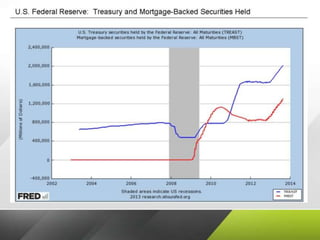

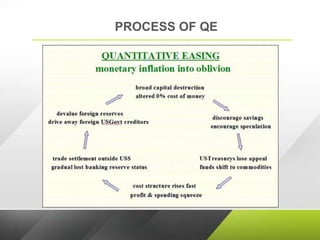

Quantitative easing (QE) is an unconventional monetary policy used by central banks to stimulate the economy by increasing the money supply. It involves flooding financial institutions with capital to promote increased lending and liquidity. The funds are created electronically rather than physically printed. Several central banks, including the Bank of Japan, US Federal Reserve, Bank of England, and European Central Bank engaged in QE programs following the 2008 financial crisis to boost their economies by lowering interest rates and purchasing assets like government bonds. While QE can help stimulate demand, there are also risks like potential impact on savings, pensions, inequality and emerging market economies.