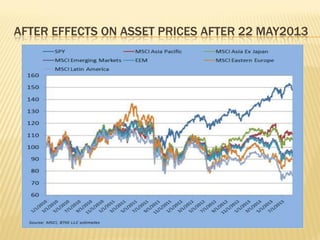

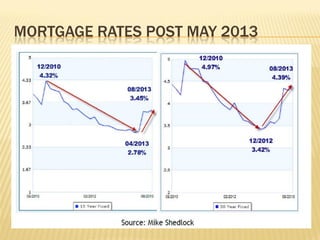

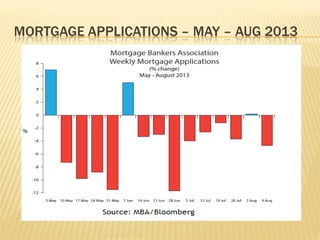

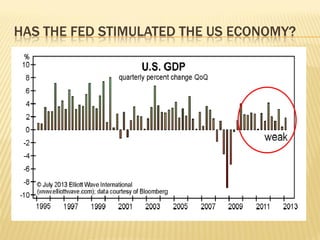

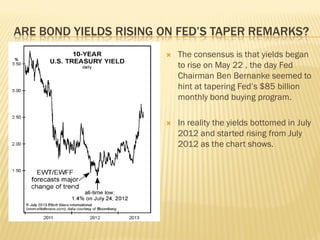

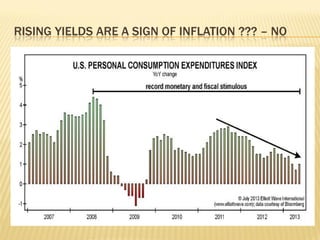

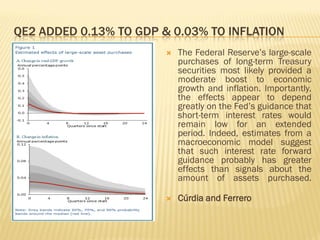

The document discusses the implications of Federal Reserve Chairman Ben Bernanke's hint at tapering the $85 billion monthly bond-buying program, noting the resulting market instability and declining mortgage applications. Research by Vasco Cúrdia and Andrea Ferrero suggests that quantitative easing (QE) has only moderate effects on GDP growth and inflation compared to conventional interest rate cuts. The potential for tapering raises concerns about rising interest rates and the disconnect between Fed intentions and market expectations.