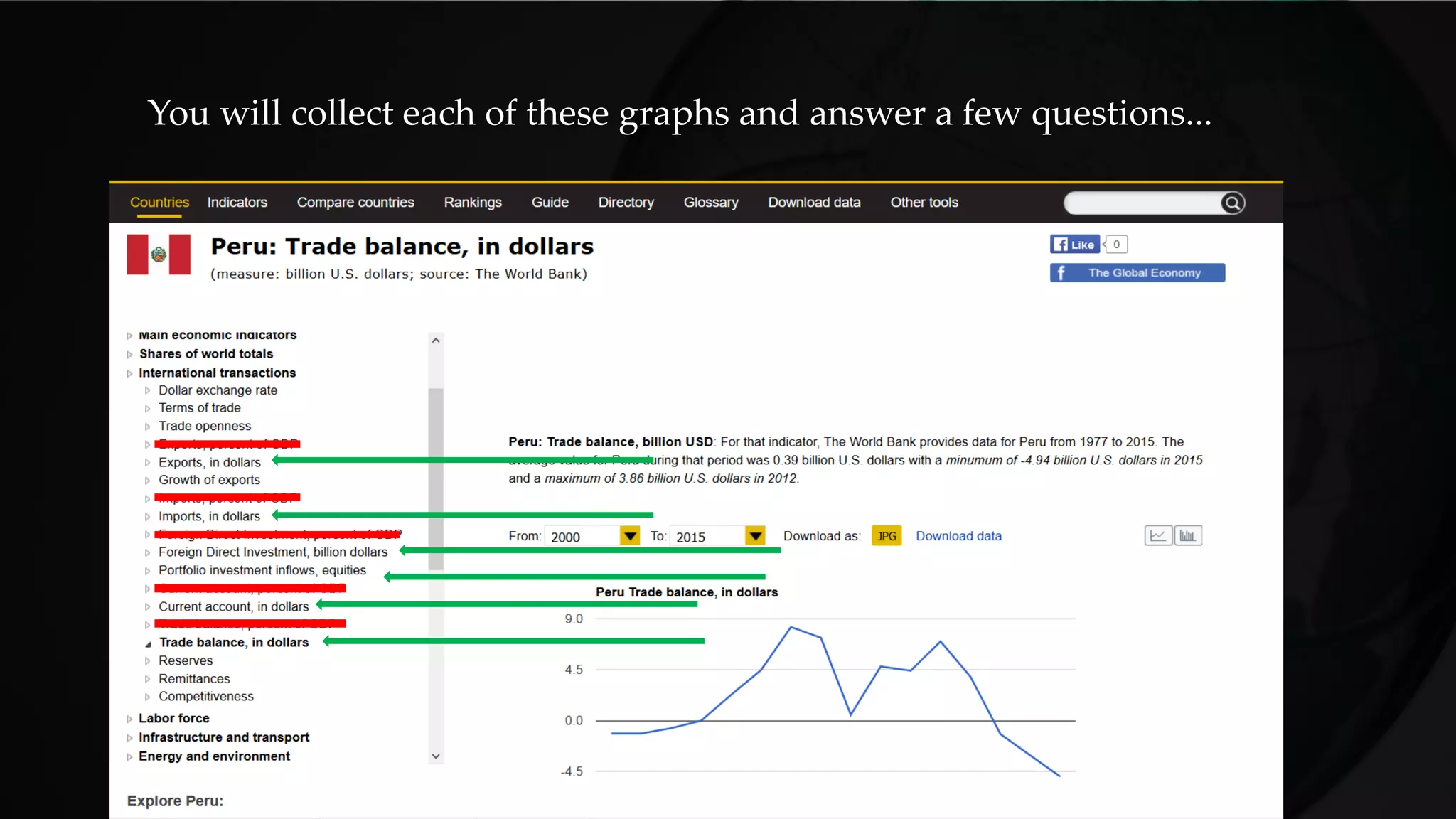

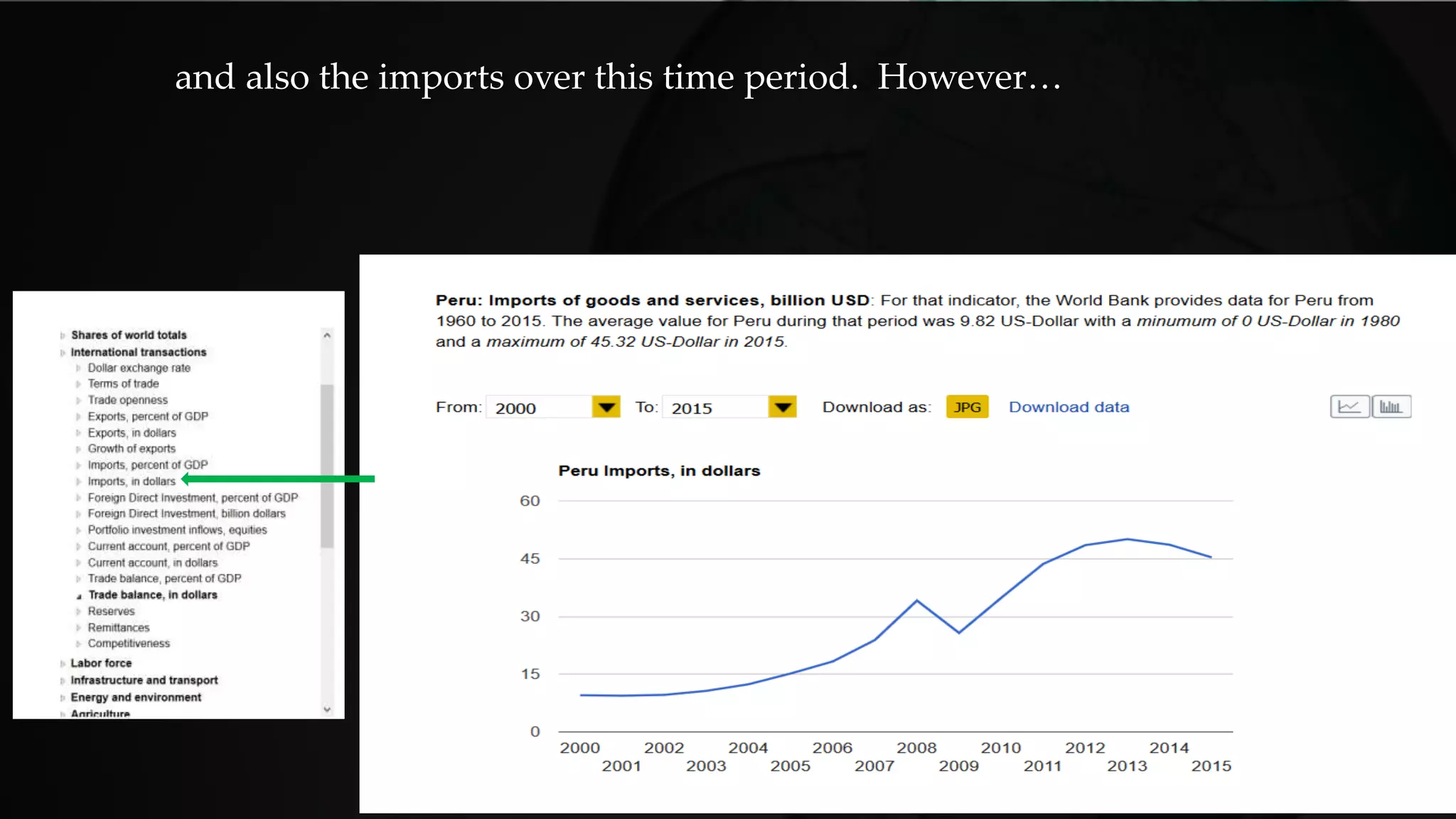

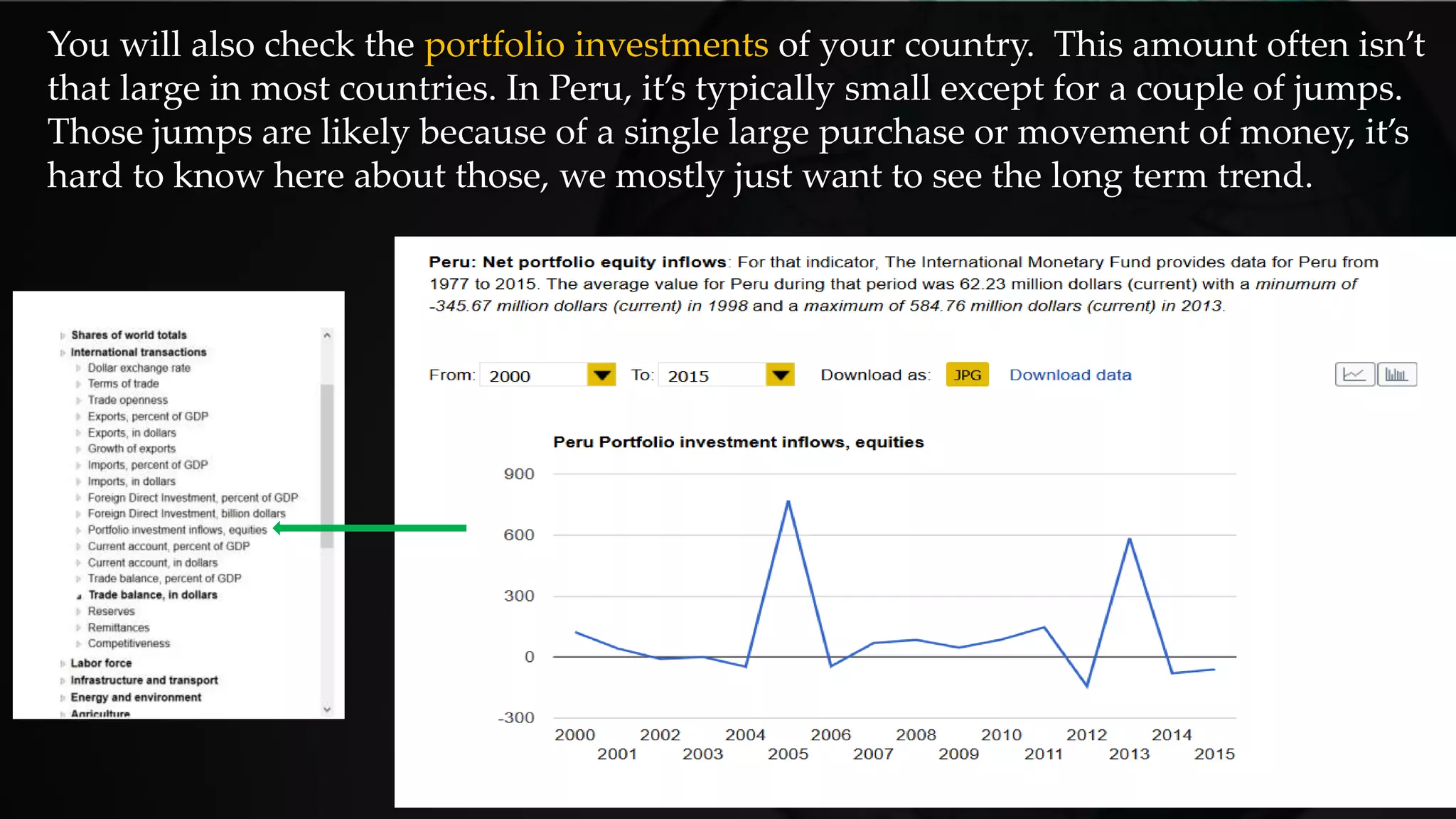

