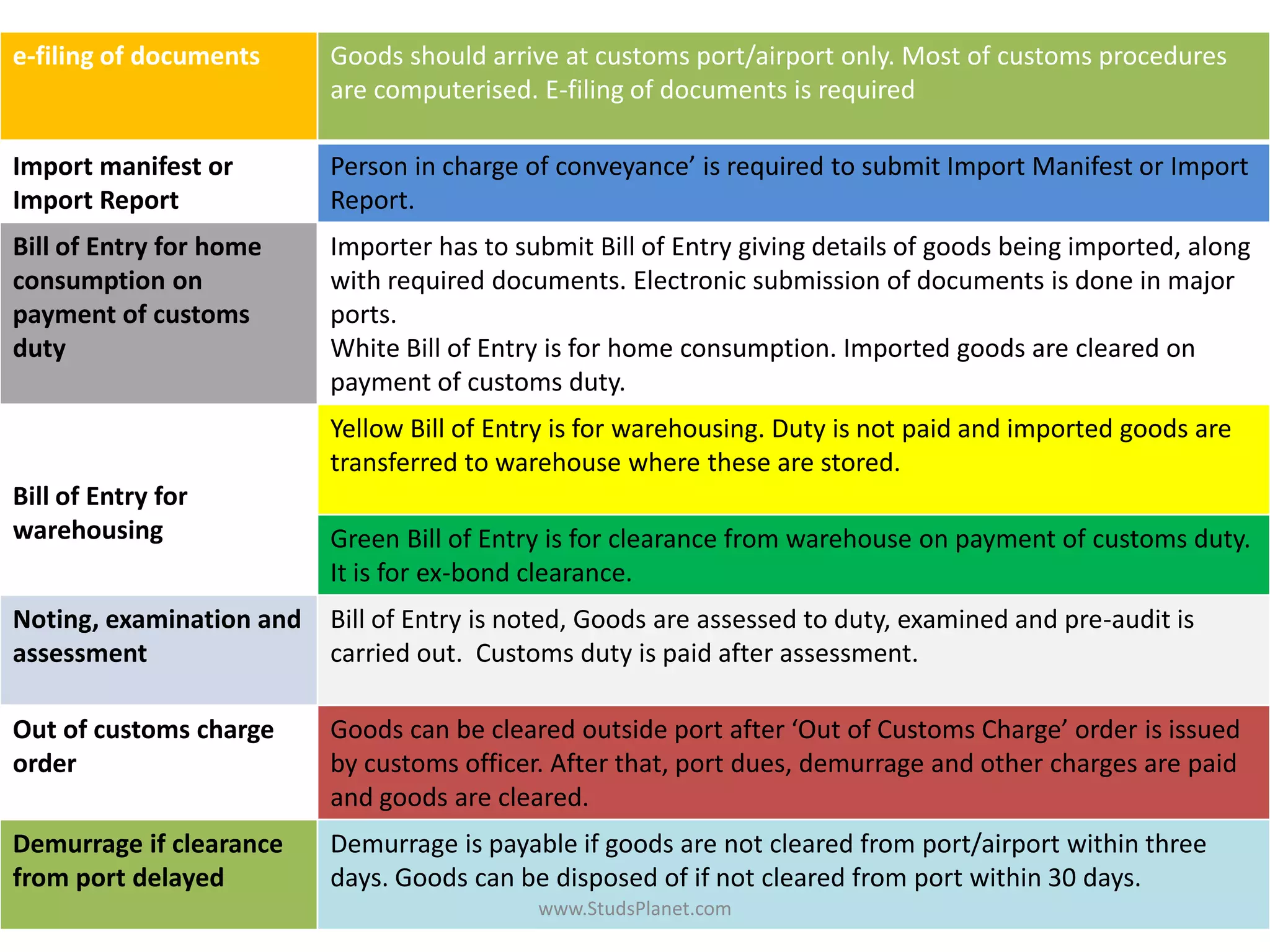

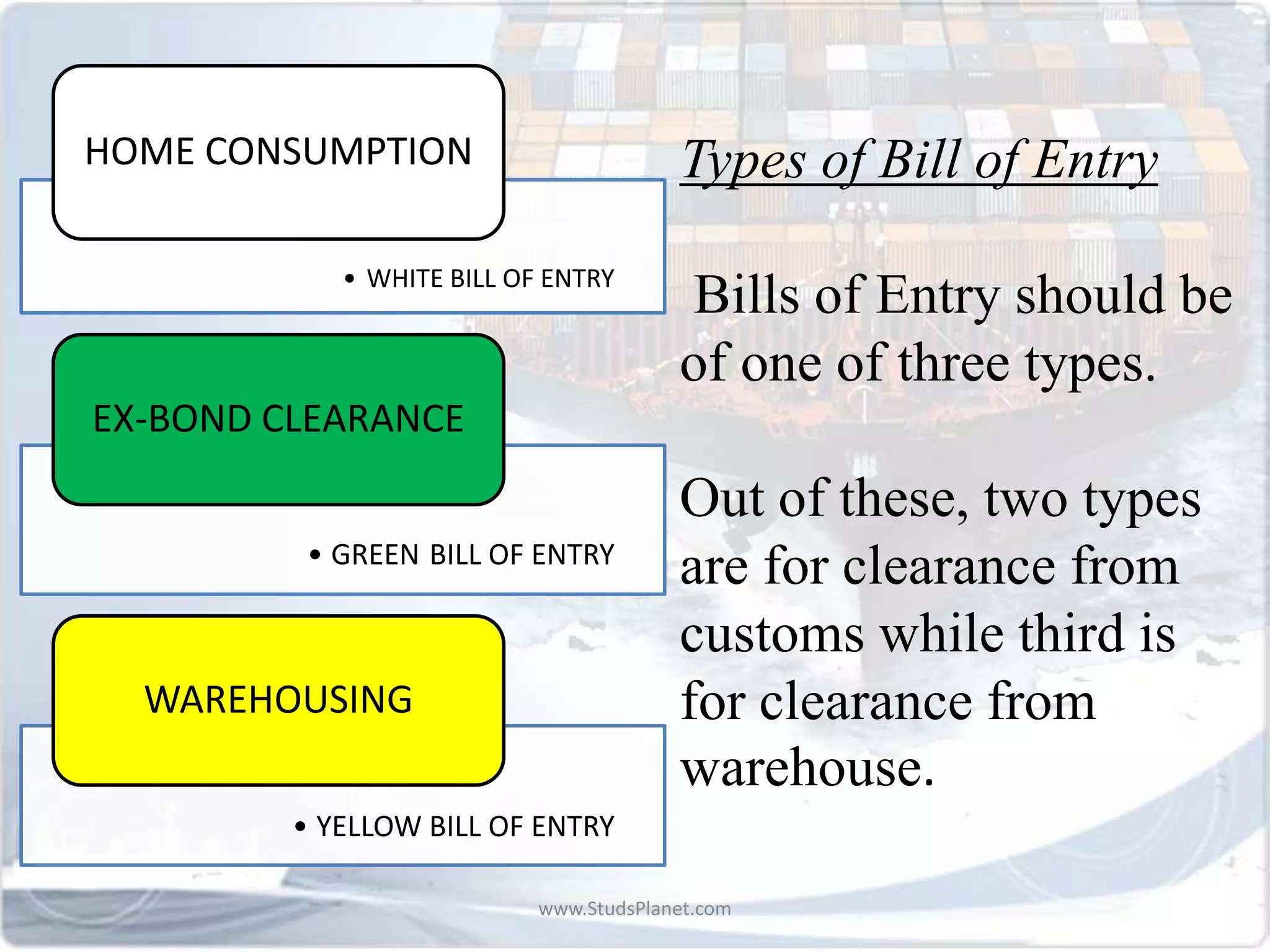

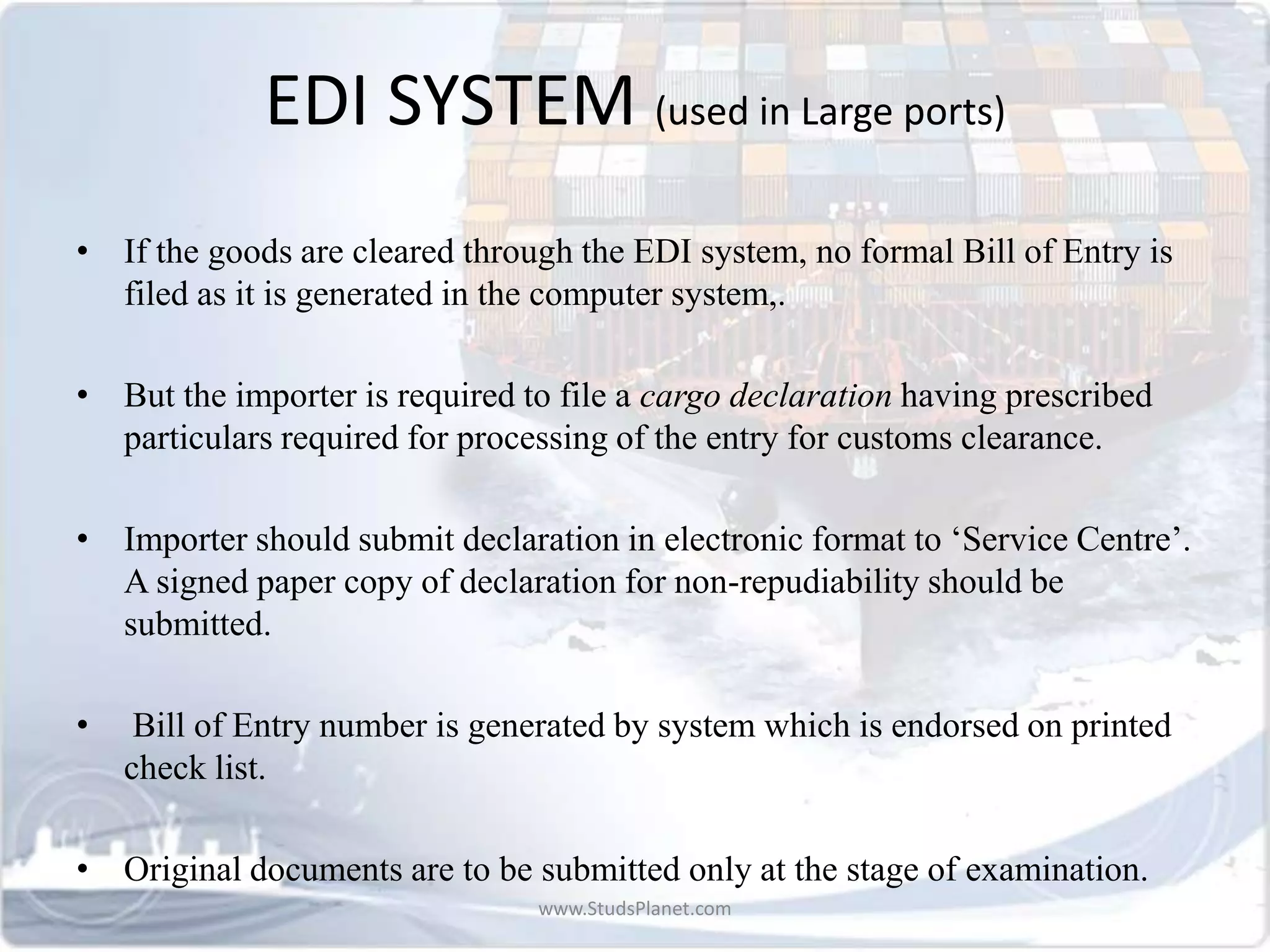

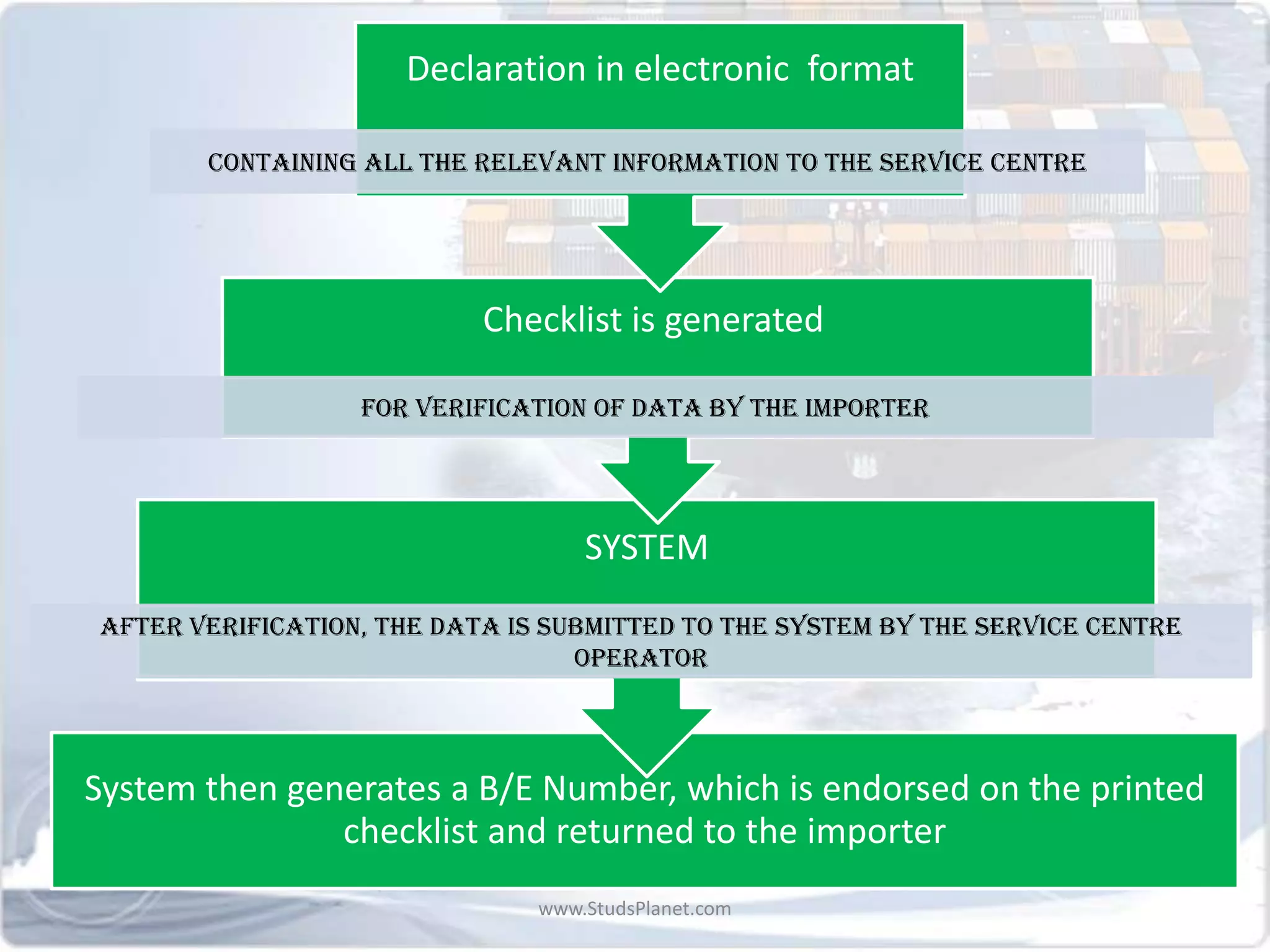

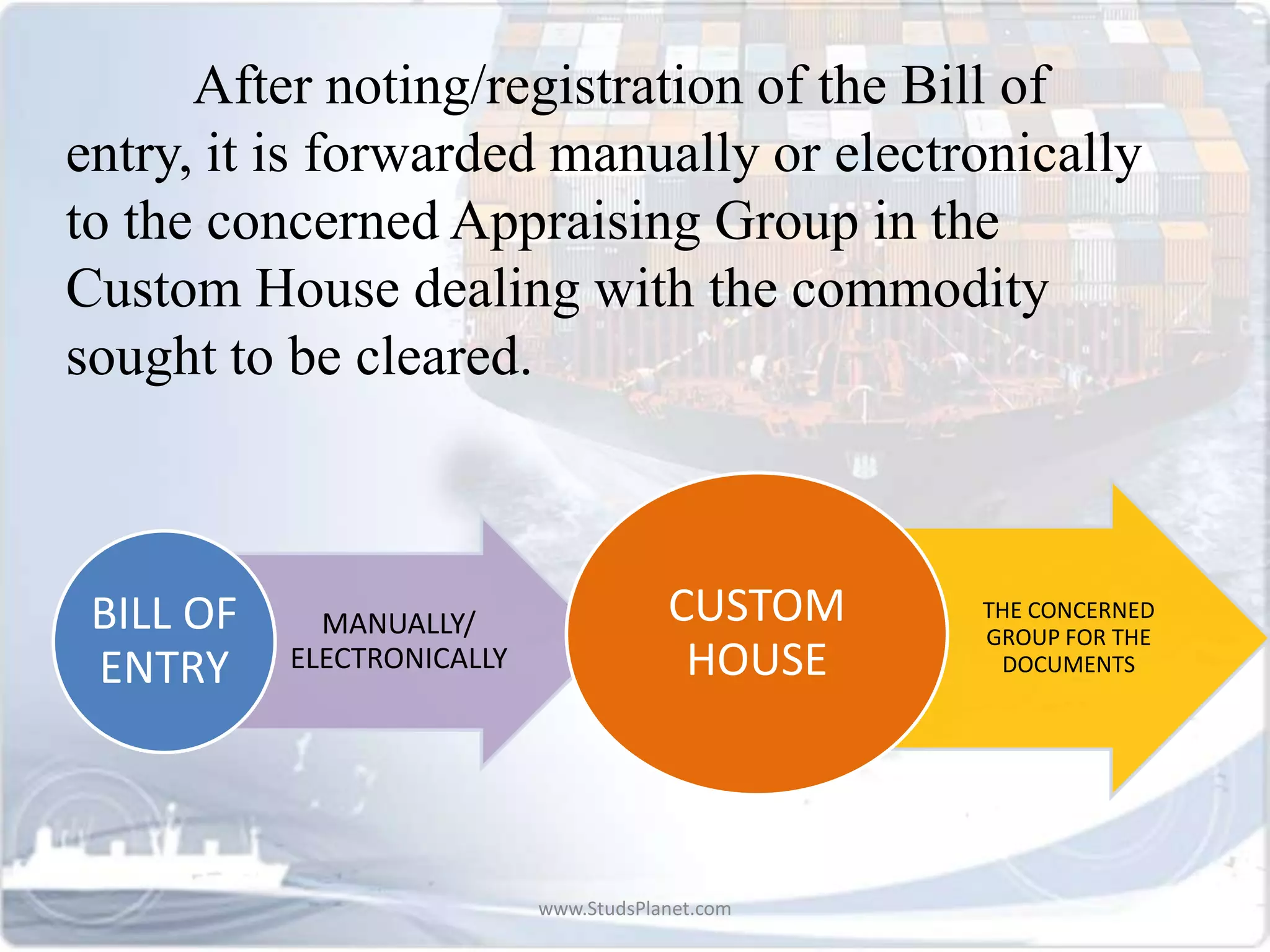

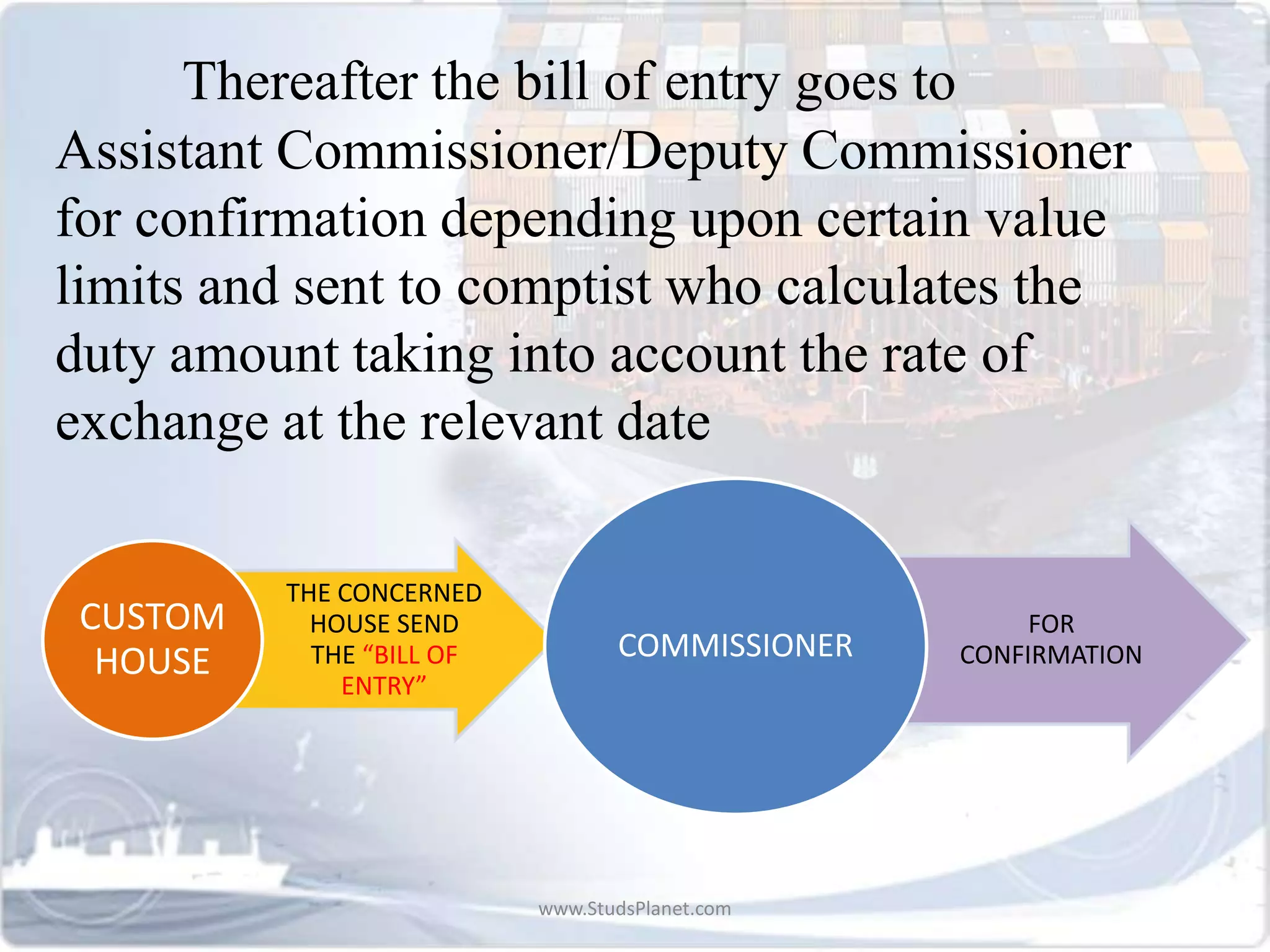

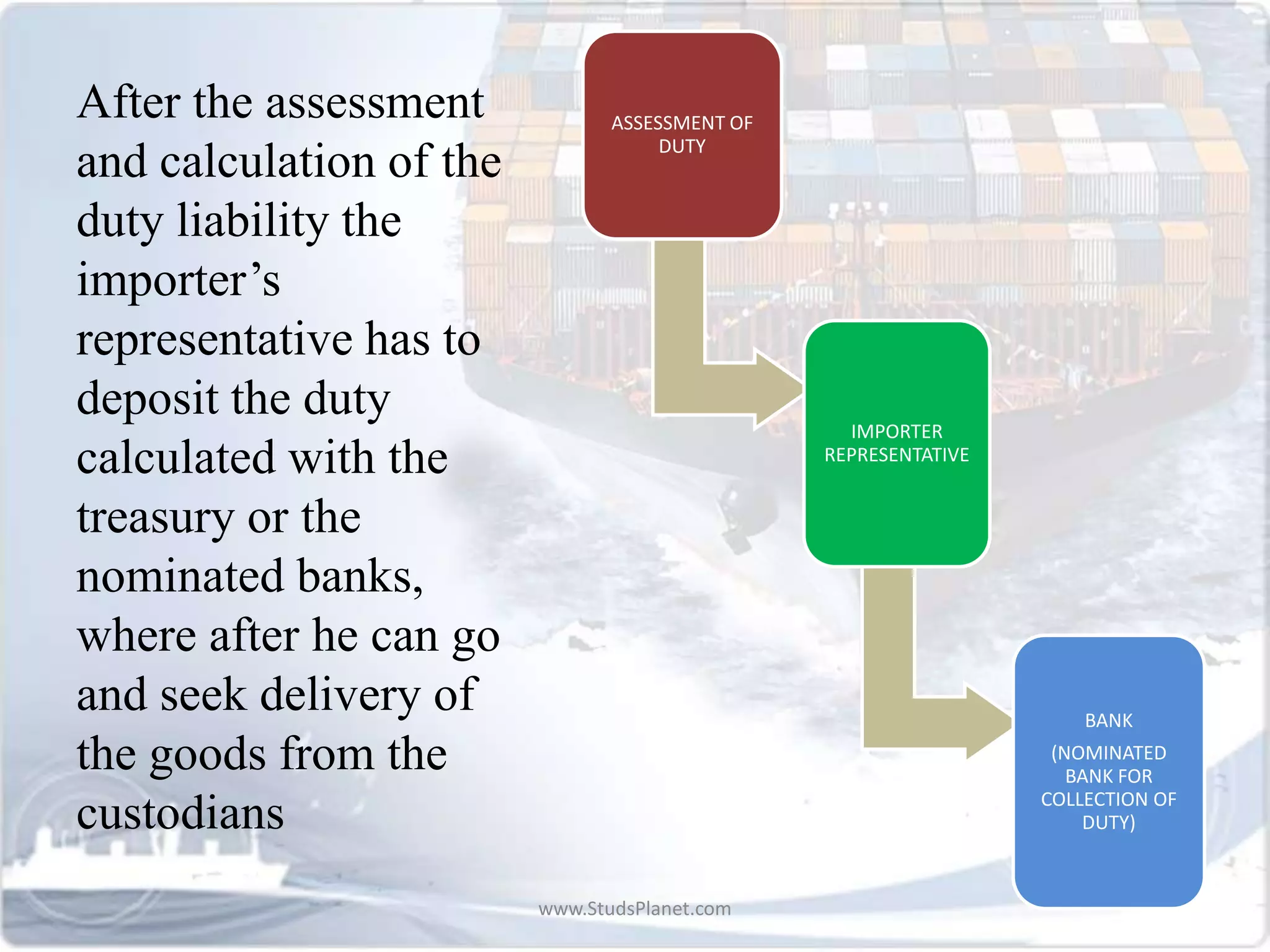

