Fm

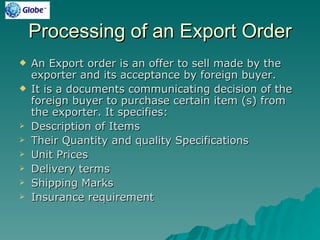

- 1. Processing of an Export Order An Export order is an offer to sell made by the exporter and its acceptance by foreign buyer. It is a documents communicating decision of the foreign buyer to purchase certain item (s) from the exporter. It specifies: Description of Items Their Quantity and quality Specifications Unit Prices Delivery terms Shipping Marks Insurance requirement

- 2. Labeling Packaging and packing Payment terms Pre-Shipment Inspection requirements

- 3. Export Agreement and Export Contract Itis an exchange of promises- exporter promises to supply goods as per specifications and buyer promises to make the payment. Contract is an agreement enforced by the law

- 4. Processing of Export Order 1. Exporter locates trade enquiry 2. The exporter then sends his profile to know the interests of buyer 3. Buyer likes to have details of certain products 4. Exporter then sends the quotation 5. Buyer specifies his requirements regarding shape and size and other terms 6. Exporter send the Performa Invoice 7. Buyer confirms the Performa Invoice

- 5. Standard Clauses of Export Contract 1. Product and its description 2. Product specifications - quality 3. Quantity 4. Incoterms 2000 5. Delivery Schedule-Time period, Part/complete dispatch 6. Mode of shipment-Sea, Ship or air 7. Type of shipment: Direct/Trans 8. Inspection 9. Labeling-Packaging-Packing, Marking requirements 10. Insurance-By Exporter/Importer

- 6. Standard Clauses of Export Contract 12 Documents required 13 Escalation Clause: Sharing of increase in cost 14 Arbitration Clause: Clause of settlement of disputes 15 Fines/Penalties 16 Applicability of Law

- 7. Shipment of Export Goods The exporter should arrange for shipment of goods as soon as they have been cleared by the inspection agency. The process of shipment of goods involves essentially their clearance by the Central Excise Clearance and Customs Clearance of the Shipments.

- 8. Central Excise Clearance All the excisable goods can be removed from the factory only after their clearance by the Central Excise Authorities. The procedure for clearance of excisable goods for exports can be classified into the following two categories: 1) Procedure for excise clearance in case of exempted units 2) Procedure for excise clearance in case of units other than exempted units

- 9. Definition of Exempted Unit: A manufacturing unit is exempt from the levy of central excise if the value of the goods cleared by it for home consumption in a financial year is within the exemption limit of Rs. 50 lakhs. Such a unit is called the exempted unit. Declarant’s Code Number: The exempted units are not required to obtain Central Excise Registration but have to file a declaration with the Central Excise Department. These units are then allotted the Declarant’s Code Number.

- 10. EXCISE CLEARANCE PROCEDURE The exempted units should prepare a document for clearance of goods in form of invoice with distinctive serial number Should have the IEC Code and the Declarant’s Code Number Should state that the goods are being cleared for Exports. Should give the details of the description of goods, name and address of the buyer, destination, value, vehicle number, date and approximate time of removal of goods and progressive total value of all excisable goods cleared for home consumption since the beginning of the financial year. The exempted units have to file quarterly statement of all the clearances with CENTRAL EXCISE DEPT in prescribed form enclosing the proof of export.

- 11. PROCEDURE FOR EXCISE CLEARANCE IN CASE OF UNITS OTHER THAN EXEMPTED UNITS Export under claim of rebate of duty: The excise duty is first paid and then the exporter claims its refund after exportation of goods. Export under Bond: In this case, the exporter is allowed clearance of goods for export without payment of the excise duty subject to the execution of bond with security or surety for a sum equivalent to the duty chargeable on the goods to be exported.

- 12. Central Excise Clearance with or without Examination of Goods The excise officer draws 3 samples. After clearance of goods, the export boxes are duly sealed by him and hands over the two boxes to the exporter-One for exporter’s records and other to hand over to the customs. The 3rd box is retained by him. The excise clearance after examination is known as exports under CENTRAL EXCISE SEAL.

