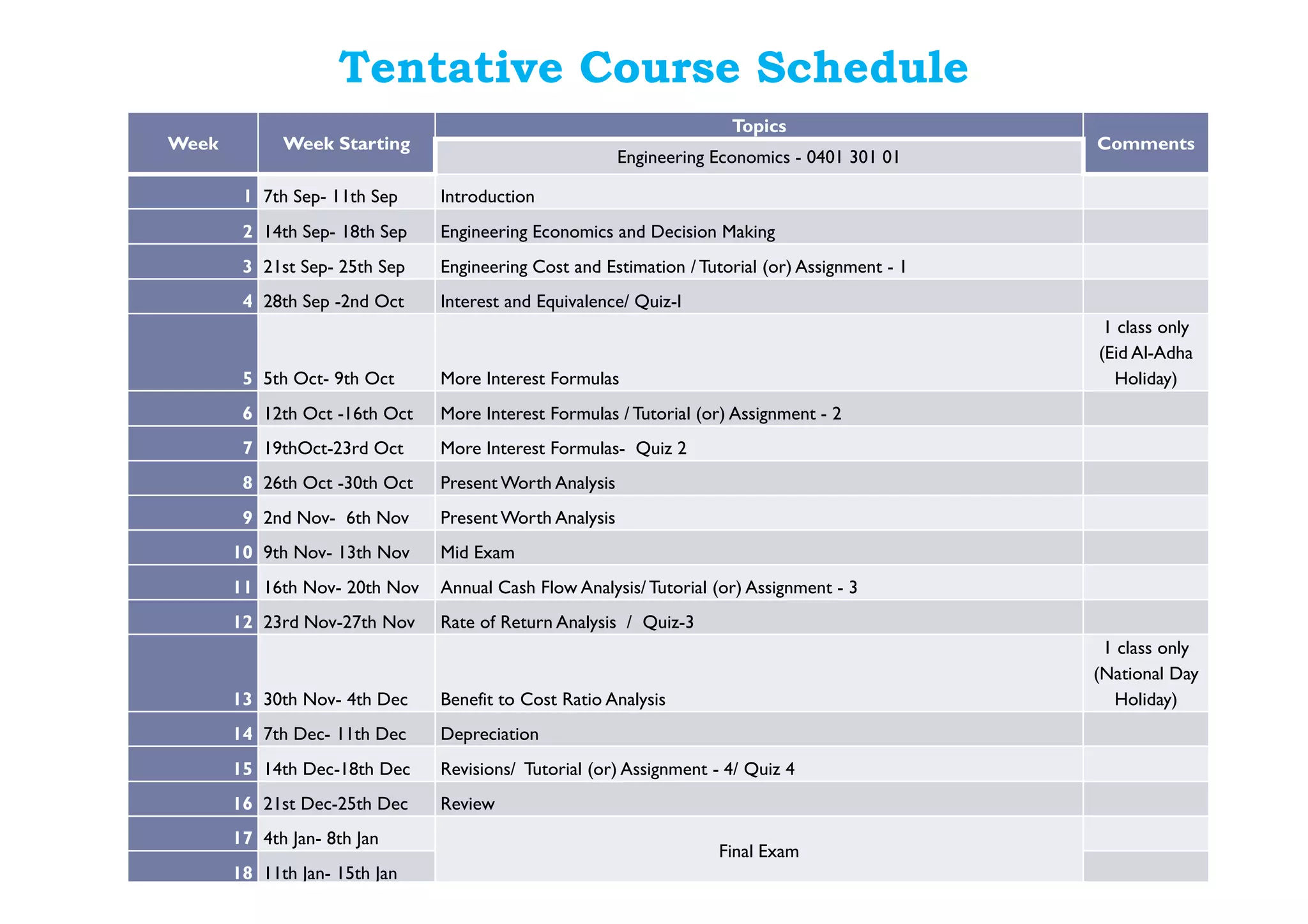

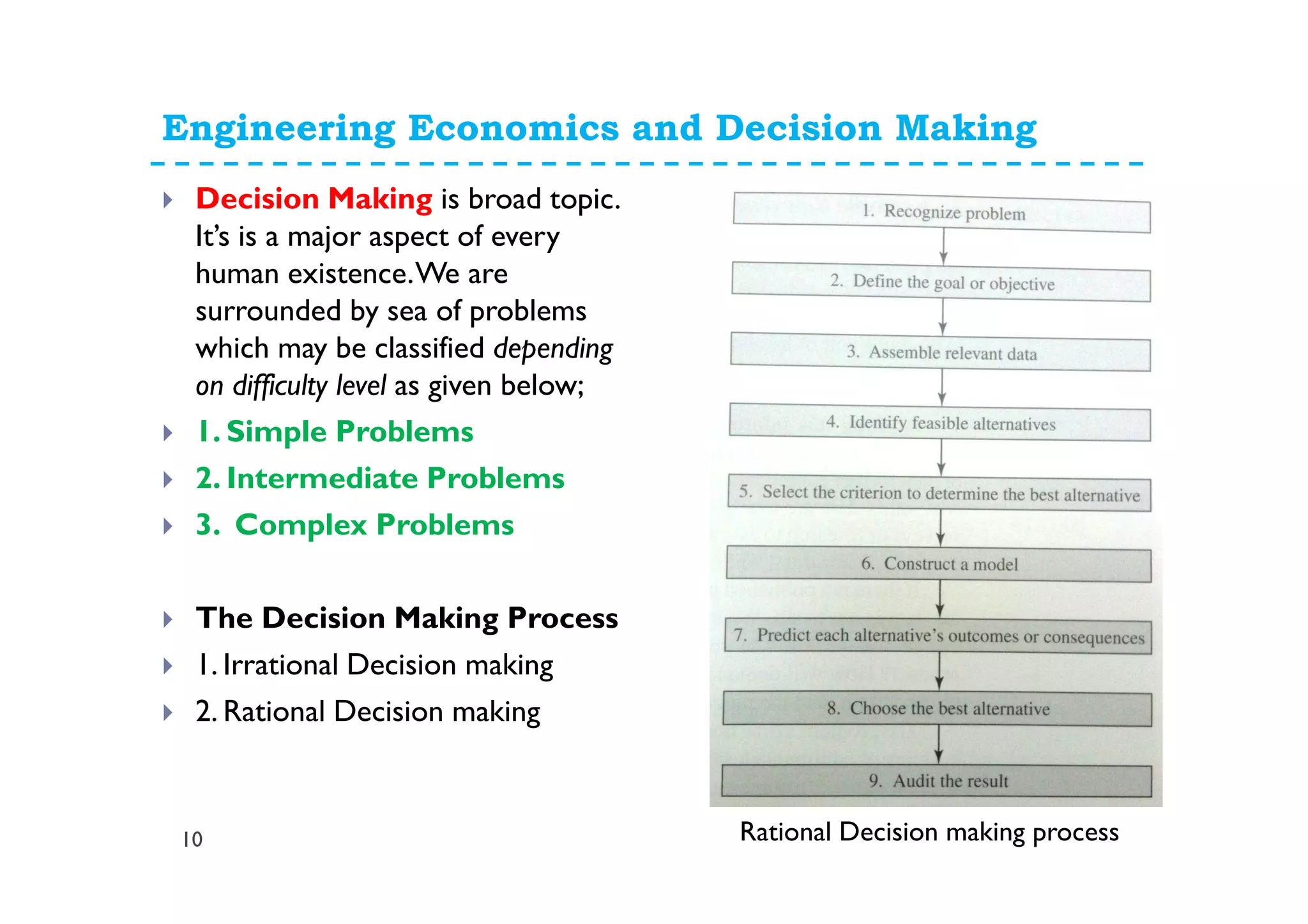

This document provides an introduction and syllabus for an engineering economics course taught by Dr. Mohsin Siddique. It outlines the course details including the instructor's contact information, course goals and objectives, topics to be covered, assessment criteria, textbook information, and tentative schedule. The course aims to provide engineering students with the basic concepts of engineering economics to aid in decision making for engineering projects. Key topics include cost estimation, interest calculation, present worth analysis, rate of return analysis, and depreciation. Students will be assessed through quizzes, exams, assignments, and a final exam.

