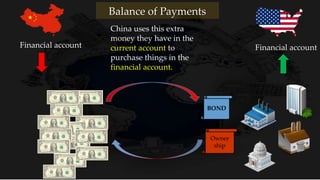

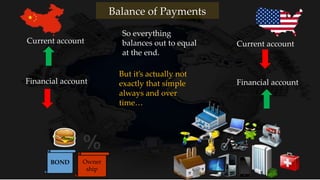

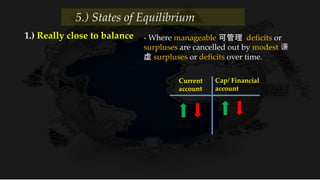

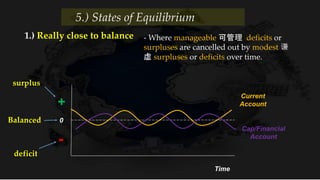

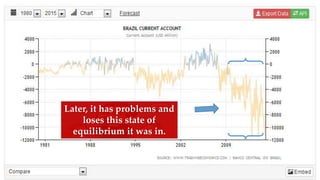

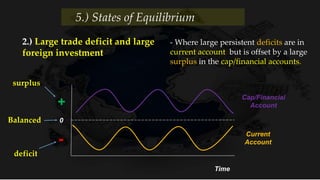

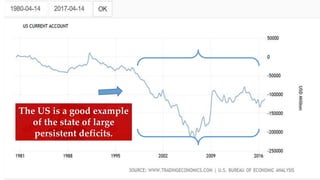

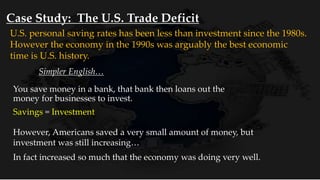

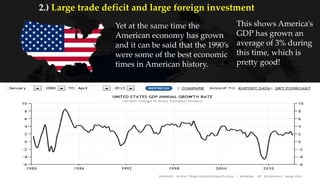

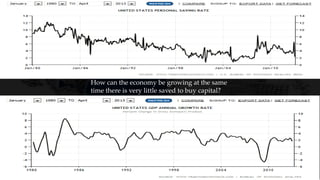

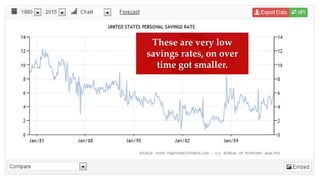

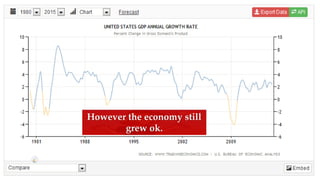

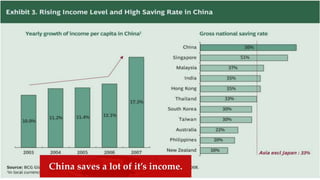

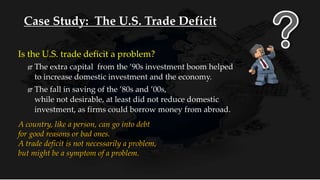

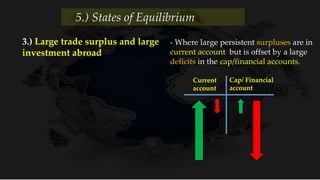

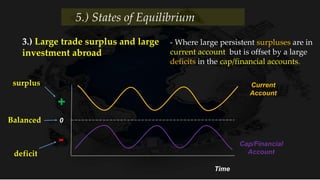

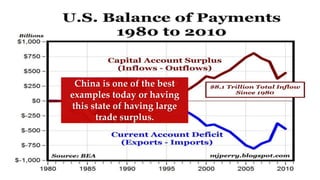

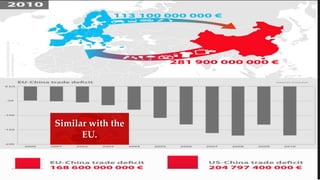

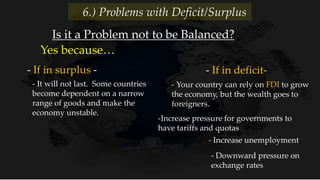

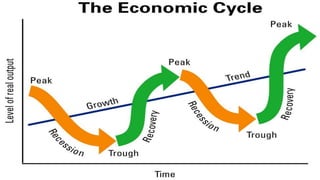

The document discusses states of equilibrium in a country's balance of payments. It describes three main states: 1) a balance that is close to zero with deficits and surpluses cancelling out over time, 2) a large trade deficit matched by a large surplus in capital/financial accounts due to foreign investment, and 3) a large trade surplus matched by deficits from investments abroad. It uses the examples of the US, which has had a large trade deficit for decades offset by foreign investment, and China, which recently had a large trade surplus. Maintaining one of these equilibrium states is ideal, but imbalances can arise from economic, political, or social changes that disrupt demand and supply of exports/imports.