- 13. DOCUMETATION REQUIREMENT FOR CENTRAL EXCISE CLEARANCE The basic form used for seeking Central Excise Clearance is AR-4 (whether by land/sea/air/post). AR4 Form: Different color of its 6 copies Original –White Duplicate-Buff Triplicate-Pink Quadruplicate-Green Quintuplicate-Blue Sixtuplicate-Yellow

- 14. CLEARANCE UNDER CLAIM OF REBATE WITHOUT EXAMINATION Inform the Respective officer in the Central Excise Department within 24 hours after the removal of the cargo from the factory. Submits: Triplicate, Quadruplicate, Quintuplicate and Sixtuplicate of AR4 to the Superintendent of the central excise having jurisdiction Retain original and duplicate copy with him to present to custom officer at the time of export.

- 15. Disposal of AR Forms Triplicate: Sent to Rebate Sanctioning Authority. This copy on request is sealed and handed over toe exporter for presenting to the rebate sanctioning authority. Quadruplicate: Chief Account’s officer in the Collectorate Head quarter. Quintuplicate: Retained by Central Excise Officer Sixtuplicate: Given to the exporter.

- 16. CLEARANCE UNDER CLAIM OF REBATE UNDER CENTRAL EXCISE SEAL Export goods may not be examined by the custom officer at the airport/port, Exporter submits AR4 application with all copies to t Central Excise at least 24 hours before he intends to remove the export goods from the factory. An Inspector of Central Excise is deputed to go for sealing and examination of the export shipment.

- 17. Disposal of AR Forms Original /Duplicate: TO the export for presenting to the customs officer at the point of export with export shipment. Triplicate: To the rebate sanctioning authority Quadruplicate: To Chief Accounts Officer at his Collectorate HO. Quintuplicate: For his records Sixtuplicate: To exporter

- 18. Processing of AR4 by the customs officer 1.Original, Duplicate and Sixtuplicate copies of the AR4 Form is given to the Custom Officer at the time of export 2.Verification by the customs officer 4. Original and Sixtuplicate: Given to the exporter- Original is used for filing rebate claim and the Sixtuplicate used for Drawback/DEEC Endorsements. 6. Duplicate: Sent to Rebate Sanctioning Authority declared on the AR4 form. The copy of which may be sealed and handed over to the exporter for presenting to the Rebate Sanctioning Authority.

- 19. Claiming Rebate Documents to be filed for rebate: Application in the prescribed form Original Copy of AR4 Duplicate copy of AR4 in sealed cover received from Customs officer (Optional) Duly attested copy of the Bill of Lading Duly attested copy of the Shipping Bill (Export Promotion Copy) Generally claim is disposed off within 2 months

- 20. TYPES OF EXCISE BONDS: The central excise clearance of the export shipment without payment of Central excise duty is allowed if the exporter submits bond. Security Bond Surety Bond General Security Bond General Surety Bond

- 21. CLEARANCE OF GOODS UNDER EXCSIE BOND WITHOUT EXAMINATION Triplicate: To the authority before whom the bond is executed and who will accept the proof of export i.e the Assistant collector of Central Excise as declared by the exporter on AR4.On request the copy will be sealed and handed over to the exporter. Quadruplicate: To Chief Accounts Officer at his Collectorate HO. Quintuplicate: For his records Sixtuplicate: To exporter

- 22. CLEARANCE OF GOODS UNDER EXCSIE BOND UNDER CENTRAL EXCISE SEAL Original /Duplicate: TO the export for presenting to the customs officer at the point of export with export shipment. Triplicate: To the rebate sanctioning authority Quadruplicate: To Chief Accounts Officer at his Collectorate HO. Quintuplicate: For his records Sixtuplicate: To exporter

- 23. CUSTOMS CLEARANCE OF EXPORT SHIPMENT Shipment by Air Shipment by Sea Shipment by Land Shipment by Post

- 24. COMPUTERISED PROCESSING OF EXPORT DOCUMENTS ROLE OF CLEARING AND FORWARDING AGENTS -Their services are classified as: Essential Optional

- 25. Essential Functions: CHA Advising the exporter as regard the relative cost of sending the goods by different airlines/shipping lines as well as selection of the route of the flight/sea route. Arrangement of containers required for shipment of the goods. Booking of shipping space or air freighting Making arrangements for the shipment of goods to be on board the ship/plane. Providing Warehouse facility to the exporters for warehousing the goods before their transportation to the docks/port. Transportation of goods to the docks and arrangement of warehousing at the port.

- 26. Essential Functions: CHA Arranging for the marine/cargo insurance of the shipment Preparing and processing of shipping documents required for custom clearance Arranging for various endorsements/issue of certificates from various agencies. Providing assistance in the packing of the shipment Making arrangements for local transportation of goods to the ports/docks Forwarding the documents to the exporter for their negotiation with the bank.

