Aaj ka trend 100914

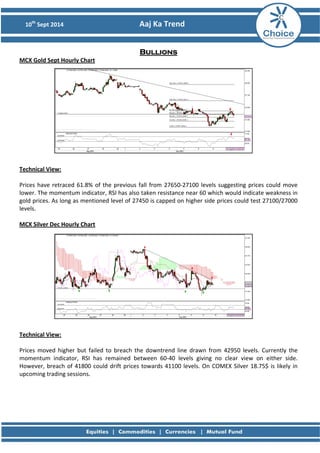

- 1. 0th Sept 201 10 MCX X Gold Sept hnical View ces have ret er. The mo d prices. As els. X Silver Dec Tec Pric low gold leve MCX hnical View ces moved mentum in wever, brea oming trad Tec Pric mom How upc 14 t Hourly Ch hart w: traced 61.8 mentum in long as me 8% of the p dicator, RSI entioned le c Hourly Ch hart w: higher but ndicator, RS ach of 4180 ing sessions failed to b SI has rem 00 could dr s. A Aaj Ka Tre B end Bullions previous fal I has also ta vel of 2745 s ll from 276 aken resista 50 is capped breach the ained betw ift prices to 650‐27100 l ance near 6 d on higher downtrend ween 60‐40 owards 411 evels sugge 60 which wo r side prices d line draw 0 levels giv 100 levels. esting price ould indicat s could test wn from 429 ving no cle On COMEX es could mo te weakness t 27100/270 950 levels. ear view o X Silver 18.7 ove s in 000 Currently t n either si 75$ is likely the de. y in

- 2. 0th Sept 201 10 Fun Pivo G S Rec 14 damental N Gold fu News: utures held dampened t dollar d Also on near a thr the appeal o n the COME nce. Silver f troy ou The do X, silver for futures hit $ llar rose to lows after d officials se month that Fed ot Levels fo Gold ilver o its highest a study by ee rates risi r the Day: ommendat S3 26,818 41,315 tion: Go Silv S2 27,04 41,63 old ver A Aaj Ka Tre ee‐month s of the preci end struck in th ous metal. r December 18.93 on M he previous r delivery sl Monday, the t level in si y the San Fr ing earlier t lipped 0.02% e lowest sin ix years aga rancisco Fe than market S1 ainst the ye deral Reser ts expect. 1 P 42 27, 0 41, Pivot 151 2 27,266 790 4 41,945 session, as s a broadly %, or 0.3 ce nce June 6. ents, to trad en, while t rve publish R1 27,375 42,105 he euro sli ed on Mon Sel Sell Below R2 27,490 42,260 ll w 41800 y stronger U U.S. de at $18.9 95 a d to fresh nday indicat 14‐ ted R3 0 27,7 714 0 42,5 575

- 3. 0th Sept 201 10 MCX 14 X Copper N Nov Hourly C hnical View above cha wn in the a mentum ind w we expect Tec The show mom now M Chart ws: rt suggests above hourl dicator, RSI t prices sho MCX Alumin M num Sept H MCX Lead S prices have y chart. By on hourly c uld move n ourly Chart Sept Hourly y Chart A Bas e given clea breaching 4 chart has m ear 417 lev t Aaj Ka Tre end se Meta als ar sell signa 423 level ha moved below vels as long l near 426 b as added fu w 40 which as 426 are p MCX M Nickel S MCX M Zinc Se by giving clo urther beari is suggestin protected o ose near th ishness to t ng weaknes on higher sid Sept Hourly ept Hourly y Chart Chart e uptrend l the prices. T s in prices. de. line The For

- 4. 0th Sept 201 10 Fun Pivo Co Alu L N Rec 14 damental N Copper News: futures dec wn in dema eenback has e earlier th ssing strong ger U.S. do nd makes d r the Day: slowdow The gre increase progres A stron asset an ot Levels fo opper uminum Lead Nickel Zinc ommendat S1 419.50 124.10 128.40 1131.20 138.60 tion: clined on Tu and from Ch s rallied in han expect gly. llar usually ollar‐priced Cop Alum Le Nic Zi S2 416.30 123.20 127.0 1112.8 136.80 pper minum ead ckel nc A Aaj Ka Tre uesday, as c hina weighe recent wee ed after ec end continued s ed. eks amid ex conomic da weighs on d commodit copper, as i ties more ex S3 3 P 0 408. .20 42 0 121. .50 12 123. .60 13 0 106 60 11 0 132. .20 14 Sell Sell Sell Sell Sell strength in t xpectations ata indicate it dampens xpensive fo Pivot 24.40 24.80 30.30 65.60 41.30 the U.S. do s that the F ed that the the metal's r holders of R1 427.6 125.7 131.8 1,184.0 143.1 llar and con ncerns abou Fed may an e recovery ut a nounce a r in the U.S s appeal as f other curr R2 ate . is an alternat rencies. 432.5 126.5 133.7 1,218.4 145.9 tive R3 5 44 40.6 5 12 7 13 4 1,27 9 15 8.1 7.0 71.2 0.4

- 5. 0th Sept 201 10 MCX X Crude Sep hnical View de Prices h 0 is capped y in crude w X Natural G Tec Crud 572 rally MCX hnical View mentioned change in o mentum in ces. For now Tec As m no c mom pric 14 pt Hourly C Chart: ws: ave remain d on higher which would Gas Sept Da ned strong i side outloo d take price aily Chart: ws: in our prev outlook. On dicator RSI w we recom vious report hourly cha on hourly mend buyin A Aaj Ka Tre E end Energy in yesterday k remains b s towards 5 y y’s trading bearish whi 5800 levels. t prices mov art prices ha timeframe ng on dips n session how le close abo ved higher ave formed has remai near 242‐24 wever, as lo ove the tren achieving o bullish FLA ned above 40 levels wit ong as dow nd line wou our targets. AG pattern 60 which w th upside le wntrend line ld initiate n Bias remain near 235 an would add evels of 246 e of new ns bullish w nd rallied. T bullishness 6/248 to tes with The s to st.