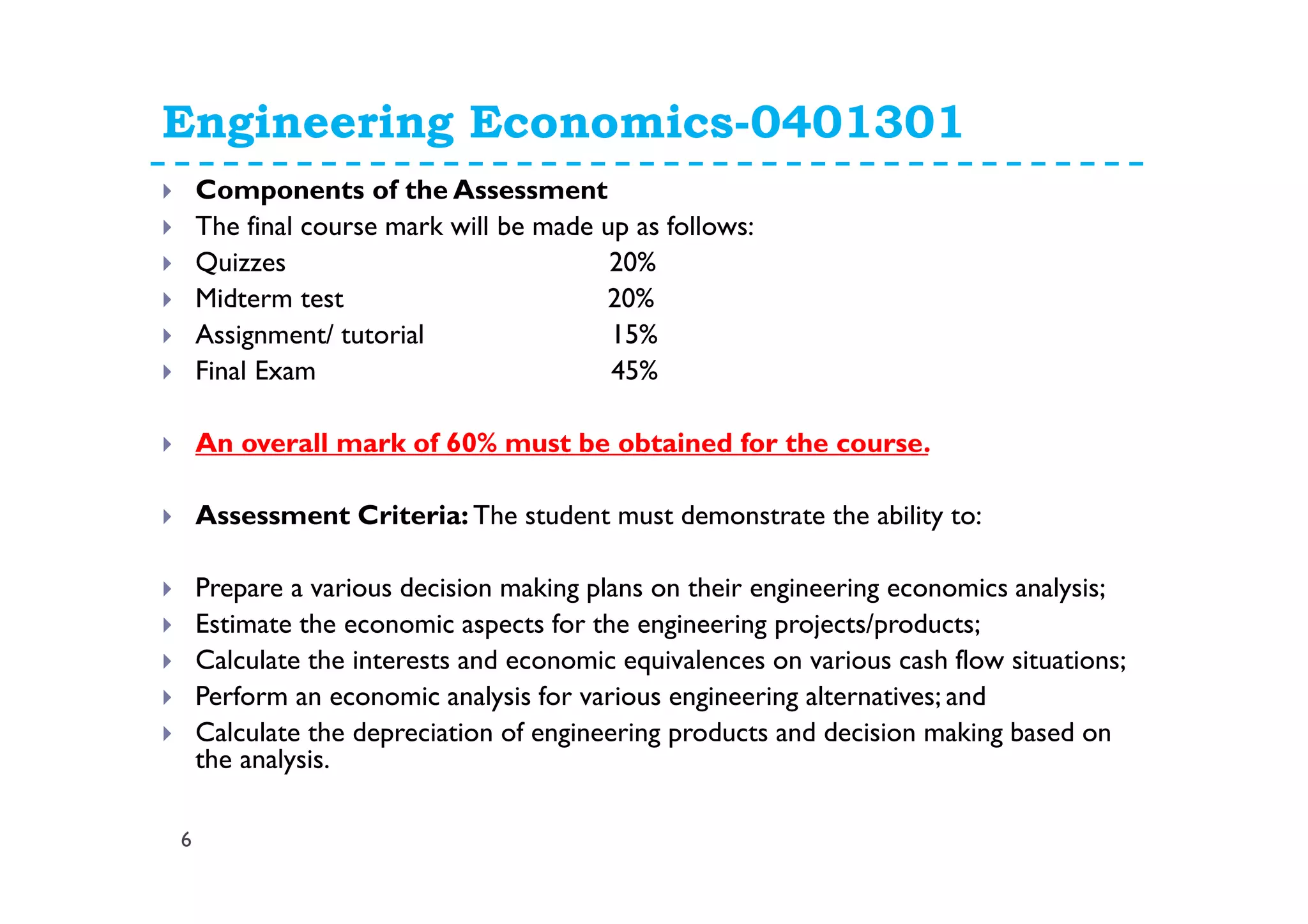

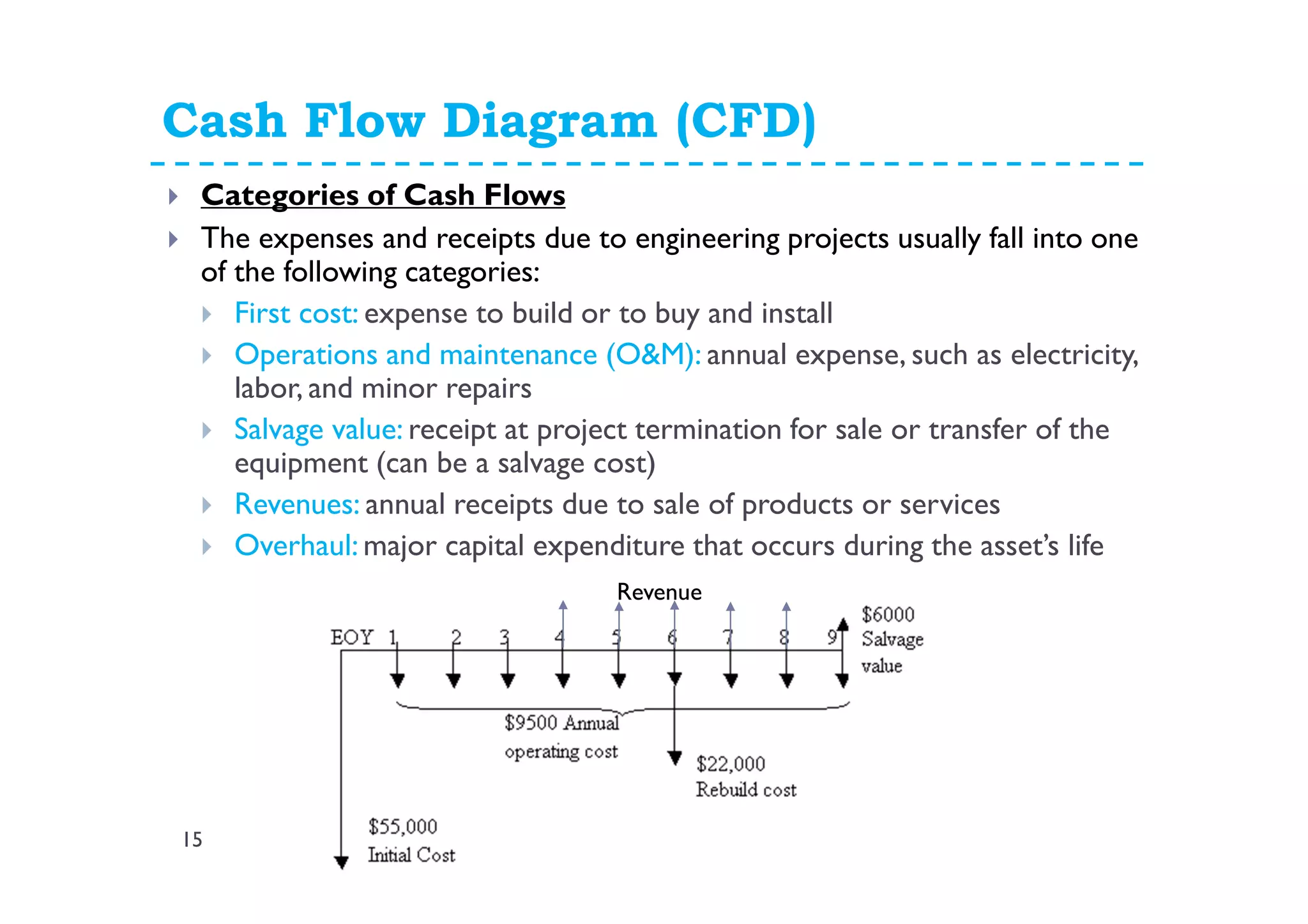

![Uniform Series Formula

17

( )

[ ]niFAF

i

i

F n

%,,/

11

A =

−+

=

0 1 2 n-1 n

A

F

( )

( )

( )niPAP

i

ii

P n

n

%,,/

11

1

A =

−+

+

=

0 1 2 n-1 n

A

P](https://image.slidesharecdn.com/1-introductiontoengineeringeconomics-150316005104-conversion-gate01/75/1-introduction-to-engineering-economics-17-2048.jpg)

