The document discusses various techniques for economic analysis of alternatives using present worth analysis:

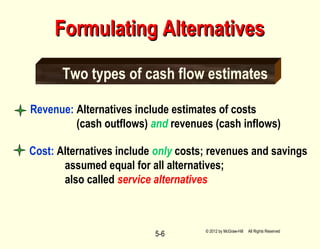

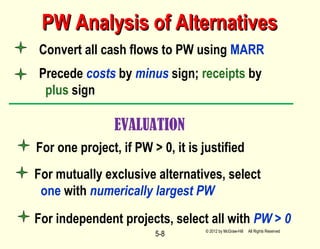

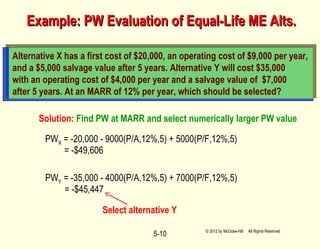

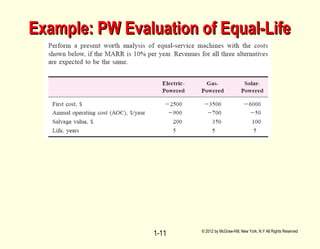

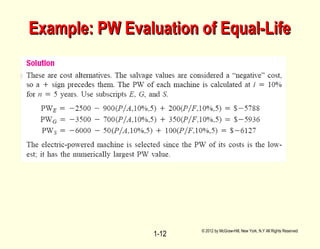

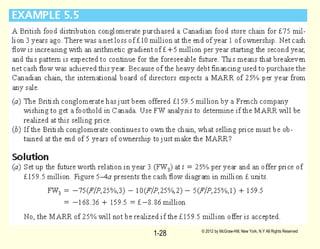

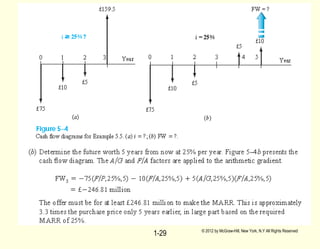

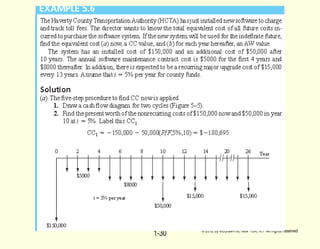

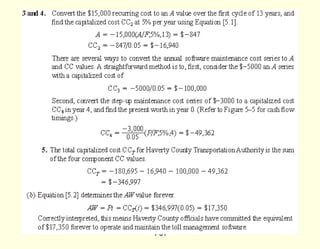

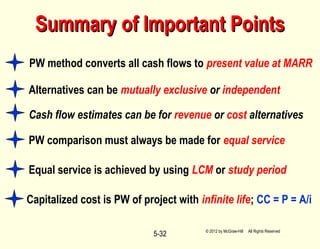

1. Present worth analysis requires converting all cash flows to their present value using the minimum attractive rate of return. Costs are assigned a negative sign and revenues a positive sign.

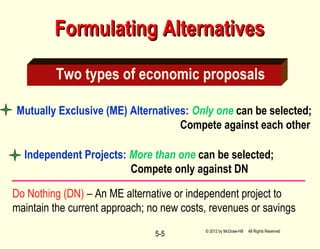

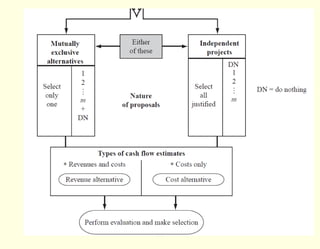

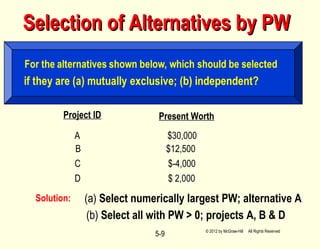

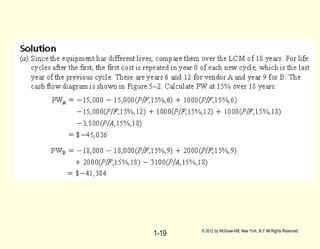

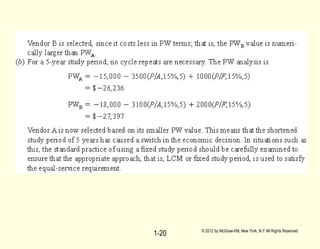

2. For mutually exclusive alternatives, the alternative with the highest positive present worth is selected. For independent projects, all alternatives with a positive present worth are selected.

