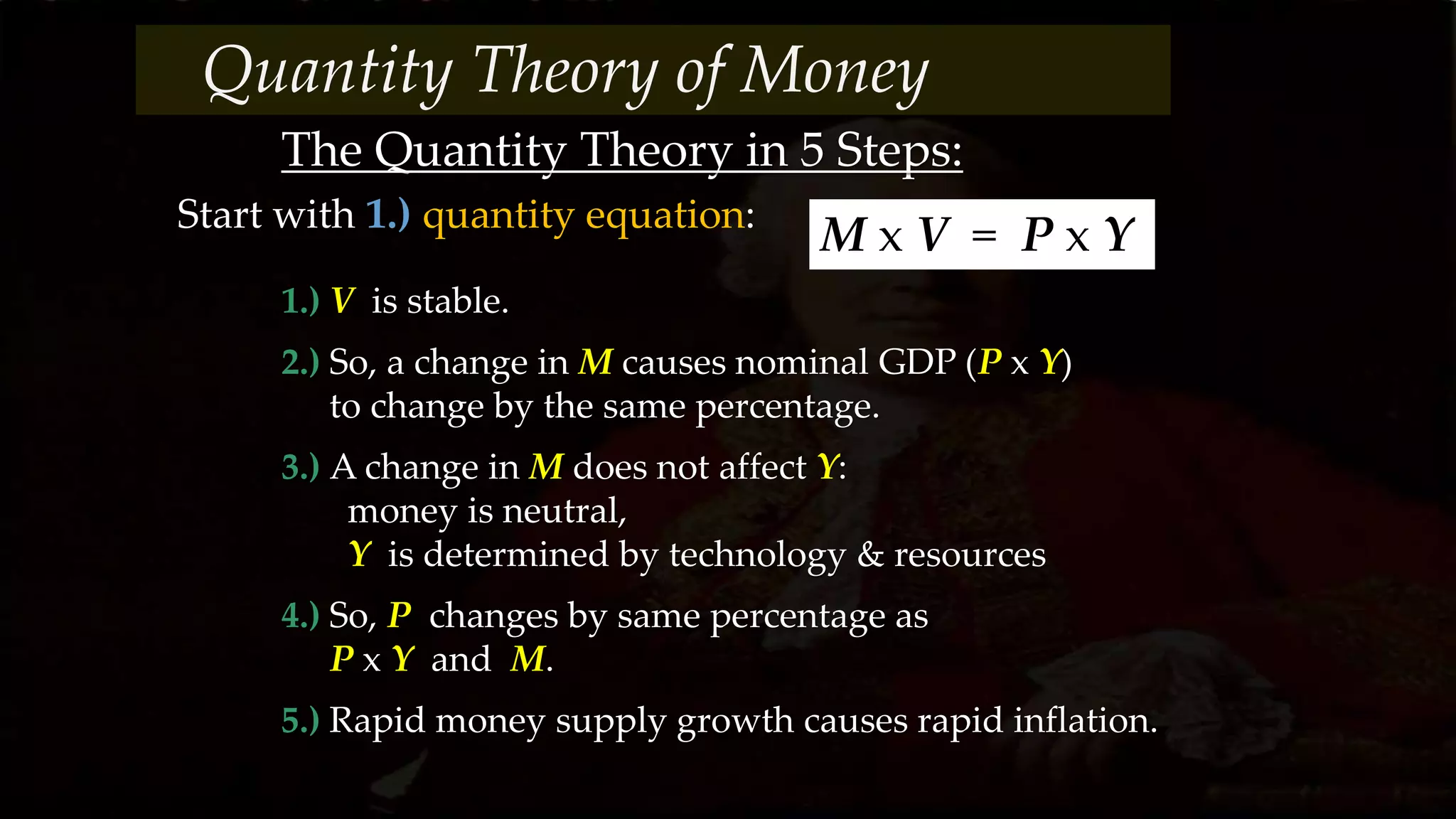

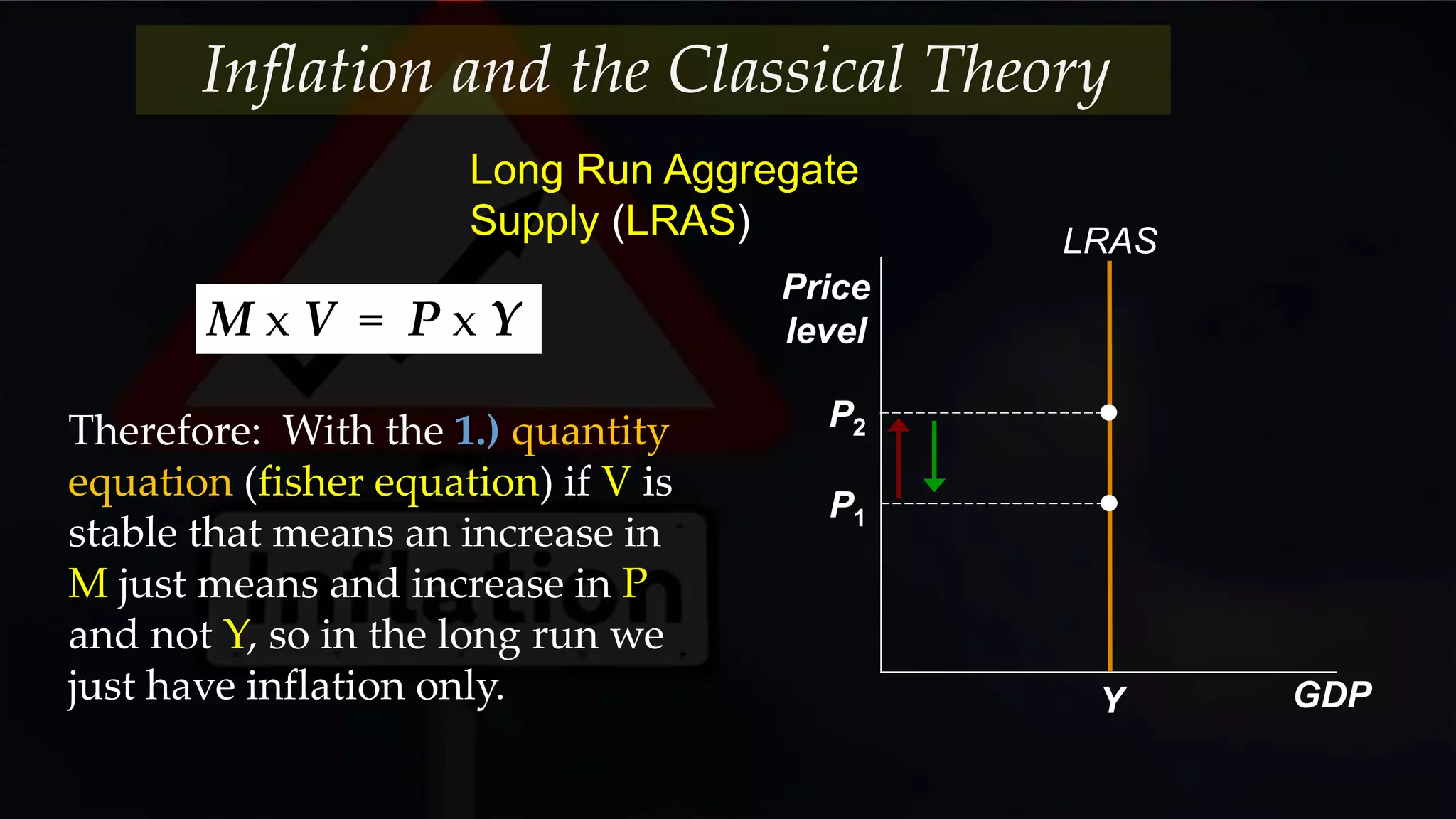

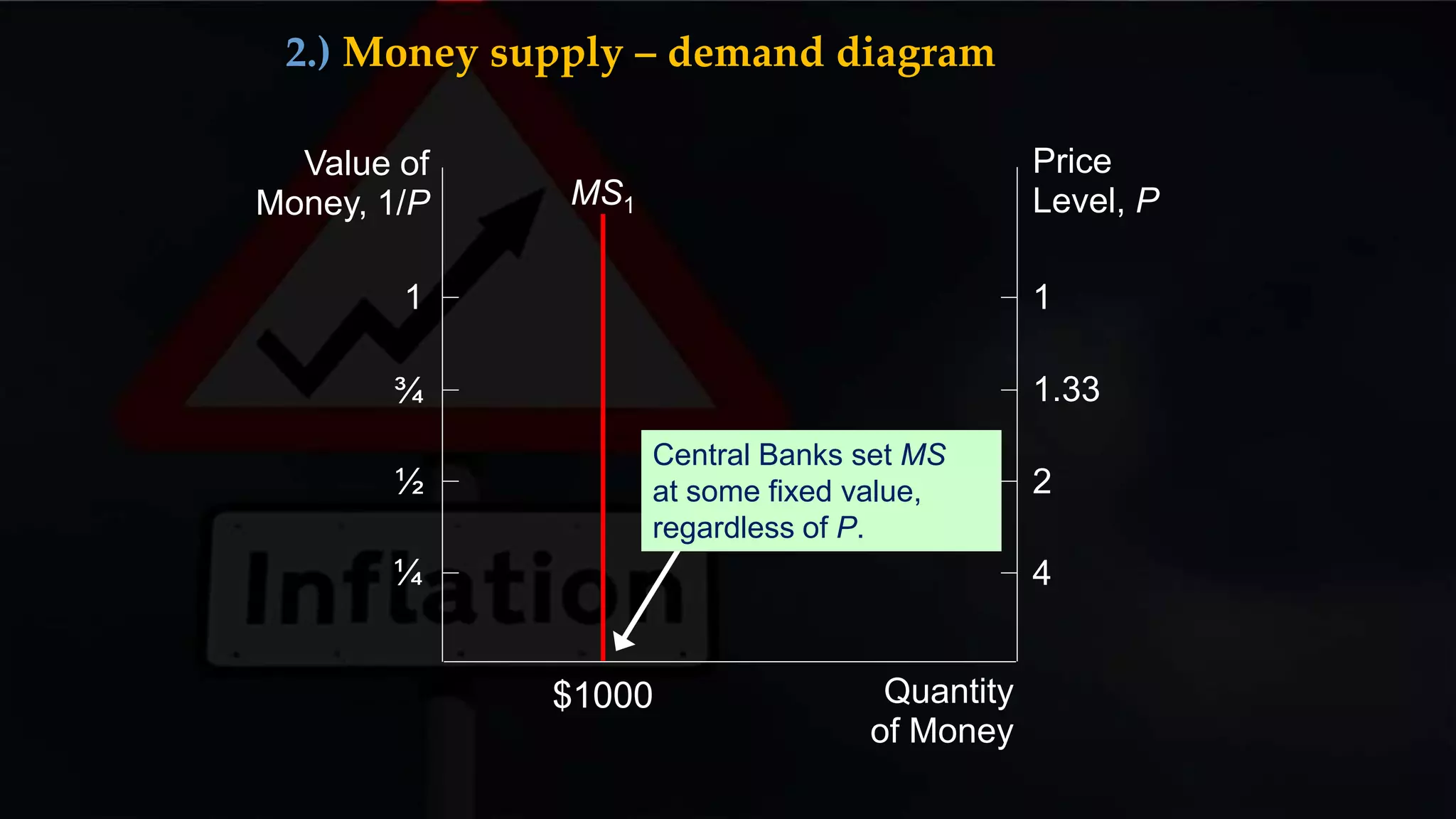

