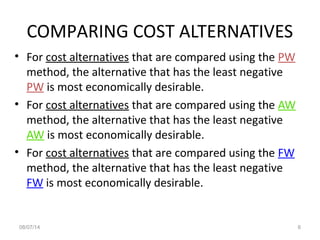

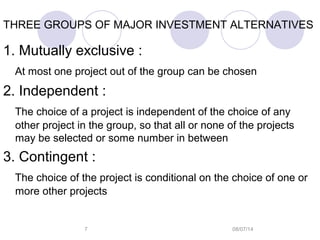

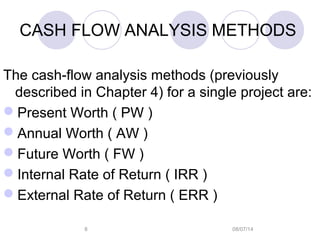

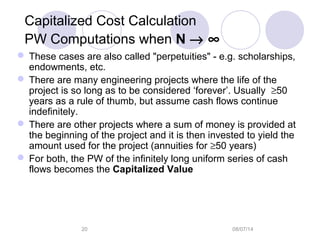

This document provides an overview of present worth analysis and cash flow analysis methods for evaluating investment alternatives. It discusses measures of profitability like present worth, annual worth, and future worth. It covers evaluating single alternatives as well as comparing alternatives of equal lives and different lives. It also introduces the concepts of planning horizon, coterminated assumptions, and capitalized worth for comparing long-term alternatives. Examples are provided to illustrate how to apply these concepts and calculate present worth, annual worth, capitalized worth, and to compare investment alternatives.

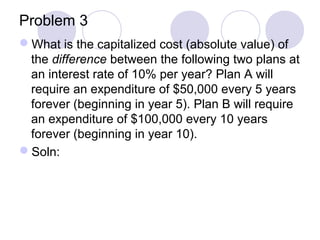

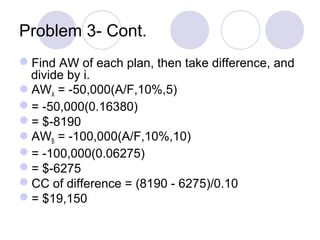

![Example – cont.

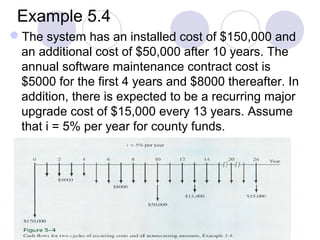

Find the present worth of the nonrecurring costs of $150,000 now

and $50,000 in year 10 at i = 5%. Label this CCI‘

CCI = - 150,000 - 50,000(P/F,5%,10) = $-180,695

Convert the recurring cost of $15,000 every 13 years into an annual

worth AI for the first 13 years.

AI = - 15 ,000(A/ F,5 %, 13) = $-847

The same value, AI = $- 847, applies to all the other 13-year periods

as well.

The capitalized cost for the two annual maintenance cost series

may be determined in either of two ways:

(I) consider a series of $- 5000 from now to infinity and find the

present worth of -$8000 - ($-5000) = $-3000 from year 5 on; or

(2) find the CC of $-5000 for 4 years and the present worth of $-

8000 from year 5 to infinity. Using the first method, the annual

cost (A2) is $- 5000 forever. The capitalized cost CC2 of $- 3000

from year 5 to infinity is found using Equation [5.1] times the P /

F factor.

CC2=-3000/0.05(P/F,5%,4)=$-49,362](https://image.slidesharecdn.com/ch5pwanalysispart1rev4-140807162451-phpapp02/85/Ch5-pw-analysis_part1_rev4-23-320.jpg)

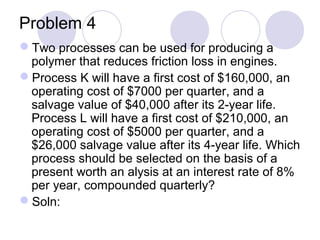

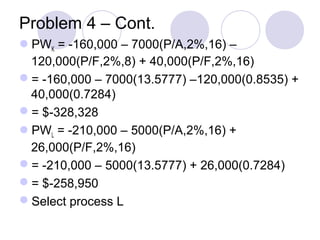

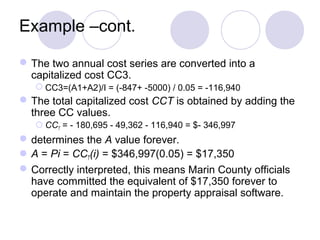

![Problem 2

Determine the capitalized cost of an expenditure

of $200,000 at time 0, $25,000 in years 2

through 5, and $40,000 per year from year 6 on.

Use an interest rate of 12% per year.

Soln:

CC = -200,000 – 25,000(P/A,12%,4)(P/F,12%,1)

– [40,000/0.12])P/F,12%,5)

= -200,000 – 25,000(3.0373)(0.8929) –

[40,000/0.12])(0.5674)

= $-456,933](https://image.slidesharecdn.com/ch5pwanalysispart1rev4-140807162451-phpapp02/85/Ch5-pw-analysis_part1_rev4-25-320.jpg)