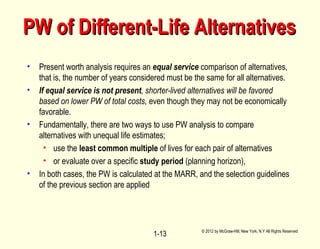

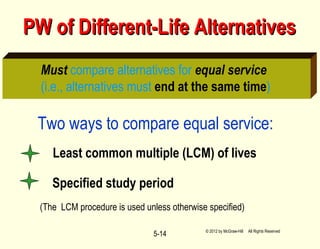

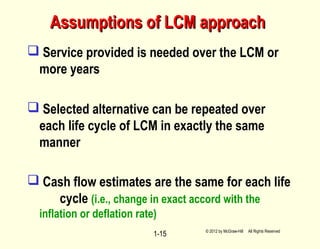

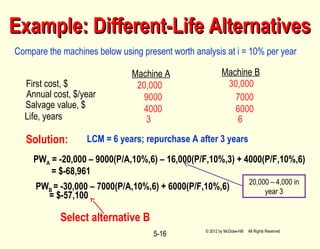

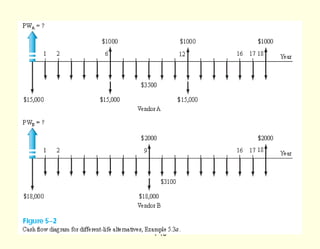

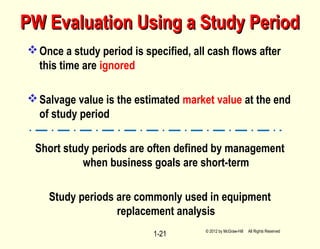

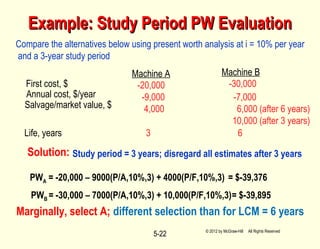

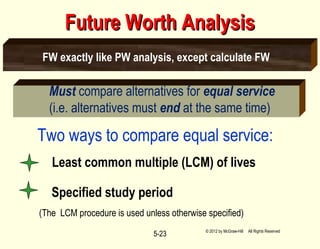

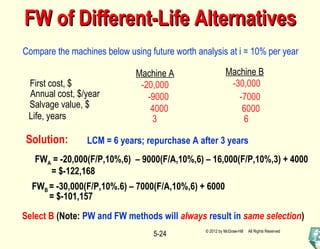

3. When alternatives have unequal lives, they must be compared over an equal period of time using either the least common multiple of lives or a specified study period.

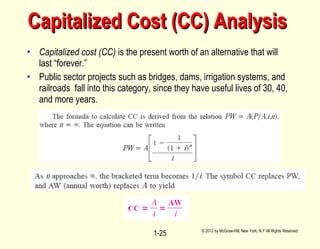

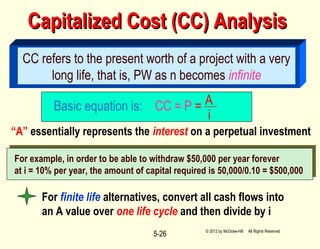

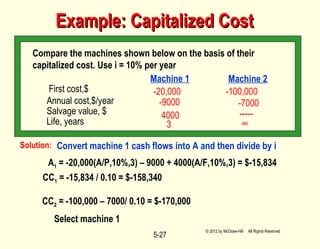

4. Capitalized cost analysis is used to evaluate alternatives that have an extremely long useful life and is calculated as the annual