- 27. Optional Services-CHA Providing warehousing abroad at least in some of the major international markets in case the importer refuses to take delivery of the goods for any reasons Providing assistance to bring back the goods to India if the situation so demands Providing assistance to locate the goods in case the shipment is misplaced or the cargo is stranded at some port. Making arrangements for assessment of damage to the goods to the file claim with the insurance company.

- 28. IMPORTANT REGISTERATIONS WITH THE CUSTOMS Allotment of EDP NUMBER (ELECTRONIC DATA PROCESSING) Importer-Exporter Code, RBI Code Number, Authorized Dealer Code of the e bank and current account

- 29. SHIPPING BILL: Manual: Exporter is required to file appropriate type of shipping bill to seek the order from customs clearance of Export Shipment called LET EXPORT. Under computerized system the exporter is not required to file the shipping bill but instead the shipping bill is generated through the computer. The exporter/CHA has to provide information through DATA ENTRY CENTRE of the customs station either in Annex A or B to generate the shipping bill. Annex A: Export of duty free goods or transactions where no foreign currency is involved, trade offers, gift parcels, re-export, warranty replacements, etc. Annex B: For Export of goods under claim of duty drawback. Verification of the data The system then generates the Shipping Bill with a definite number. The shipping bill is a basic document for obtaining the LET EXPORT ORDER

- 30. EXCHANGE CONTROL DECLARATION FORM Every exporter is required to declare the exchange value of the export shipment by giving an undertaking that the export proceeds shall be released within a period of 6 months or due date whichever is earlier. Manual processing: GR FORM for sea and air. It is issued in 6 copies. GR form in case of Post is called PP GR form in case of Software is called SOFTEX. Computerized Processing: GR Form is replaced by SDF DECLARATION-2 Copies

- 31. ENDORESMENTS OR CERTIFICATIONS ON SHIPPING BILL Eg: Quota for the exports of ready made garments from the Apparel Export Promotion Council on the shipping bill. Since the shipping bill is generated from the computer only after obtaining the LET EXPORT ORDER, the endorsements are to be done later.

- 32. DOCUMENTATION REQUIRMENT FOR CUSTOMS CLEARANCE Objective: To obtain LET EXPORT ORDER

- 33. DOCUMENTATION REQUIRMENT IN CASE OF SHIPMENT BY SEA/AIR Shipping Bill (if manual) or Annex A or B Commercial Invoice Packing List Certificate of Origin/GSP Certificate of Origin GR/SDF Copy of the LC/Export Order/Export Contract AR-4 duly approved by the Central Excise officer or Invoice showing clearance of excisable goods Declaration from Export of goods under: – Claim of duty drawback – Anticipation of Advance License/DEEC – DEEC Scheme – Without Certification from Export Inspection Agency

- 34. DOCUMENTATION REQUIRMENT IN CASE OF SHIPMENT BY SEA/AIR Additional Documents (If Required): Export License Pre-Shipment Certificate Marine Insurance Policy in triplicate Freight Declaration Special custom/consular legalized invoice Declaration of quality, quantity and weight Sea: Port Trust Copy of the shipping bill (Dock Challan) Cart Chit/Vehicle ticket

- 35. DOCUMENTATION REQUIRMENT IN CASE OF SHIPMENT BY POST CUSTOM DECLARATION FORM instead of Shipping Bill Commercial Invoice Packing List Certificate of Origin/GSP Certificate of Origin Copy of the LC/Export Order/Export Contract AR-4 duly approved by the Central Excise officer or Invoice showing clearance of excisable goods Instead of GR/SDF, the Exchange Control Declaration Form will be PP FORM DEEC Book in case of shipment under Advance License is required. Form D in case the shipment is for exports of goods under claim for duty Drawback. Insurance Policy Export License Pre-shipment inspection Certificate

- 36. DOCUMENTATION REQUIRMENT IN CASE OF SHIPMENT BY LAND The shipment of goods by lorry of rail or boat can be sent to the neighboring countries like Pakistan, Bangladesh Myanmar and Nepal Documents required are: Bill of Export of appropriate type Commercial Invoice Packing List Certificate of Origin/GSP Certificate of Origin Copy of the LC/Export Order/Export Contract AR-4 duly approved by the Central Excise officer or Invoice showing clearance of excisable goods Exchange Control Declaration Form will be GR FORM Drawback Bill Insurance Policy Export License Pre-shipment inspection Certificate