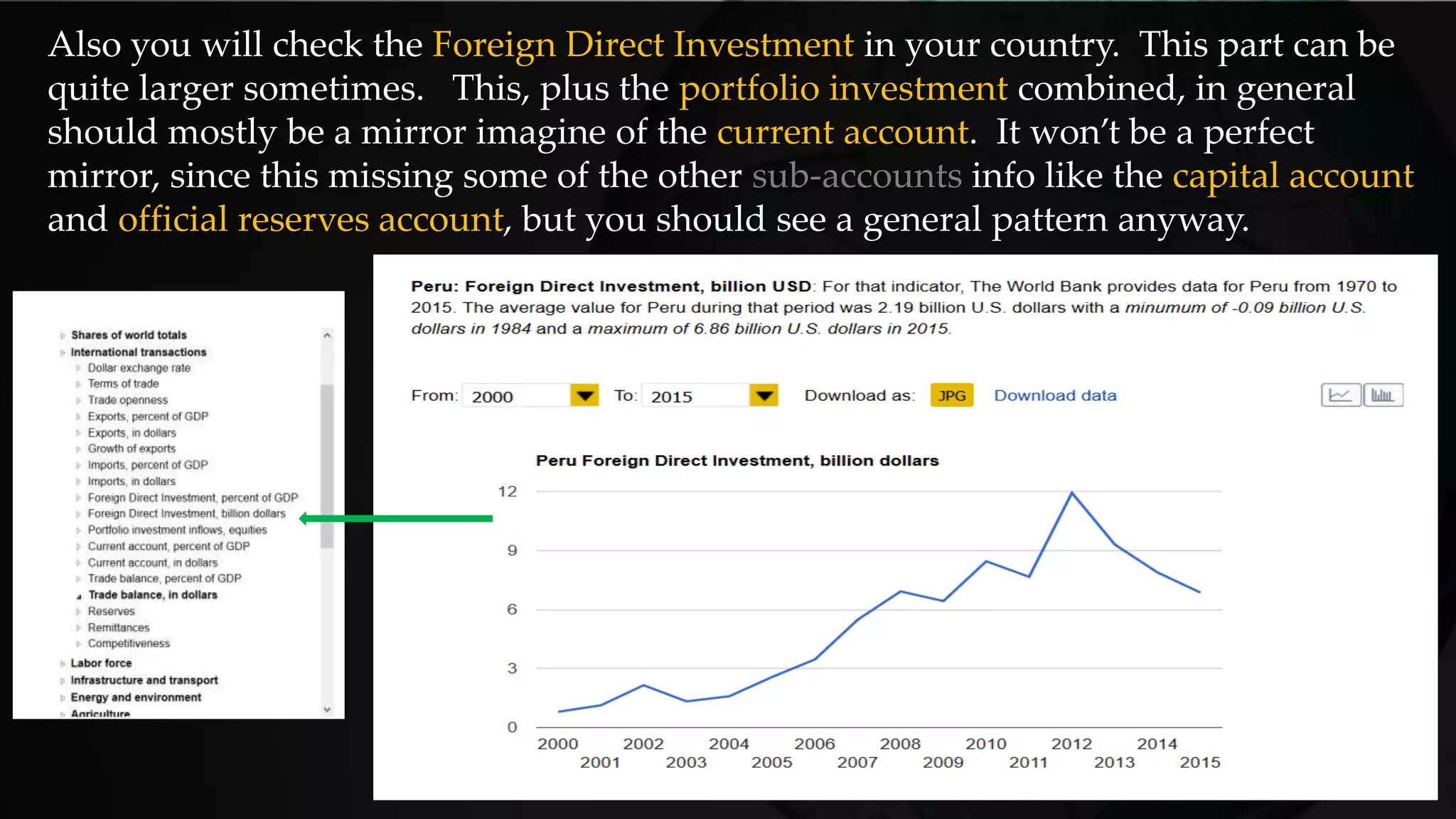

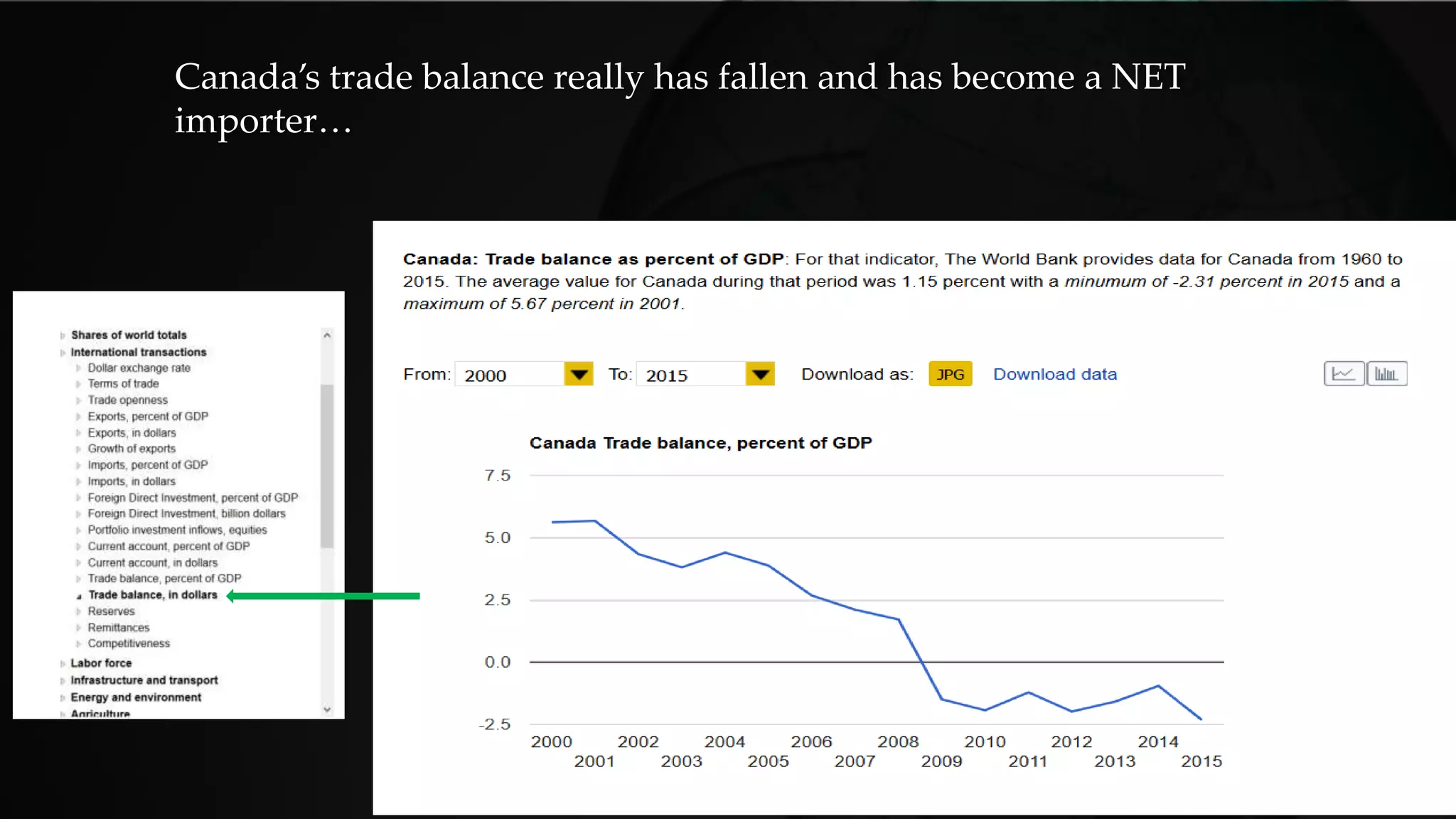

