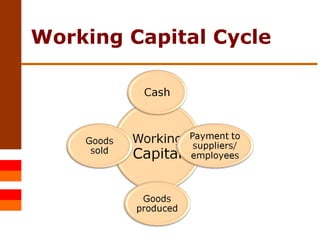

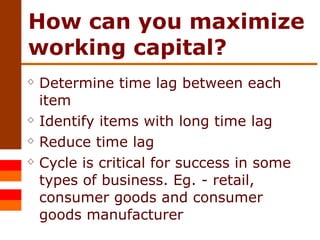

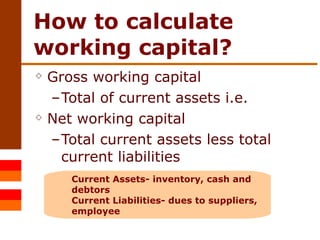

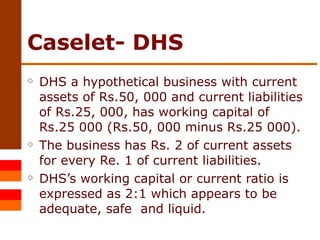

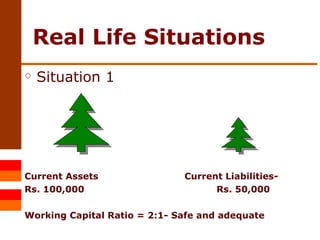

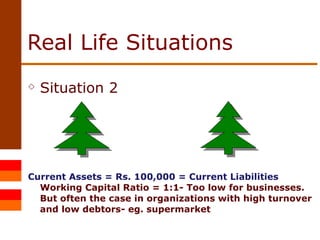

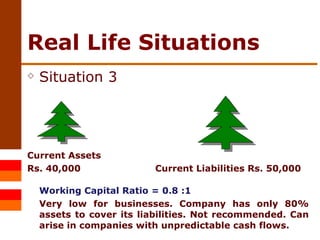

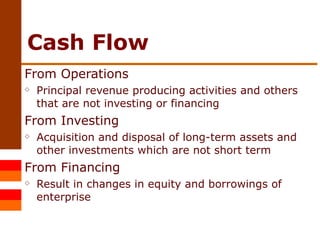

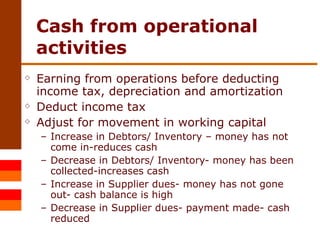

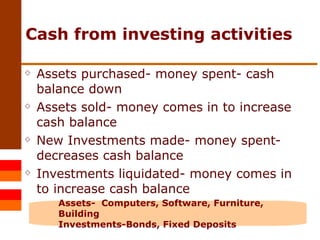

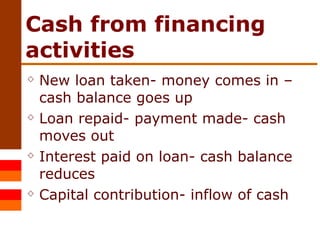

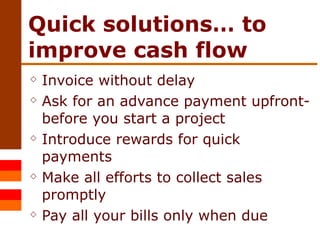

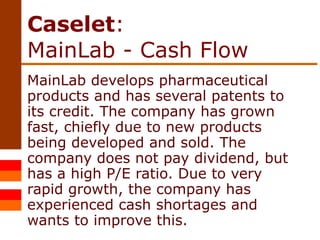

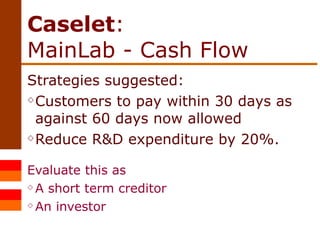

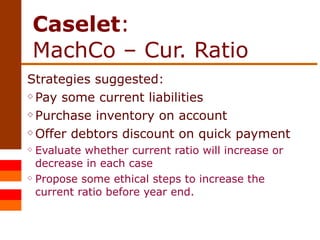

Working capital management and cash flow analysis are important for business success. Working capital is the time between investing in business assets and receiving payment, and measures current assets versus current liabilities. Managing working capital efficiently balances inflows and outflows to maximize liquidity. Cash flow looks at the timing of money in and out of the business from operations, investing and financing activities. Monitoring cash flows helps ensure solvency and adequate cash levels through analyzing components like receivables, payables and inventory levels.

![Working Capital Management & Cash Flow Analysis Anjana Vivek Ketoki Basu www.venturebean.com www.finexsolutions.com [email_address] [email_address]](https://image.slidesharecdn.com/workingcapitalmanagementandcashflowanalysis0607-12835067689007-phpapp02/75/Working-Capital-Management-And-Cash-Flow-Analysis-06-07-1-2048.jpg)