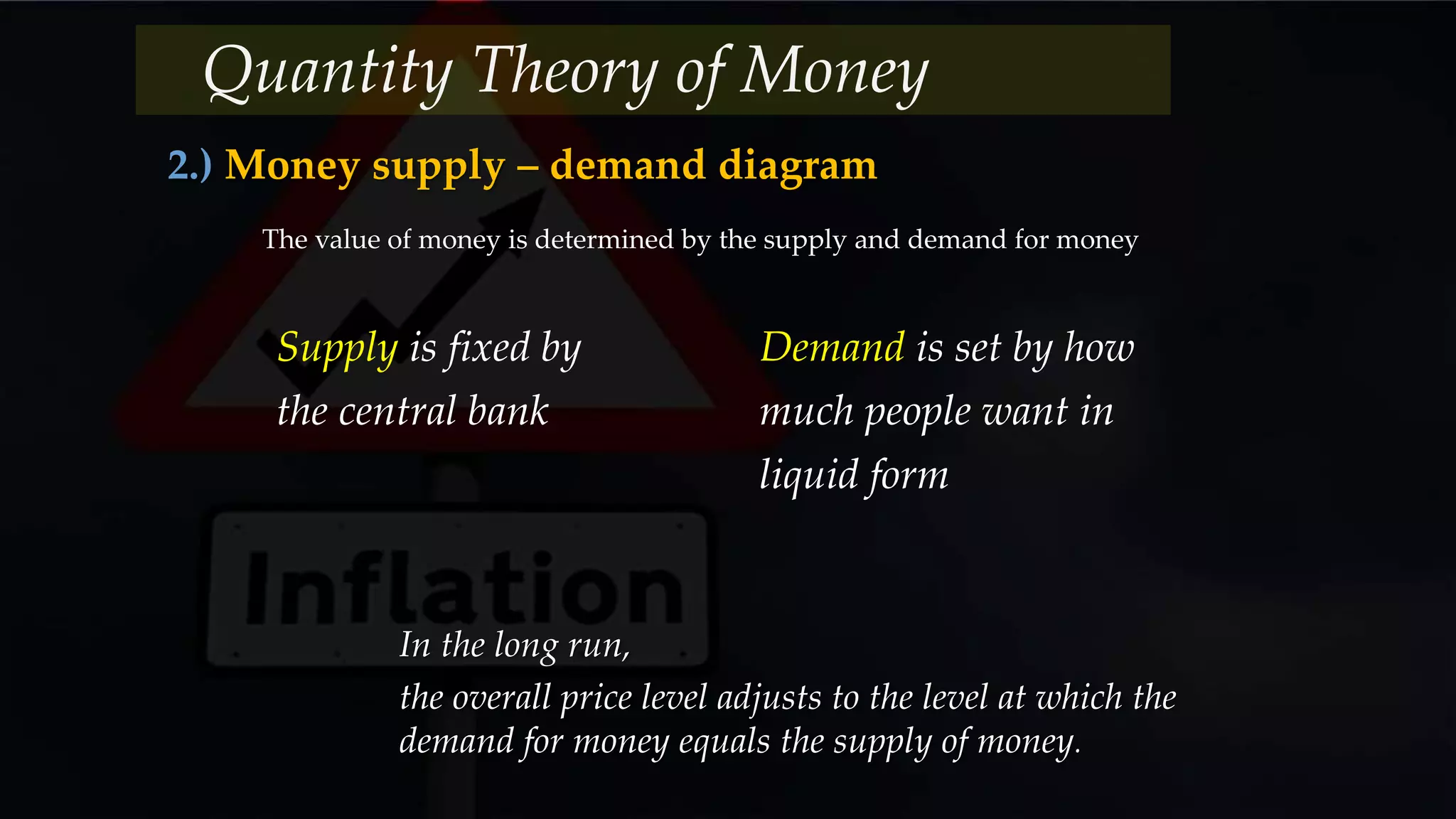

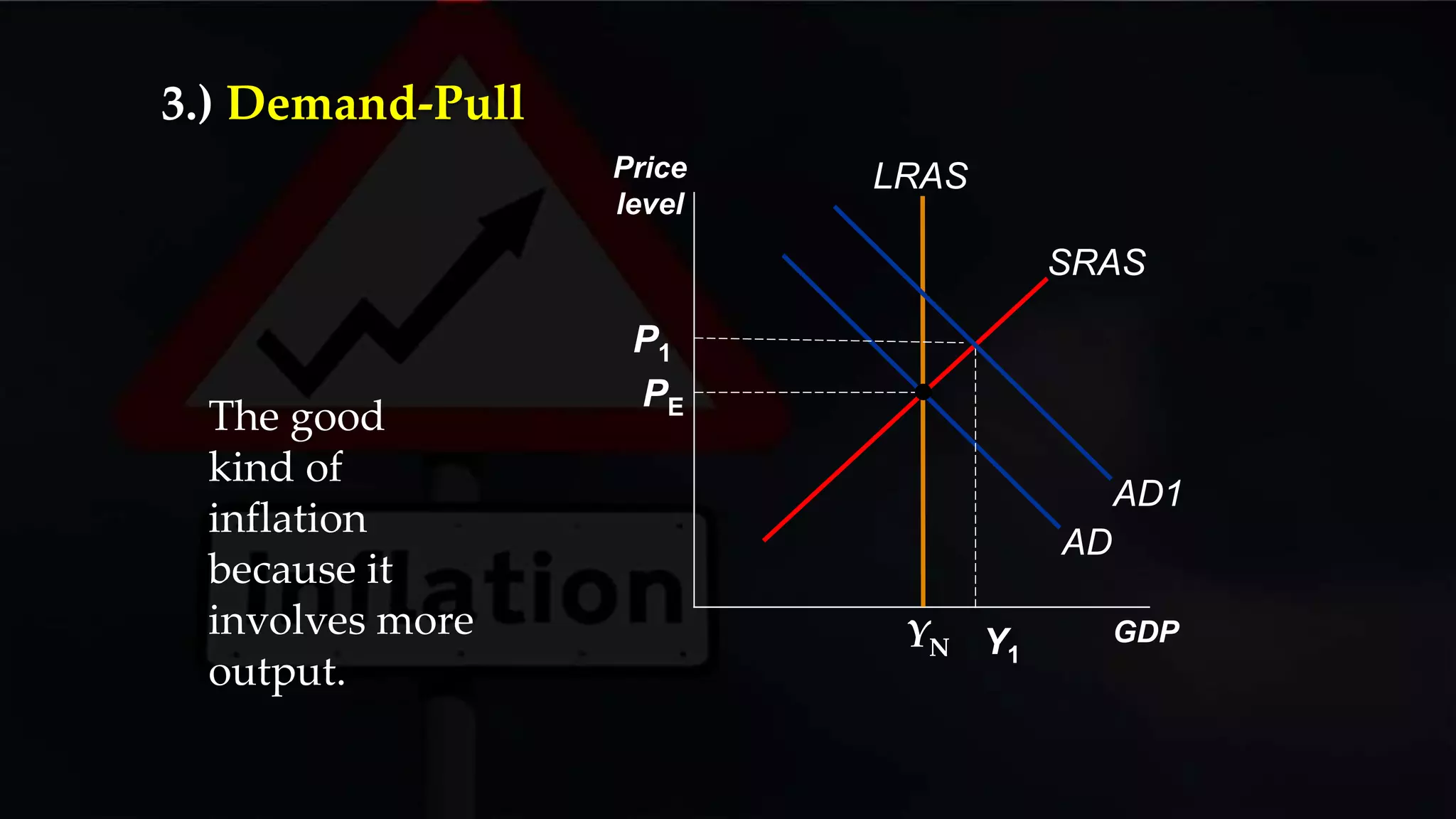

