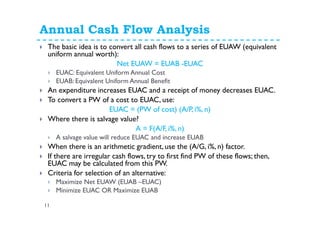

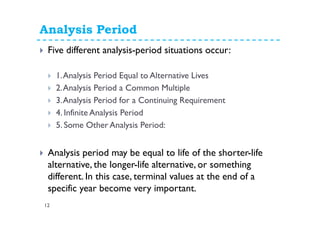

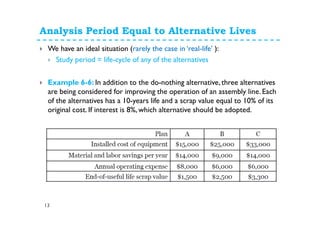

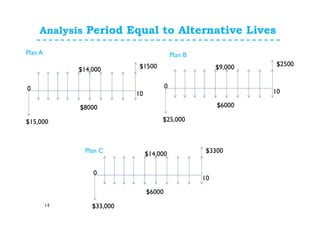

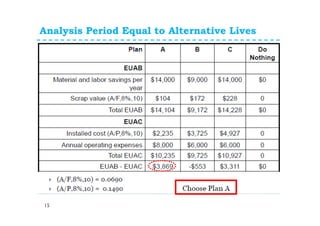

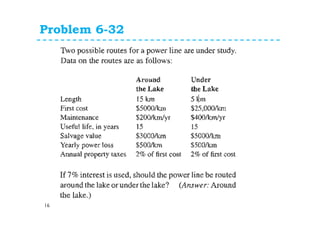

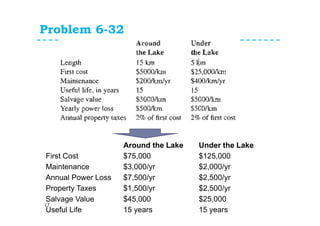

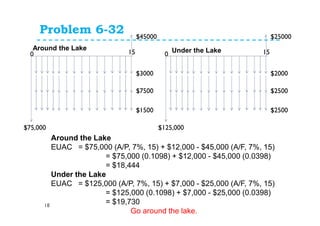

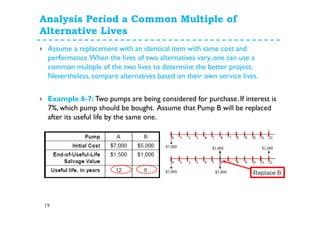

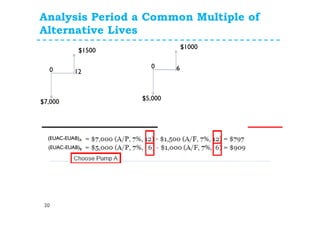

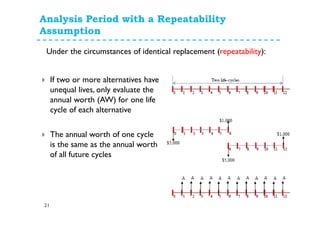

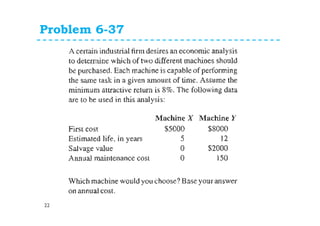

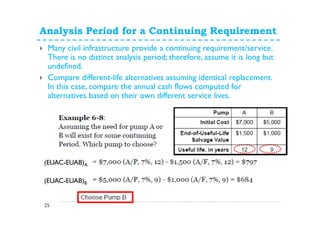

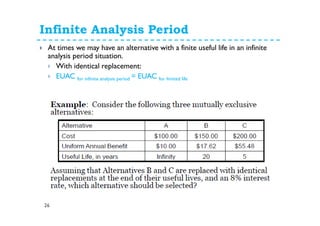

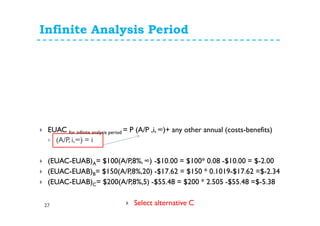

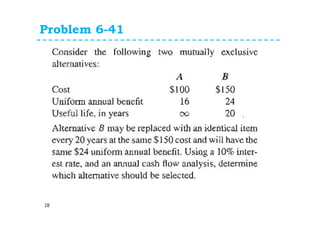

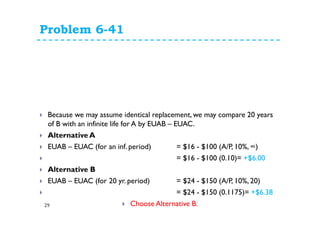

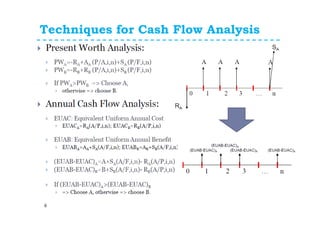

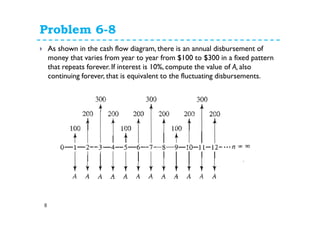

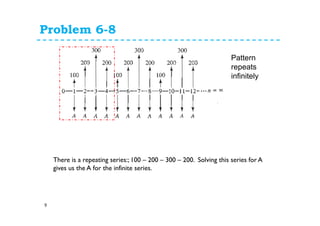

This document provides an overview of annual cash flow analysis techniques for engineering economic evaluations. It defines equivalent uniform annual cost (EUAC) and equivalent uniform annual benefits (EUAB) and explains how to use them to compare alternatives over different time periods, including having the same analysis length, different lengths, infinite lengths, or other periods. The document outlines key concepts like converting cash flows to EUAC/EUAB and discusses analysis periods for alternatives with equal lives, a common multiple of lives, a continuing requirement, or an infinite period. It includes examples of problems applying these techniques. The assignment at the end instructs students to complete 5 problems from the chapter.

![Problem 6-8

10

A= $100 + [$100 (P/F, 10%, 2) + $200 (P/F, 10%, 3) + $100 (P/F, 10%, 4)] (A/P, 10%, 4)

= $100 + [$100 (0.8254) + $200 (0.7513) + $100 (0.6830)] (0.3155)

= $100 + [$301.20] (0.3155)

= $195.03

0

$100

4 0

200

4

+

100100](https://image.slidesharecdn.com/7-150316005526-conversion-gate01/85/7-annual-cash-flow-analysis-10-320.jpg)