- 6. 0th Sept 201 10 Fun Pivo C Na Rec 14 damental N West Te News: exas Interm sday, ahead s awaited ke consumer. merican Pe sday’s gove nded Septe l gas prices temperatu g. Thermal olds in the r the Day: on Tues Traders largest The Am Wedne week e Natural normal heating househ ot Levels fo rude atural Gas ommendat S1 5611 226 tion: mediate oil f d of the rele ey U.S. wee troleum In ernment re ember 5. s shot up o ures to swee power pla northern U Cru Natur S2 5549 224.60 ude ral Gas A Aaj Ka Tre futures bou ease of U.S. ekly supply d end nced off an weekly sup data to gau stitute wil eport could eight‐mon pply data. ge the stre l release it show crud n Tuesday ep across th nts may bu .S. turning o th low struc ngth of oil d ts inventor de stockpile after upda he northern urn more n on their hea S3 ries report es fell by 1 ted weathe n U.S. and p natural gas aters. 3 P 543 Pivot 39 5 0 213. 70 23 Sell b Buy 659 35.50 er‐forecasti prompt hou s this week below 572 on dips 24 R1 5721 236.90 20 42 ck in the pr demand fro later in th 1.5 million ng models useholds to k to meet R2 5769 246.40 evious sess ion om the worl ld’s he day, wh barrels in t hile the called belo crank up th demand fr ow‐heir om R3 587 9 257.3 30

- 7. 0th Sept 201 10 For 14 Sumee Ritesh Deveya et Bagadia Patel a Gaglani r Private Cir a rculation On https://t nly twitter.com http://w m/ChoiceBro www.slides https:// share.net/c /www.yout https:// tube.com/u /plus.google https://w e.com/1152 www.faceb https:// book.com/p /www.linke edin.com/co A Aaj Ka Tre (Associat (Research (Research oking end te Director h Associat h Advisor) choiceindiab broking user/Choice eBroking 293033595 pages/Choi r) te) ) 831069270 ce‐Equity‐B ompany/ch hoice‐intern Webs 0/posts Broking‐Pvt national‐lim sumeet.ba ritesh.pat deveya.ga agadia@cho tel@choicein aglani@choc site: www.c oiceindia.com ndia.com cieindia.com choiceindia ‐Ltd/35249 a.com 9171824964 mited?trk=p 44 parent_com m m mpany_logo

- 8. 0th Sept 201 10 Di 14 isclaim mer This is s advice. instrume respons in any m in check but Cho respons informa Technica forecast analysis recomm recomm based th has not accepts within t subject summar suggeste for the intraday disclosu copying, disclosu or othe perform achieve investm olely for info It is also not ents. Any ac ibility alone manner for th king the corre oice India or ible for any tion contain al analysis s t future price and news mendations mendations s his documen independen no respons he report ar to change w ry form and ed price leve day of the y basis and res provided , forwarding res provided er financial mance does n any targete ent. POTENT stateme Instrume ormation of t intended a ction taken and Choice I he conseque ectness and r any of its loss or dama ned in this re studies mar e and marke s sources. T issued by tated in this nt on inform ntly verified; ibility or liab re based upo without not have been els are inten report how the recomm d herein ma g or disclosu d herein do n product or not guarante ed rates of r TIAL CONFLIC ent – • Anal ent (s): ‐ No. CT OF INTE yst interest . A Aaj Ka Tre clients of Ch s an offer or by you on t India its subs ences of such authenticity subsidiaries age that may ecommenda ket psycholo t movement The recomm Choice Ind s report is de ation obtain Choice India bility as to i on publicly a ice. The info prepared fo nded purely wever trading mendations ay be consid ure by any p not constitut instrument. ee future ret return, and end hoice India a r solicitation the basis of sidiaries or it h action take y of the infor or associat y arise to an tion or any ogy, price p ts. Technical mendations dia in the erived purel ned from sou a makes no g its accuracy vailable info ormation an or informatio for trading g trends and may be sub dered confid person is str te a solicitat . The curre turns. There there is no REST DISCLO of the stoc and does not n for the pur the informa ts employees en by you. W rmation cont es or emplo ny person fro action take patterns and analysis is c issued her company y from tech urces it belie guarantee, r or complete ormation at t nd any discl onal purpos purposes. T d volumes m bject to chan ential. Any rictly prohib ion or offer t nt performa can be no a guarantee a OSURE (as o k /Instrume t construe to rchase and s ation contai s or associat We have exer tained in this oyees shall n om any inadv n on basis o d volume le complementa rewith migh research un nical analysi eves to be re representatio eness. The o the time of p osures prov es. The reco he recomme might vary s nge. The inf use, distribu ited. The inf to purchase ance may b assurance th against the on date of nt(s): ‐ No. o be an inve ale of any fi ned herein es will not b rcised due di s recommen not be in an vertent erro of this inform evels. It is u ary to funda ht be contr ndertaken a is. Choice In eliable but w on or warran opinions con publication a vided herein ommendatio endations ar substantially formation a ution, modifi formation a or sell any s be unaudited at investme loss of your report) Disc • Firm inte stment nancial is your e liable ligence dation, ny way r in the mation. used to mental rary to as the dia has which it nty and ntained and are are in ons and re valid y on an nd any ication, nd any security d. Past nts will r entire closure of i rest of the nterest stock /