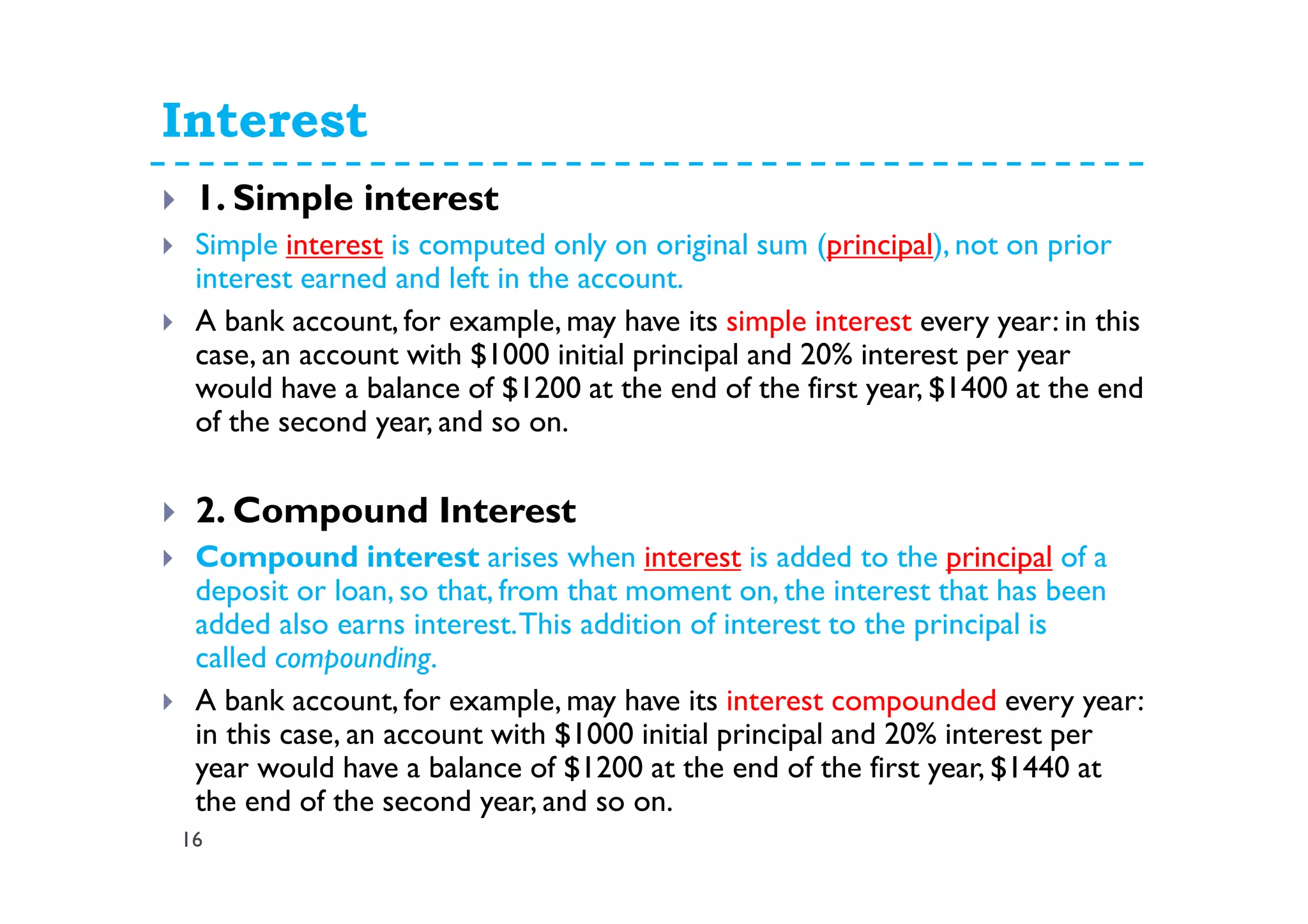

![Arithmetic Gradient Series

18

( ) [ ]niGFG

i

ini

GF

n

%,,/

11

2

=

−−+

=

( )

( )

[ ]niGPG

ii

ini

GP n

n

%,,/

1

11

2

=

+

−−+

=](https://image.slidesharecdn.com/1-introductiontoengineeringeconomics-150316005104-conversion-gate01/75/1-introduction-to-engineering-economics-18-2048.jpg)