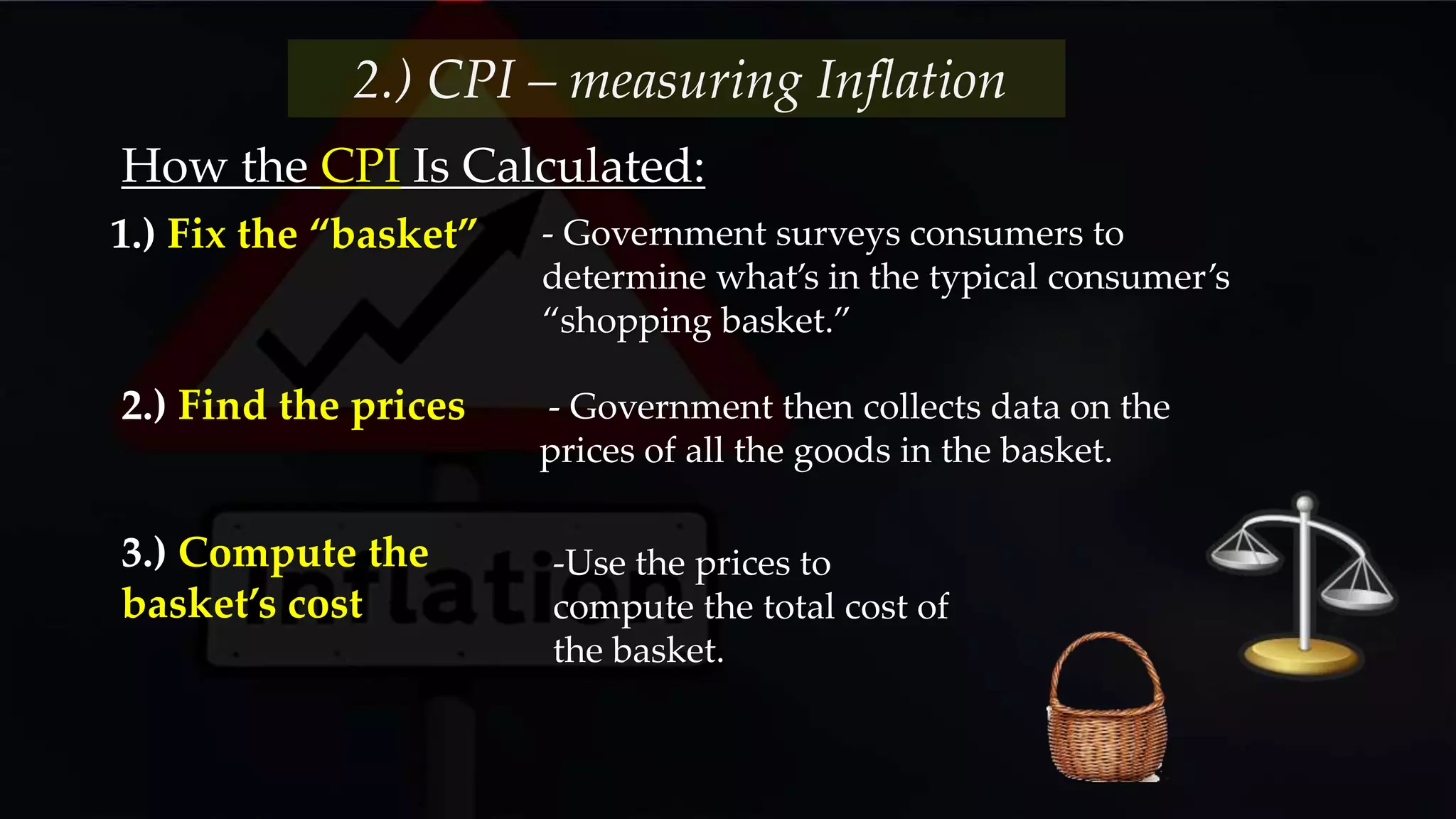

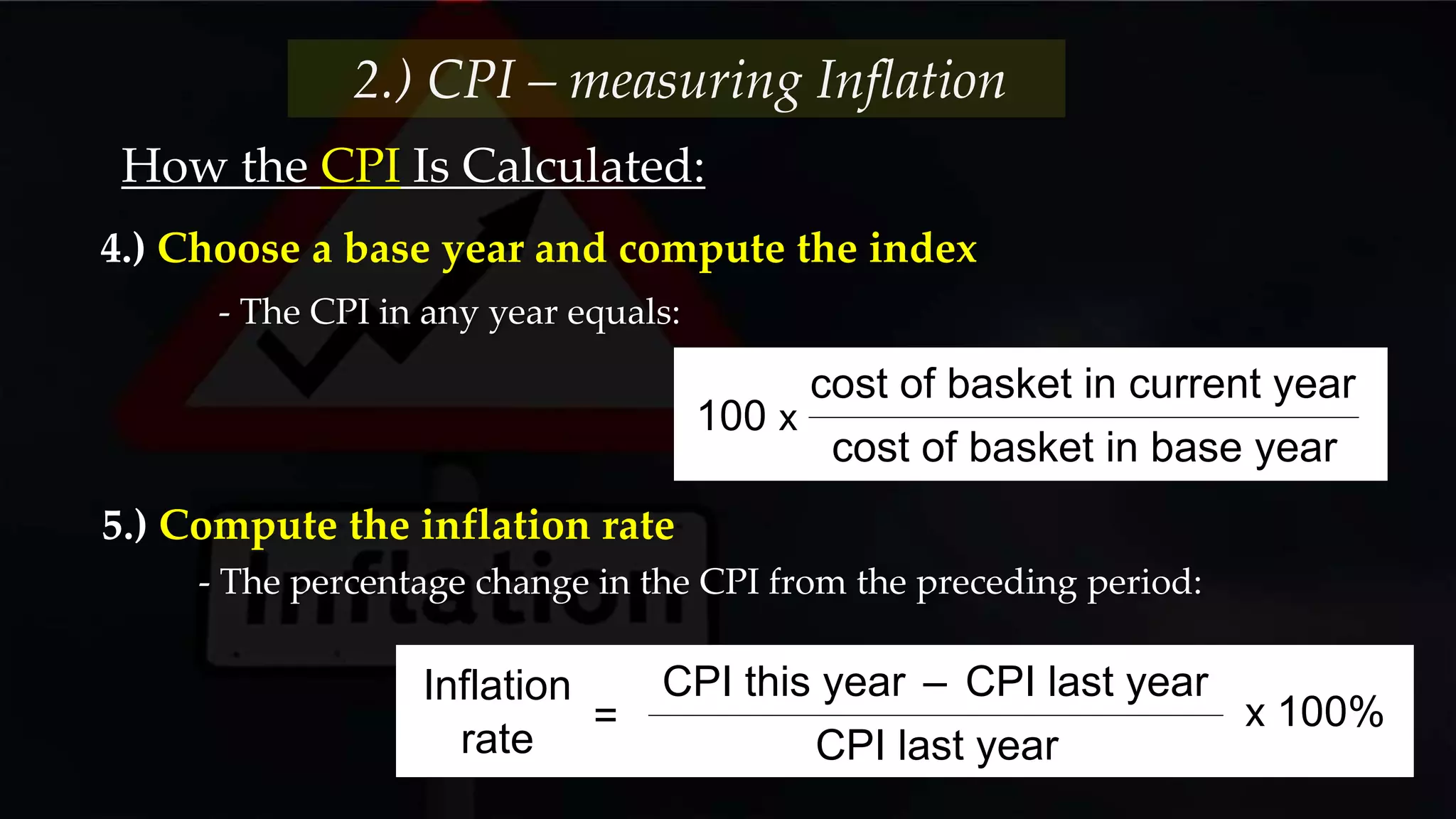

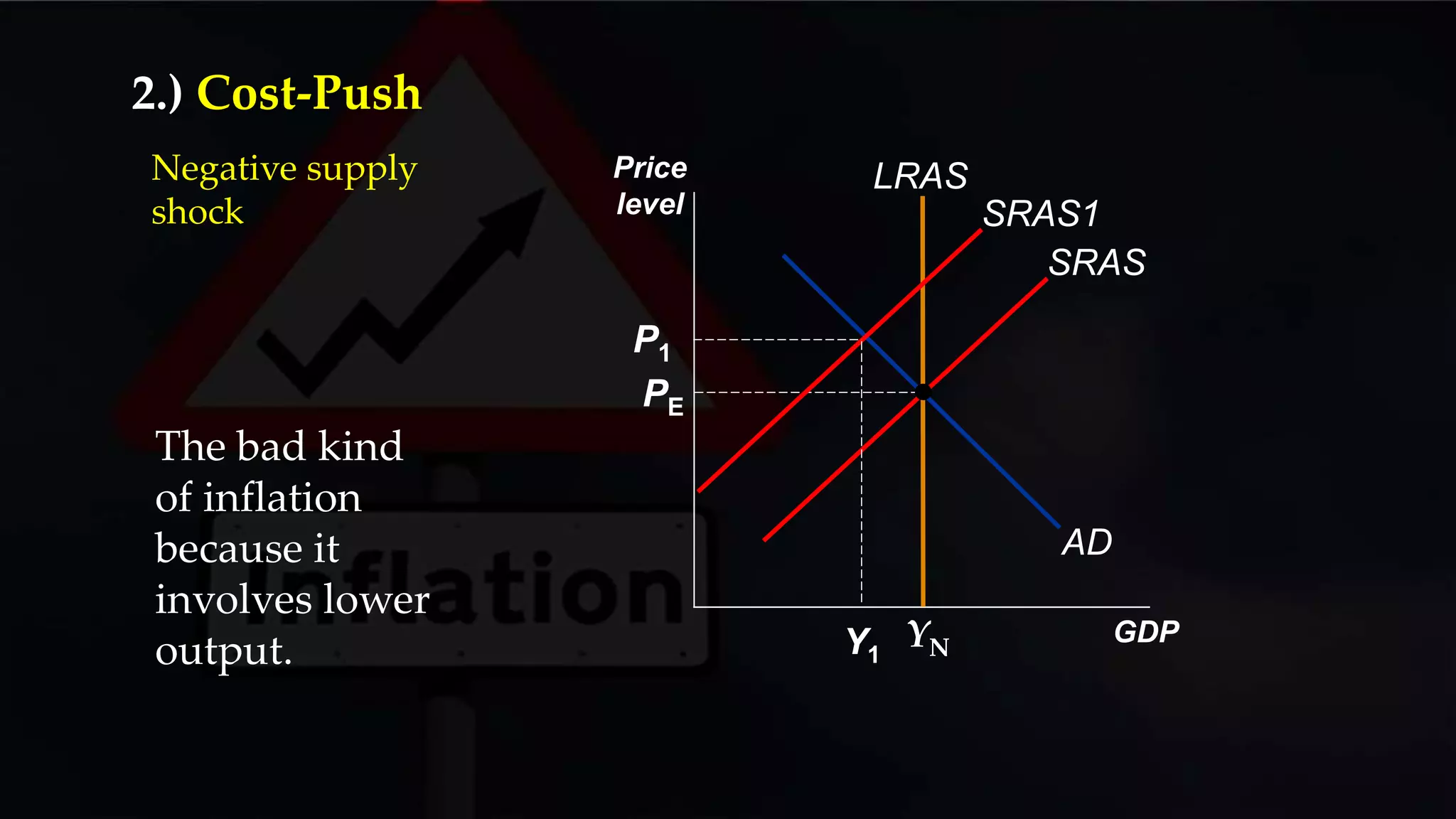