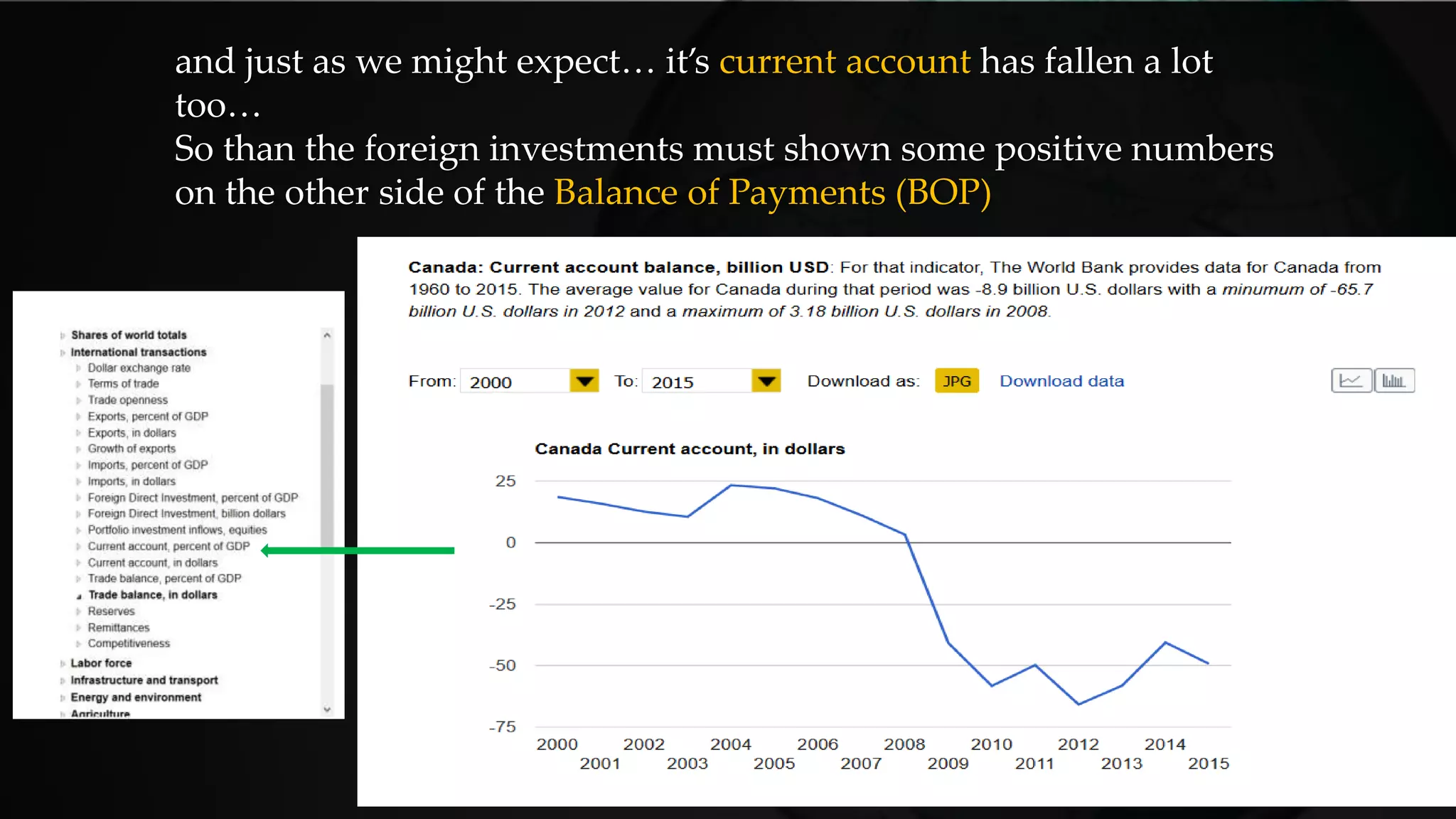

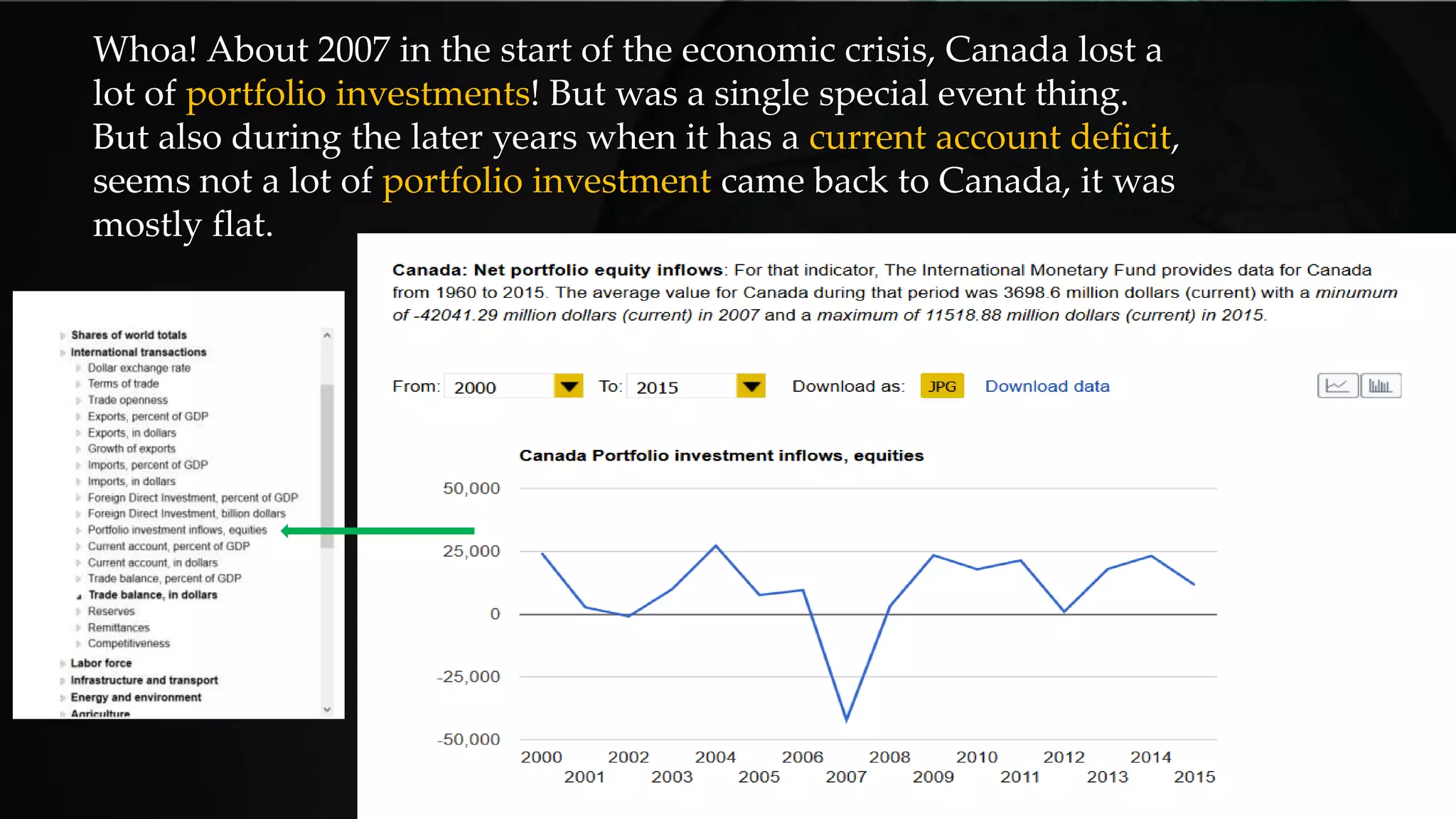

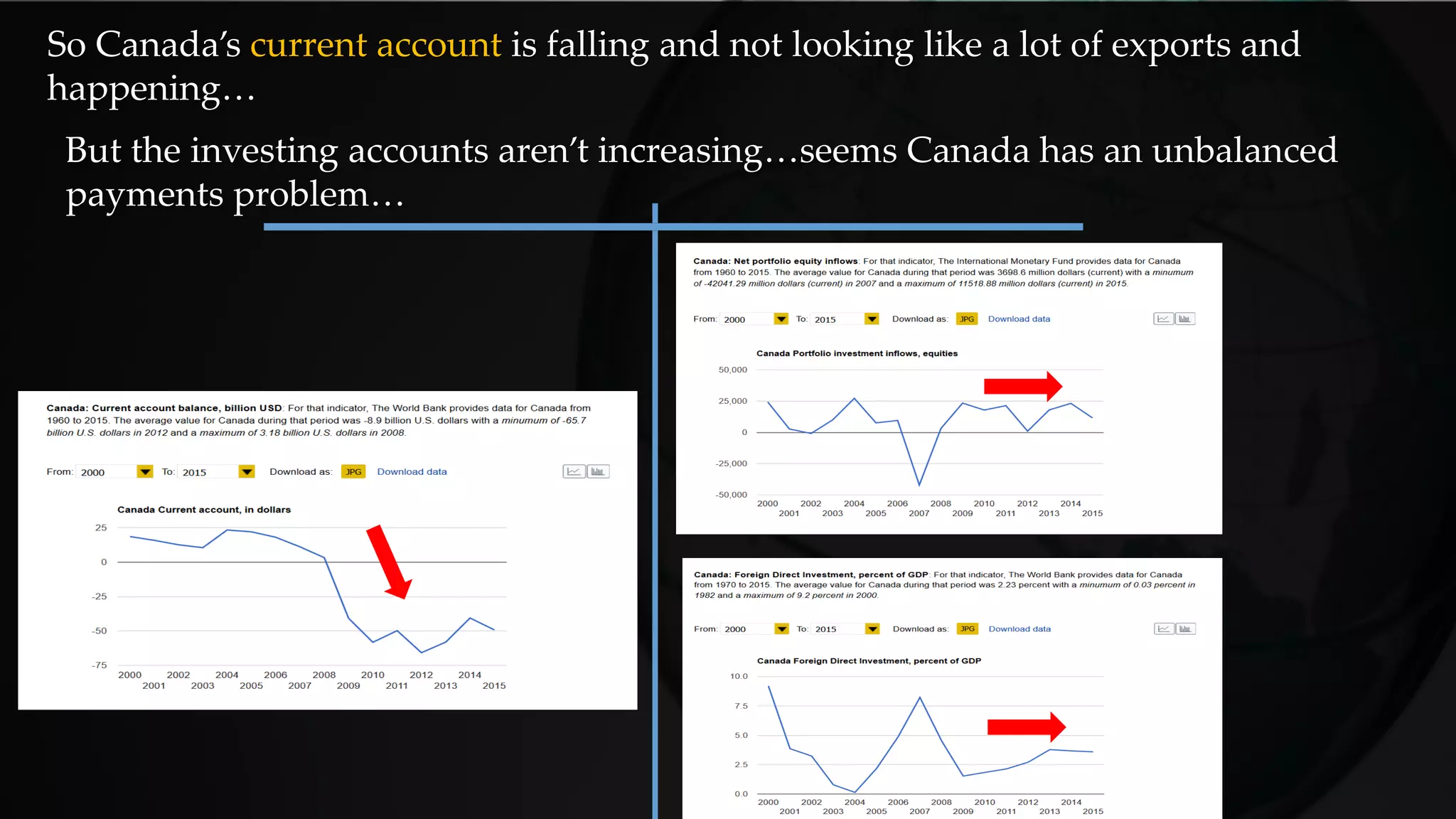

This document provides instructions for an assignment to research a country's balance of payments using two websites. Students are asked to analyze trends in their selected country's balance of trade, current account, foreign direct investment, and portfolio investment from 2000-2015. They should describe patterns between the current account and financial account and attempt to determine if the country has a balanced or unbalanced payments situation. Questions are provided for students to answer in their analysis.