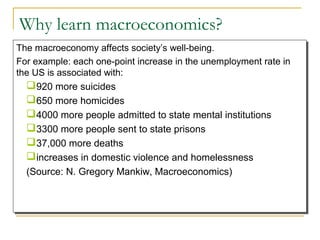

This chapter introduces macroeconomics and important macroeconomic concepts. It discusses what macroeconomists study, including issues like inflation, unemployment, recessions, government budgets, trade balances, and economic growth. It introduces tools and concepts used in macroeconomic analysis, including aggregate supply and demand, GDP, unemployment, inflation, and exchange rates. It explains why macroeconomics is important by outlining how the macroeconomy impacts society's well-being. Finally, it provides an overview of basic macroeconomic models and concepts like stocks and flows, production possibility frontiers, and the differences between endogenous and exogenous variables.