This document provides information on import clearance procedures in India. It discusses the key steps which include filing a bill of entry, assessment of goods by customs authorities, payment of applicable duties, and clearance of goods from the port. There are three main types of bills of entry - white (for home consumption), yellow (for warehousing), and green (for clearance from warehouse). The document also describes differences between the EDI and non-EDI systems for submitting import documents electronically or manually.

![Basic document is

‘Entry’

Entry’ in relation to goods means entry made in Bill of Entry,

Shipping Bill or Bill of Export

Loading and unloading

at specified places only

Imported goods can be unloaded only at specified places. Goods can

be exported only from specified places.

Computerisation of

customs procedures

Customs procedures are largely computerised. Most of documents

have to be e-filed.

Amendment to

documents

Documents submitted to customs can be amended with

permission In case of bill of entry, shipping bill or bill of export, it can

be amended after clearance only on the basis of documentary

evidence which was in existence at the time the goods were cleared,

warehoused or exported, and not on basis of any subsequent

document. [proviso to section 149].

ICD and CFS Imported and export goods are usually handled in containers. These

can be stored in Inland Container Depot (ICD) or Container Freight

Station (CFS). They function like dry port for handling and temporary

storage of imported/export goods and empty containers.

GENERAL PROVISION ABOUT CUSTOM PROCEDURE

www.StudsPlanet.com](https://image.slidesharecdn.com/importclearanceprocedure-131010061058-phpapp02/75/Import-clearance-procedure-23-2048.jpg)