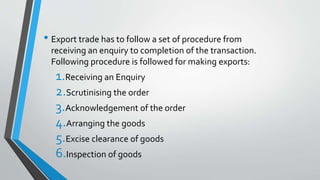

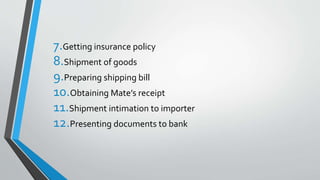

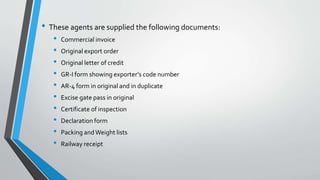

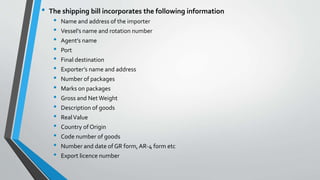

The document outlines the standard procedure for exporting goods, which involves 12 main steps: 1) Receiving an export inquiry, 2) Scrutinizing the order, 3) Acknowledging the order, 4) Arranging the goods, 5) Obtaining excise clearance, 6) Inspecting the goods, 7) Obtaining insurance, 8) Shipping the goods, 9) Preparing the shipping bill, 10) Obtaining the mate's receipt, 11) Informing the importer of shipment, 12) Presenting documents to the bank to obtain payment. The exporter must follow this procedure to complete an export transaction from initial inquiry to receiving payment.