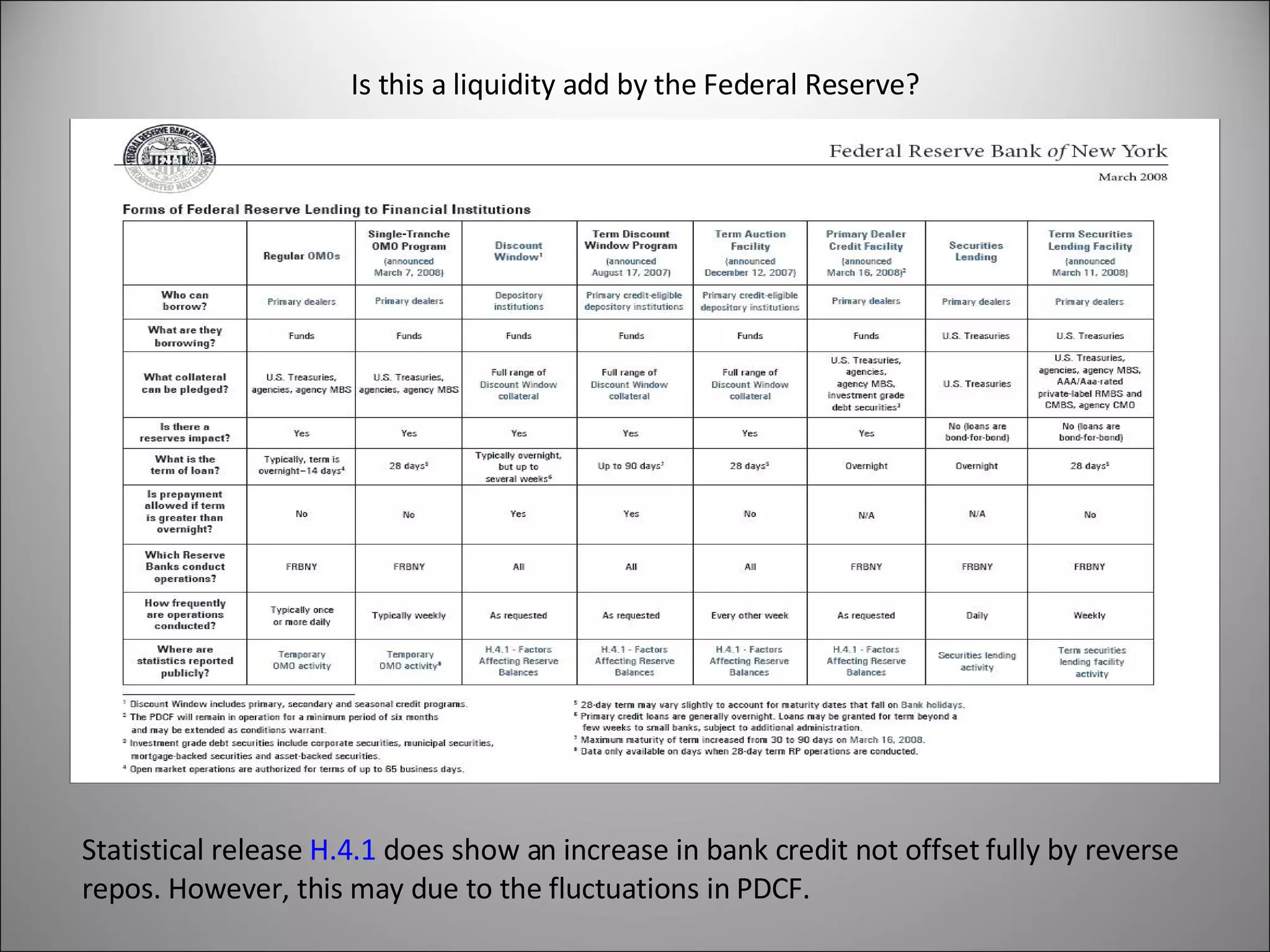

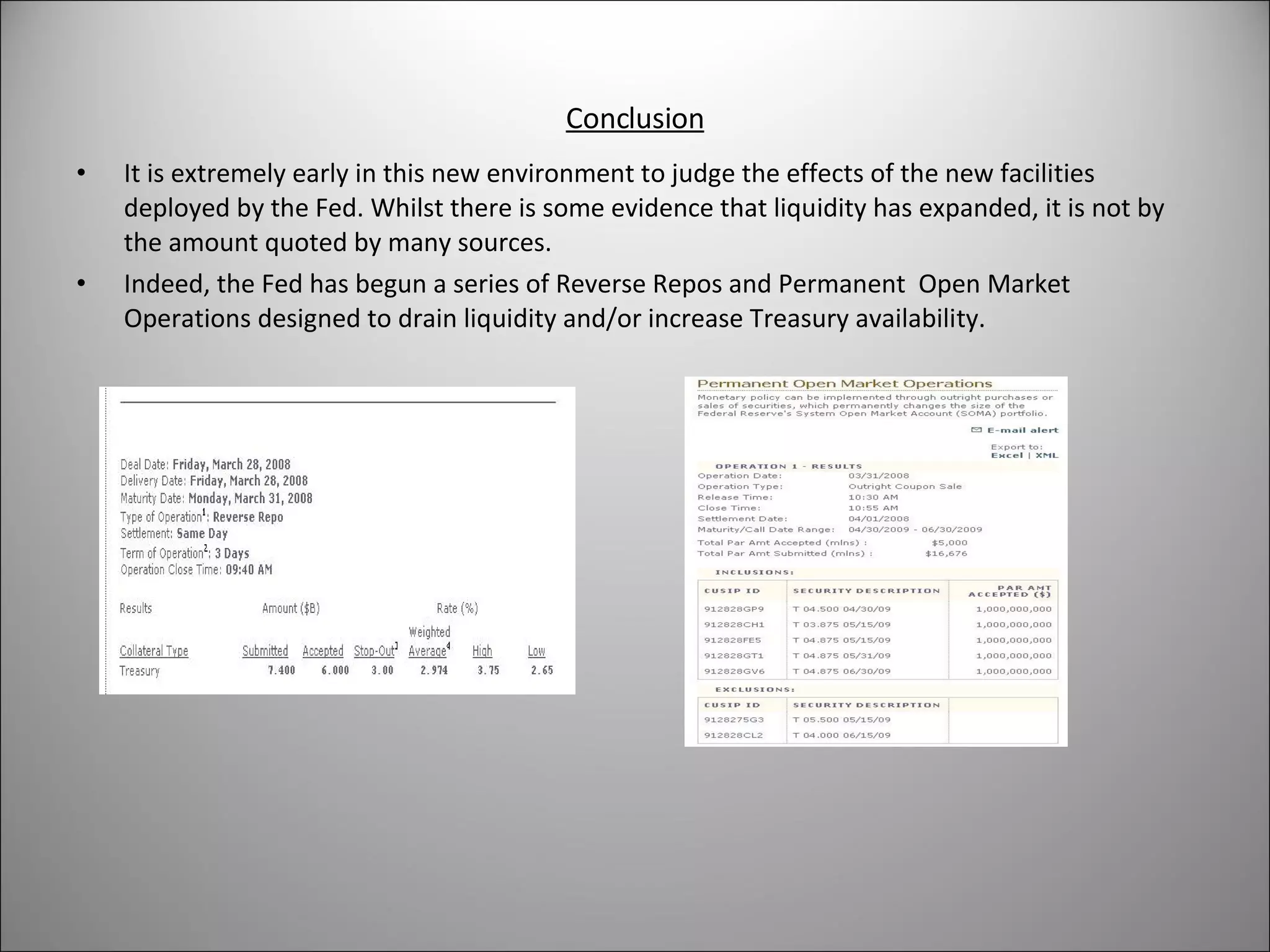

The Federal Reserve introduced new lending facilities like the Term Auction Facility, Term Securities Lending Facility, and Primary Dealer Credit Facility to promote liquidity in financial markets during the crisis. These facilities allow banks and dealers to borrow against collateral at auctioned rates. While they have increased liquidity, the Fed still faces risks around moral hazard and controlling inflation if lending standards are not maintained as financial markets stabilize. The success of the Fed's actions depends on restoring confidence without re-inflating asset prices.