- 37. CUSTOMER CLEARANCE PROCEDURES Checking the Shipping Documents Physical Examination of the export cargo Loading of the goods Post Loading Certification

- 38. SHIPMENTS BY AIR Checking Of the Shipping Documents: Booking –Carting Order-AWB Submit the Original and Duplicate of SDF to the Central Registration Unit (CRU) who signs the SDF form and allots the running 10 digit RBI Code number on the SDF Forms The CHA then submit the Annex A or B as per the case to the Service Center at the Customs Station The service center then issues the Check list to CHA for verification who verifies and signs and gives back to the service center for generation of the shipping bill for noting and further processing. The service Center generates the shipping bill and shipping bill number is automatically allotted to it for follow up

- 39. SHIPMENTS BY AIR The export documents are submitted to the export department of the customs for checking. Once satisfied the customs officer examining the documents determines the extent of physical examination of goods and the official is assigned to conduct the physical examination. If any export cess has to be paid, then its receipt should be submitted to the accounts dept of customs

- 40. SHIPMENTS BY AIR Physical examination of the export cargo Cargo is brought to the export shed on the day mentioned in the caring order. CHA gives ANNEXE C to the examining officer, who verifies CHA then arranges to unload the cargo and does the weight check. CHA arranges for the stacking of the cargo in the export cargo shed at the place ear marked for the particular airline If satisfied then the in order then the inspector shall record the report of the physical examination of the cargo on the shipping bill through the computer system. The superidentant of the customs will then issue the LET EXPORT ORDER if the report and the documents are in order. CHA will now get the shipping bill printed and he is given the exporter’s copy and the export promotion copy of the shipping bill duly signed by the competent authorities.

- 41. SHIPMENTS BY AIR Loading of the Goods: After the LET EXPORT ORDER, export cargo is moved to the bonded are for its storage and palletisation by International Airport Authority of India (IAAI) The latter acknowledges the receipt of the cargo and on the caring order and copy of the AWB. For security reason a period of 24-48 hours is observed before loading the cargo aboard in the aircraft. The airline prepares the EXPORT GENERAL MAINFES (EGM) before the arrival of the flight for its handing over to the customs. On the day of the flight the cargo is moved to the loading are as per the details given by EGM and loading is under the supervision of the customs officer in charge of loading operations. After the cargo is loaded the airlines file EGM with the customs in a day or two.

- 42. SHIPMENTS BY AIR Post lading Certification: After loading the captain of the airline flight signs the duplicate and triplicate copy of the shipping bill against the goods received by him. After the process of customs clearance, the CHA/exporter is returned the documents he has submitted except for the original SDF is directly given by customs to the RBI

- 43. SHIPMENT BY SEA Verification of Documents: Facilities are provided by Port Trust Authority of the concerned sea port. Booking starts 4-6 weeks before the arrival of the ship and CHA gets the Shipping Order The customs authority assign a number and date on the shipping bill, GR/SDF and also assign the rotation number of the ship/vessel, the details of shipment are noted in a register. After the examination of documents and appraisement of the value, the Customs Appraiser/Examiner makes an endorsement on the shipping bill giving the directions to the Dock Appraiser to conduct the physical Examination of the

- 44. SHIPMENT BY SEA . At this stage the Original Shipping bill and a copy of the commercial invoice are returned to the CHA to be presented to the Dock Appraiser. CHA then submits the Port Trust documents to the Shed Supervisor of the port and obtain the caring order for bring the export cargo to the transit shed for physical examination by the Dock Appraiser.

- 45. SHIPMENT BY SEA Physical Examination : Done by the Dock appraiser and the documents submitted are: Duplicate, Triplicate and export promotion copy of the shipping bill Commercial Invoice Packing List AR-4 Inspection Certificate in Original GR/SDF (Duplicate) After the examination, Dock Appraiser records his report on the shipping bill and issues the LET EXPORT ORDER on the duplicate of the shipping bill and gives it to the CHA CHA presents all the documents with LET EXPORT ORDER to the Preventive Officer of Customs for the issue of LET SHIP ORDER

- 46. SHIPMENT BY SEA Loading of the Cargo: It is done under supervision of Preventive officer of Customs. He makes an endorsement LET SHIP ORDER on the duplicate copy of the shipping bill. This authorizes the shipping company to accept the cargo for loading on the vessel. After the LET SHIP Order, the cargo is move to the dock for loading onto the vessel. The mate of the ship issues a receipt called the MATE’S RECEIPT to the shed superidentant after the loading of the cargo. The CHA gives payment of port and dock charges and get the Mate’s receipt

- 47. SHIPMENT BY SEA Post Loading Certification: CHA gives the Mate Receipt to the Preventive officer who records the Certificate of Shipment on all copies of the shipping bill and AR-4. The preventive officer returns the export promotion cop, a copy of the drawback shipping bill and the duplicate AR-4 to the CHA. CHA then presents the Mate receipt to the shipping line and requests it for issue of BL (Negotiable or Non-Negotiable) The agent of the shipping lines files the Export General Manifest with the customs.

