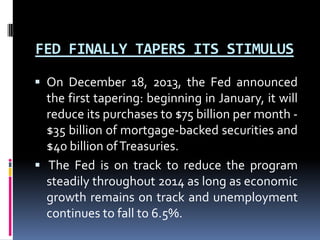

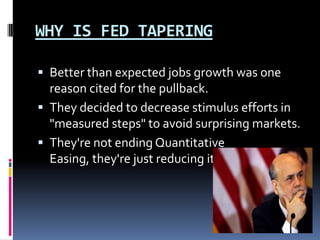

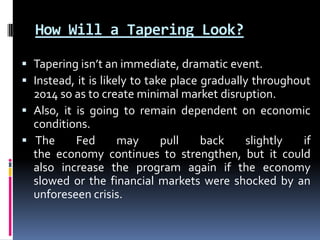

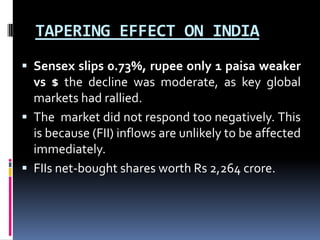

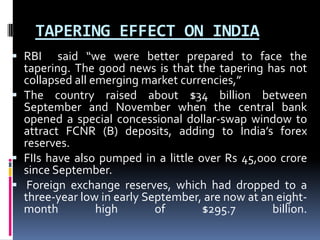

The document discusses the Federal Reserve's tapering of quantitative easing and its effects on the Indian economy. It explains that tapering refers to the Fed reducing its bond buying program. While initial tapering talk caused market volatility, India was better prepared for the actual tapering in December 2013 due to measures like raising foreign currency reserves. The tapering had a moderate negative effect on Indian markets, but further tapering could pose more risks if not managed properly.