The document provides an analysis and outlook for various global economies and financial markets in January 2014. Regarding the US, it summarizes that the Fed commenced a cautious tapering of bond purchases in December 2013 and expects similar gradual reductions going forward, with quantitative easing ending by late 2014. It also notes the Fed's commitment to keeping rates low for the foreseeable future. For the Eurozone, it discusses the ECB strengthening its forward guidance on keeping rates low and signals the ECB will maintain an accommodative policy stance as the domestic economy shows signs of recovery. However, further disinflation remains a risk.

![Page 4 of 20 This marketing communication cannot be deemed as being impartial. This means that RI can act or may have acted on the

information contained therein. Please see last page for important information.

Monthly Outlook

14 January 2014 www.rabotransact.com

Eurozone

Beefed-up forward guidance…

In the January press conference, ECB President Draghi firmed up the

forward guidance language: “[…] the Governing Council strongly

emphasises that it will maintain an accommodative stance of monetary

policy for as long as necessary […] Accordingly, we firmly reiterate our

forward guidance that we continue to expect the key ECB interest rates to

remain at present or lower levels for an extended period of time.” He then

underscored that the Governing Council “remain[s] determined to

maintain the high degree of monetary accommodation and to take further

decisive action if required.” The timing for this change in language did

not come entirely unexpected. Now that the Fed has initiated a

tapering cycle and economic data are slowly improving, a firming up of

its language is likely to be more successful than during much of 2013

when it was ill striving against the stream for the ECB. This is largely

because the ECB’s forward guidance is conditional and asymmetric in

nature. By talking dovish amidst improving conditions the ECB can

finally distinguish itself from other central banks, the Federal Reserve in

particular, even as the latter has retained a dovish stance. Overall, we

expect the ECB to maintain policy in the coming months. But it is likely

to act quickly if there is any discernible deterioration in either the

growth, inflation or money market outlook. The March meeting (when

it publishes fresh staff projections) is likely to be our next reality check.

… as the domestic economy shows more signs of recovery

Draghi has clearly indicated that the Governing Council will resist

tightening action even when the economy continues to recover. On

that note, perhaps the most encouraging news is that it is domestic

demand that appears to be strengthening, notably in the periphery.

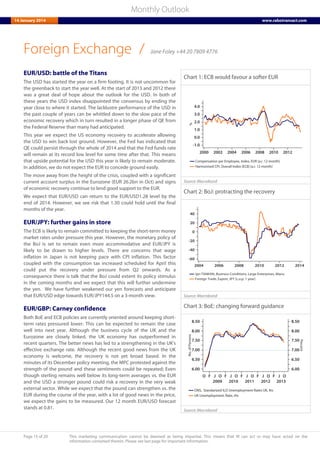

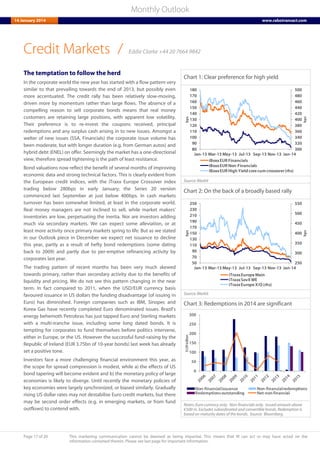

Figure 1 shows the impressive acceleration in retail sales growth in the

periphery, albeit from a low base. Recent data for retail sales, consumer

confidence and retail surveys suggest that overall eurozone

consumption expanded at a pace of around 0.2% QoQ in Q4.

Unemployment remains at a high level, but appears close to stabilising.

In the medium-term the low inflation environment should support a

gradual recovery in consumer spending. Meanwhile, business surveys

also point to a somewhat stronger pickup in investment spending

growth than we had previously pencilled in. The credit environment,

deleveraging pressures and government finances are likely to keep a lid

on the economy’s growth potential for a protracted period of time,

however. We have slightly upped our 2013Q4 growth forecast.

Further disinflation remains a risk

The elephant in the room is inflation and President Draghi has signalled

that the Governing Council will not accept a significant deterioration in

the medium-term outlook. We would stress that recent declines in core

inflation have been partly driven by technical factors and indirect taxes

falling out of the comparison base. Super-core inflation (Figure 2) has

not shown a discernible downward trend since end-2012. We expect

headline inflation to move within a fairly narrow range over the next six

months (between 0.8% to 1%), but a persistent fall below it may spur

the ECB into action again. Initially this would likely be a combination of

liquidity measures and a further beefing-up of the forward guidance.

We remain sceptical of negative deposit rates, conditional LTROs and

asset purchases (particularly at his stage), but – clearly - nothing can be

excluded should deflation risks be seen as being on the up.

Chart 1: Retail sales growth: core vs. periphery

-10

-8

-6

-4

-2

0

2

4

6

05 06 07 08 09 10 11 12 13

%YoY

core periphery

Source: Macrobond, Rabobank

Chart 2: Core and super-core inflation

Source: Macrobond, Rabobank

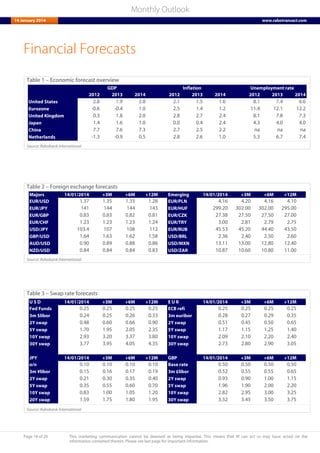

Table 1: Economic forecasts

2012 2013 2014 Q3/13 Q4/13 Q1/14 Q2/14

GDP -0.6 -0.4 1.0 0.1 0.3 0.3 0.2

Consumption -1.4 -0.5 0.5 0.1 0.2 0.1 0.1

Investment -3.9 -3.1 1.6 0.4 0.5 0.3 0.4

Government -0.6 0.2 0.3 0.2 -0.1 0.1 0.2

Trade 1.7 0.6 0.2 -0.4 0.1 0.1 0.0

Inventories -0.6 -0.1 0.2 0.3 0.0 0.0 0.1

CPI (%y-o-y) 2.5 1.4 1.2 1.3 0.8 0.9 1.0

Unemp. %rate 11.4 12.1 12.2 12.1 12.2 12.2 12.2

Yearly Quarterly

Source: Rabobank

/ Elwin de Groot +31 30 216 9012](https://image.slidesharecdn.com/35fc3797-0dab-4c69-af95-09390866ba43-150414124046-conversion-gate01/85/GlobalOutlook-4-320.jpg)