- 48. SHIPMENT THROUGH INLAND CONTAINER DEPOT INLAND CONTAINER DEPOT (ICD) AND CONTAINER FREIGHT STATIONS ICD’s:Pithampur, Indore, Guntur, Haryana, Sabarmati, Gujrat, Chinchwad, Pune CFS’s: Mulund, Mumbai, Moradabad, UP, Panipat, Haryana

- 49. SHIPMENT THROUGH INLAND CONTAINER DEPOT CWC-CENTRAL WAREHOUSING CORPORATION Besides, the export should approach the Central Excise officer for the sealing of the container in the factory. The carting order for bringing the cargo at the ICD is issued by CWC. The CHA presents the carting order, the check list issued by the service centre of the Computer Unit, Annex C

- 50. SHIPMENT THROUGH INLAND CONTAINER DEPOT Once the Superintendent of the customs is satisfied after the examination of the documents and the goods, he will issue the LET EXPORT ORDER on the shipping bill though the Computer system. After the LET EXPORT order, 5 copies of shipping bill are issued: Customs Copy Exporter’s Copy Export Promotion Copy TR-1 (Transference) copy TR-II Copy

- 51. SHIPMENT THROUGH INLAND CONTAINER DEPOT The CHA should submit all the 5 copies of the shipping bill and the duplicate copy of GR/SDF to the Superintendent of the Export Shed for his signatures who returns The exporter hands over the TR-I ad TR-II copy of the shipping copy t the CWC for its onward transmission to the gateway port with export containers. The shipping line’s agent issues the Received for Shipment BL to the CHA at the ICD which is converted into SHIPPED ON BOARD when the container is loaded on the ship at the sea port.

- 52. EXPORT THROUGH POST PARCEL Shipment with low volume, High Value Goods like Handicraft items, gems and jewellery Dispatch of trade samples to the foreign buyers The post parcels for the shipment of export goods are sent through the FOREIGN POST OFFICES

- 53. Steps are to be followed while sending shipment by post Booking: The parcels for export goods should be booked by the Foreign POST OFFICES Weight: The general maximum Weight limit of a foreign parcel by sea/air is restricted to 20/10kg respectively by the Universal Postal Union. Size: Maximum Size of post parcel should not exceed 2 METERS. However in no case should the length exceed 1.05 METERS Minimum Size should not be less than 90mmx140mm Manner of addressing: It is obligatory to write the address of the sender on the parcel in ink or with copying ink pencil.

- 54. Steps are to be followed while sending shipment by post Packing: Leave sufficient space for scribbling instructions and affixing stamps and labels Parcel should be sturdy to cover long distances or is to undergo many trans-shipments An Air Mail post parcel must bear on the top left hand corner of the address side, the special blue mail air mail label-PAR AVION- BY AIR MAIL AVAILABE AT POST OFFICE Documentary Requirements: Dispatch note: It is used for giving instructions to the postal authorities for the treatment to be given to the parcel in the event of its non-delivery. Failing which, the parcel is automatically returned back giving rise to covering of return charges. Customs Declaration Form (CDF) PP Form:

- 55. EXPORT SHIPMENT THROUGH COURIER To send samples or free trade samples or documents or small shipments Maximum Weight of the package should not be more than 70 kg The exporters now can send the commercial samples up to the value limit of Rs 50000/-.

- 56. EXPORT SHIPMENT THROUGH COURIER The authorized courier shall file a statement with the proper officer of the Customs either in the Form Courier Shipping Bill- I or the Form courier shipping bill-II regarding the export goods before the departure of the flight. After filing the relevant Courier Shipping Bill with custom officer with inspect, examine and assess the consignment. The Courier should pack the export goods separately in separate identifiable courier company bags with appropriate labels in the following categories, namely Documents Samples and Free gifts Dutiable or Commercial Goods

- 57. SHORT AND SHUT OUT SHIPMENT Sometimes, it may so happen that all the export boxes cannot be stuffed into it and the remaining boxes have to be sent separately. In such a case the exporter or his agent will have to inform the CUSTOMS about the part of the shipment not being sent to get the endorsement n the GR Form In case of SHUT-Out Shipment the exporter should give similar notice to the customs who will forward a copy of this notice to the RBI For cancellation of the original GR. New GR is used if the goods are to be exported subsequently.