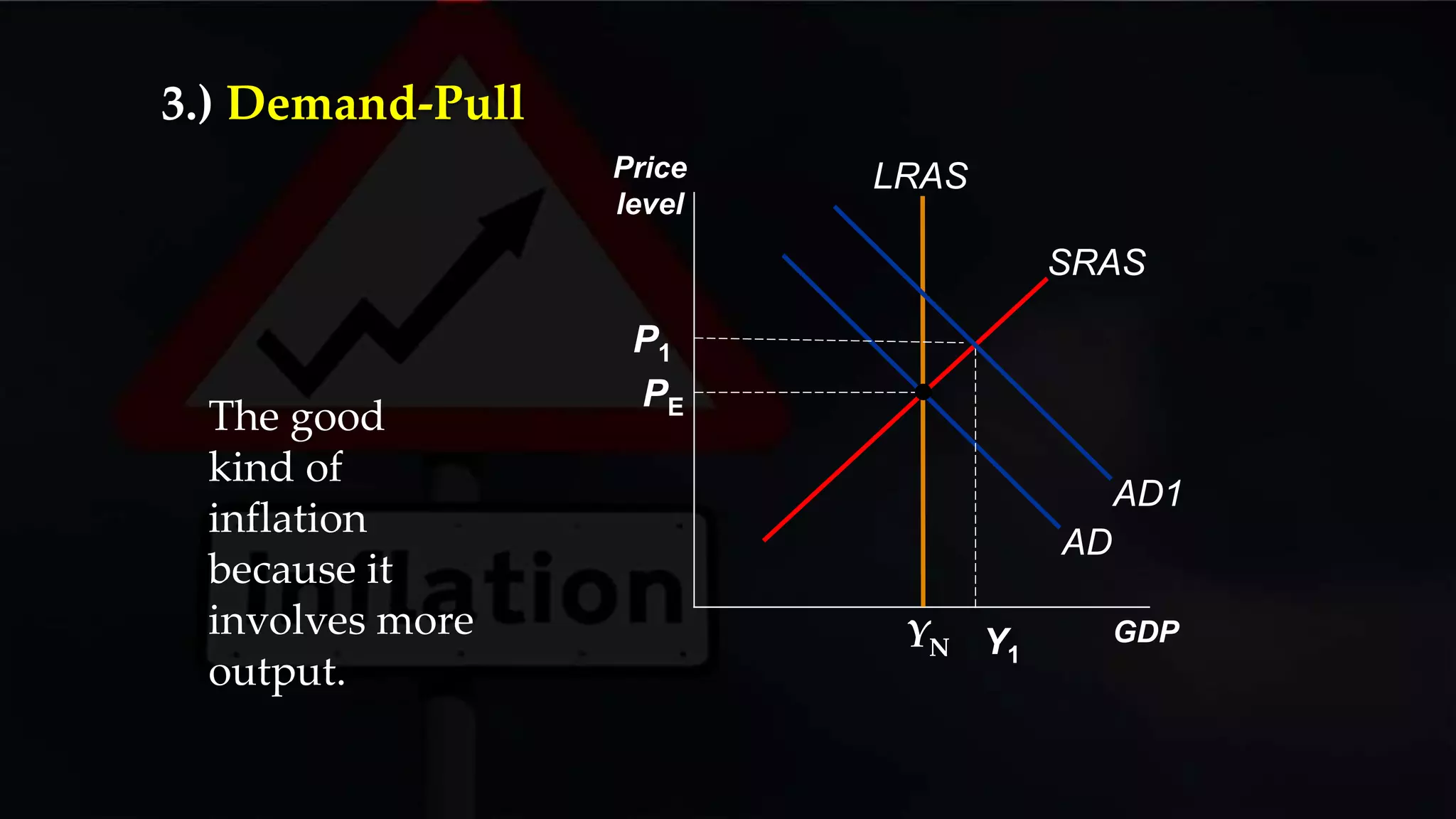

This document discusses inflation and the quantity theory of money. It begins by explaining how inflation is measured using the consumer price index. It then covers the quantity theory of money, including the quantity equation and using a money supply-demand diagram to show how the quantity of money determines the price level in the long run. The document also discusses the main causes of inflation, including monetary factors like too much money growth as well as cost-push factors like rising input costs.