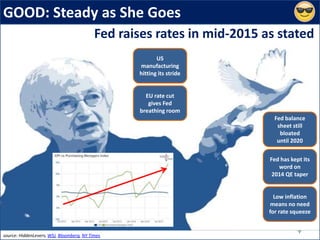

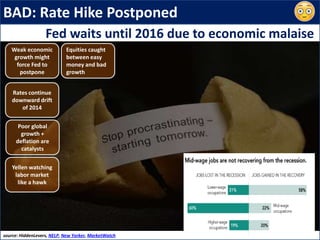

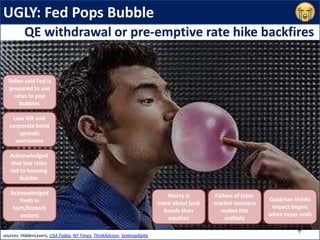

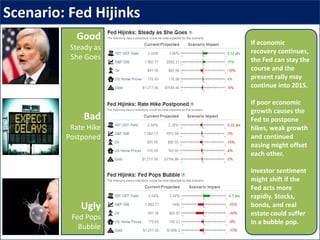

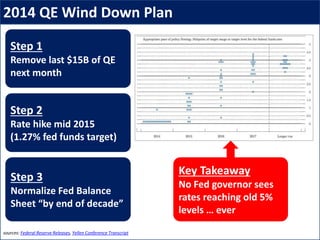

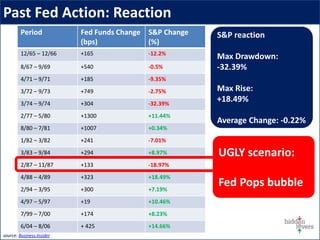

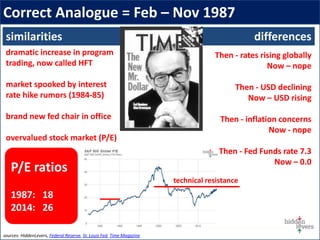

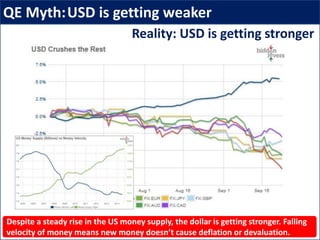

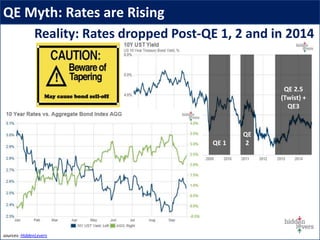

This document provides a summary and analysis of the end of quantitative easing (QE) by the US Federal Reserve. It discusses three possible scenarios for how the end of QE may play out: 1) steady economic growth allows the Fed to raise interest rates gradually in 2015; 2) weak economic growth forces the Fed to postpone rate hikes; and 3) the Fed acts more rapidly to pop potential asset bubbles. The document also reviews past Fed actions, debunks myths about the effects of QE, and notes that other central banks like the ECB and BOJ are expanding their own QE programs to offset the Fed's tapering.