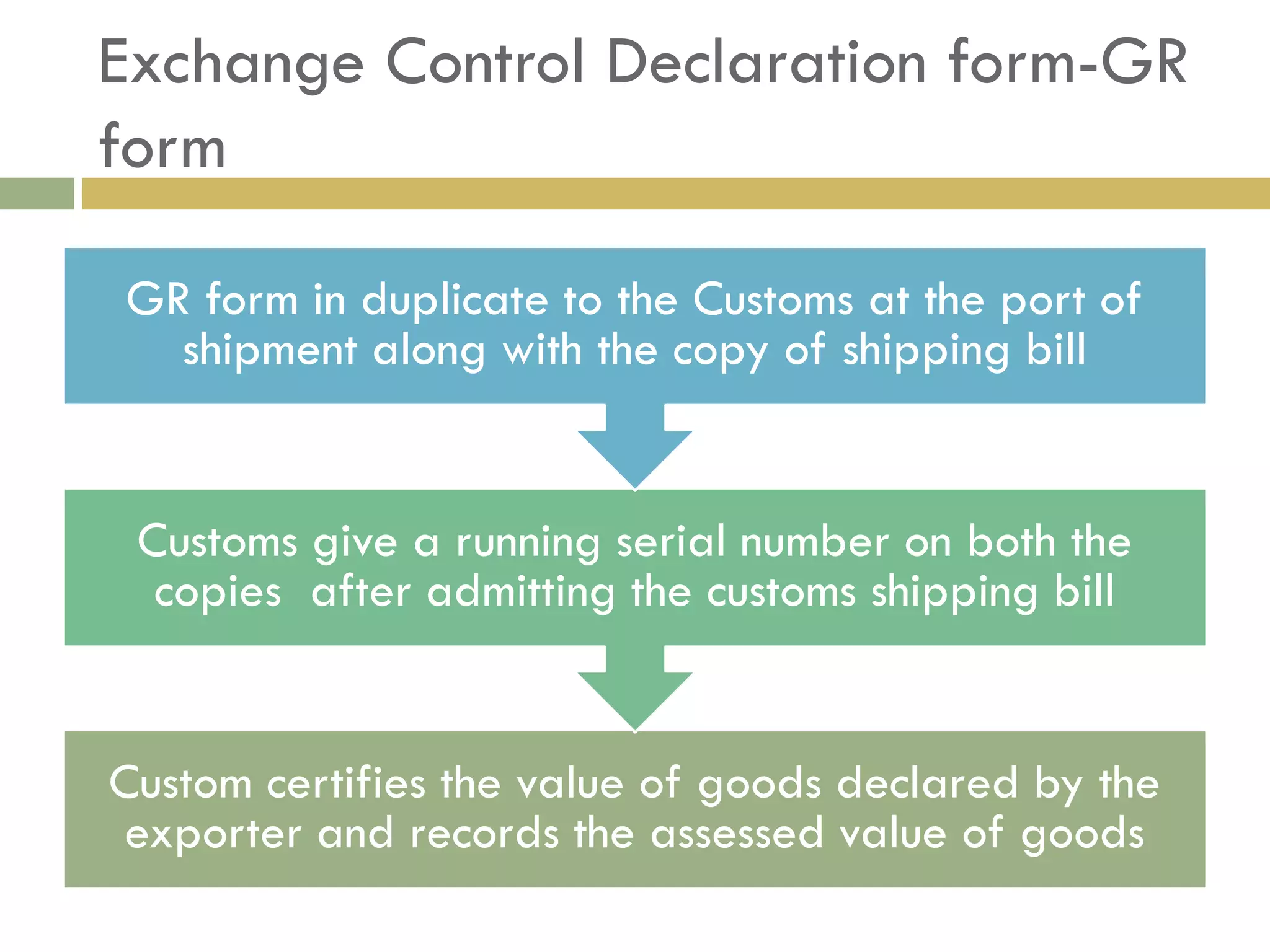

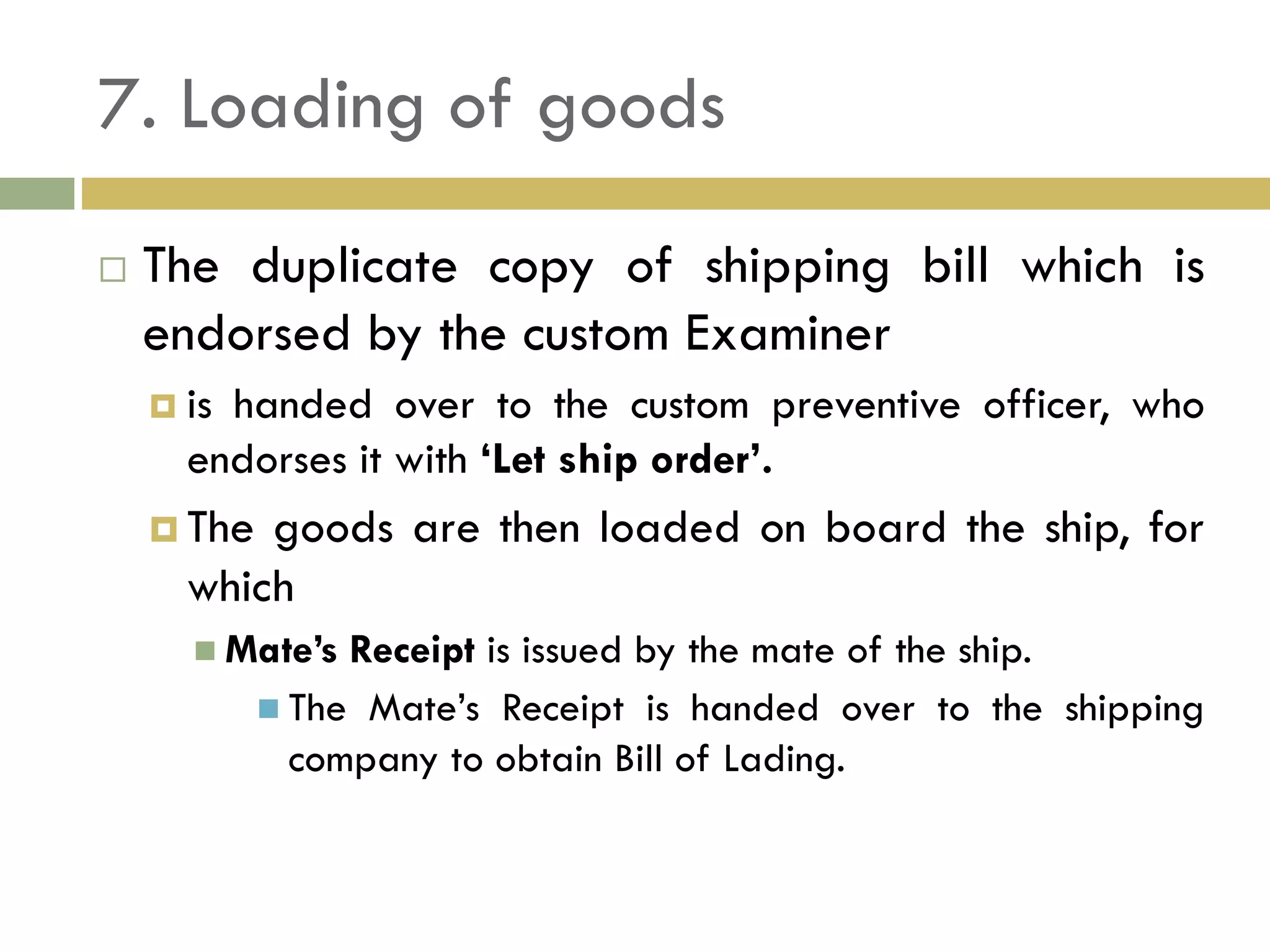

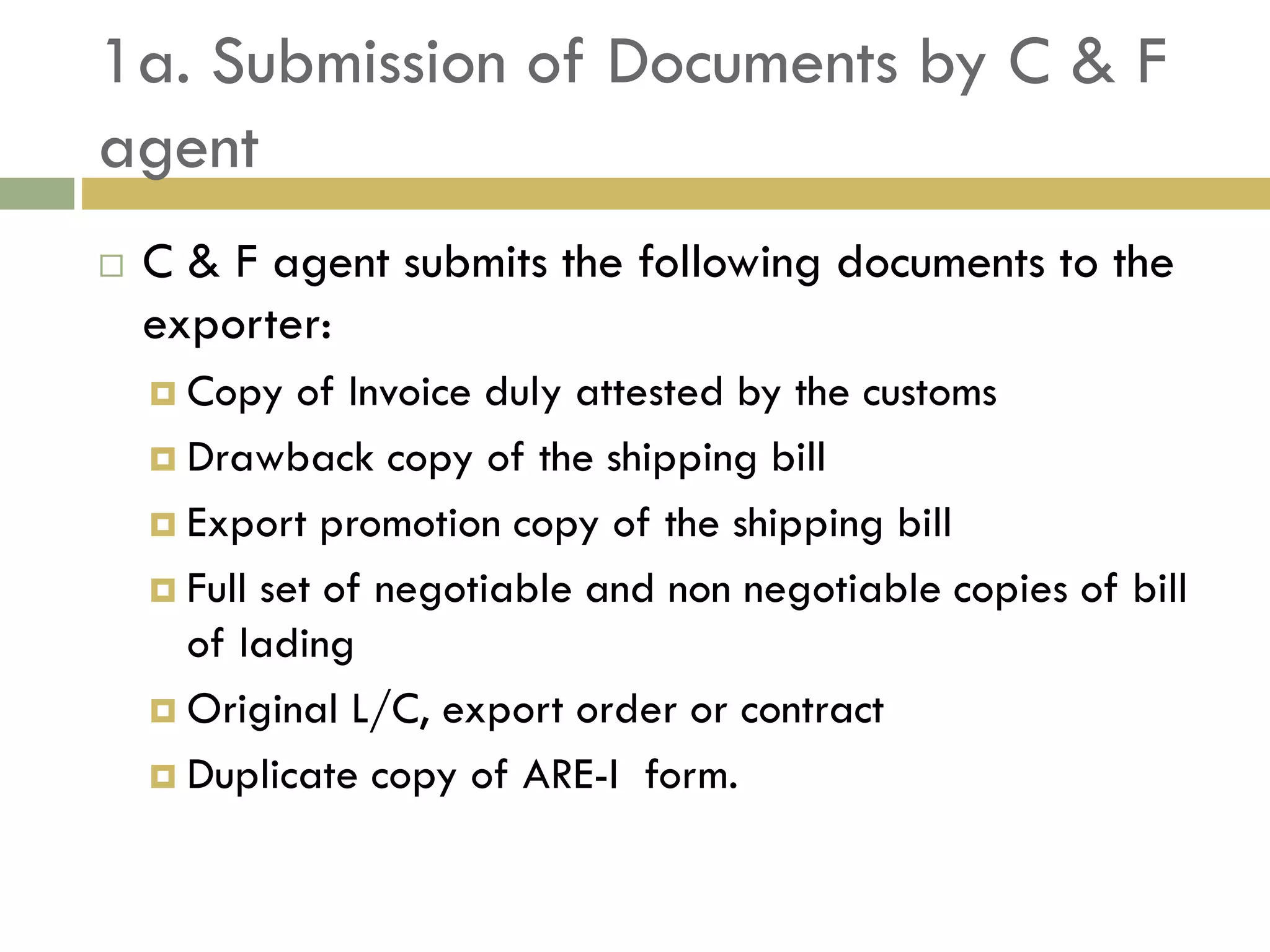

The document outlines the key stages of an export order process, including preliminary registration and planning, pre-shipment procedures like obtaining orders, financing, and customs clearance, shipment activities such as booking cargo space and loading goods, and post-shipment tasks like submitting documents and collecting payment. The process involves coordinating with various authorities, buyers, banks, and shipping and customs agencies at each stage to successfully fulfill an international sales order.