- 58. Pre-Shipment Documentation Importance of Export Documents: The export documentation should be prepared with care as they are used (i) as an evidence of the shipment and title of goods (ii) for obtaining payment.

- 59. Basic Documents: Export Order Performa Invoice Packing List Documents required by Customs: Shipping Bill Foreign Exchange related documents: Form SDF GR Form Softex PP Form

- 60. Documents specifically required by the buyer to avail concession or to facilitate easy passage of the cargo: GSP / Certificate of Origin Inspection Certificate Bill of exchange Consular Invoice Documents relating to shipment Bill of leading or Charter party Marine Insurance Policy Shipping Bill

- 61. Export Order: This is the document on the basis of which the exporter procures or prepares the goods and is also useful in the preparation of various other documents. Performa Invoice: This document indicates the details of goods to be exported. It is an offer to sell made by an exporter to the importer. Once the offer is accepted by the exporter it becomes an export order.

- 62. Export Invoice Customs Invoice: Consular Invoice legalized invoice Packing List:

- 63. Intimation for Inspection: This is a prescribed form of notice by the Export Inspection Agency. The exporter has to give notice for inspection in this prescribed form for inspection of the export shipment. Inspection Certificate: The export inspection agency conducts pre-shipment inspection of the goods notified for compulsory pre-shipment inspection of the export goods. This agency issues the Certificate called Certification of Inspection. Shipping Instructions: This document provides a check list of various instructions an exporter may like to convey to the Shipping agent.

- 64. Certificate of Origin/GSP Certificate of Origin The GSP Scheme enables the importers in developed countries to import goods form developing countries like India at concessional rates of import duty or without payment of duty. In India, GSP can be issued by the following agencies: Export Inspection Agency (For all products) Textile Committee (Ready made garments and other textile products) Central Silk Board (Silk Items) Coir Board (For Coir Products) Development Commissioner (Handicrafts

- 65. Bill of exchange: It is an unconditional written order requesting the buyer to pay a specified sum of money to a specified person at specified time. Shipping Order: This is a reservation slip issued by the shipping line at the time of reservation of shipping space for a particular export shipment. Mate’s receipt: It is receipt issued by Mate (Chief Officer) of the ship acknowledging the loading of cargo on the ship. This receipt states the conditions in which goods ere received.

- 66. Bill of Lading A receipt for the goods shipped A contract of affreightment a document of title to goods. It is transferable by endorsements and delivery. It’s possessions equivalent to the possession of goods.

- 67. Types of BL Freight paid or freight to collect B/L Clean or clause B/L Direct or through B/L Shipped B/L (or on-Board) and Received for shipment B/L Copies of B/L: The original alone can transfer the title to the goods

- 68. Endorsement on B/L: The B/L is a transferable document as per custom and practice. It is very important and useful and the utility lies in the ability to transfer the title to the goods from the Exporter to any party or to the importer by means of an endorsement on the B/L

- 69. Shipment Advice Letter to Bank for Negotiation/Collection of Documents Regulatory Documents: Exchange Control Declaration Form –GR, PP, Softex, SDF Freight Payment Certificate Insurance Premium Payment Certificate AR4: Application for Removal of Excisable Goods for Export Marine Insurance Policy

- 70. Shipping Bill It gives the details such as: Quantity and value of the goods and of the export order, The name of the vessel carrying the goods The FOB price of the goods, total number of packages, etc. This is an important document required by Customs for permitting shipment.

- 71. Types of Shipping Bill Free shipping bill-used for exports of goods which attract no duty nor entitled to any duty drawback. White) Drawback shipping.-Green DEPB shipping bill: used when goods are shipped under the DEPB scheme-Blue Shipping bill for Ex-bond: used when the exported goods are those which had been imported earlier and meant for re-export. Shipping bill for goods on which export duty is payable.-Yellow Re-export of imported goods

- 72. Black List Certificate Manufacturers/ Supplier's Quality/ Inspection Certificate: Manufacturer's Certificate Weight Note Certificate of Chemical Analysis Antiquity Measurement