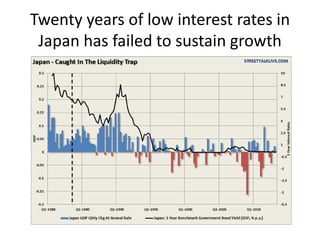

The document discusses how interest rates have behaved since the financial crisis and makes several predictions:

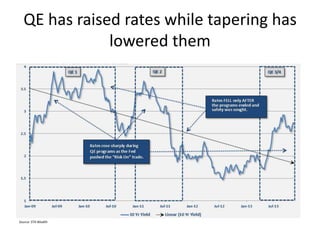

1) Tapering of quantitative easing by the Federal Reserve is likely to lower interest rates as investors flee to safety in bonds, increasing bond prices and lowering yields.

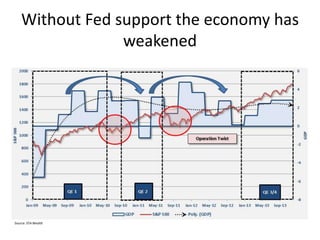

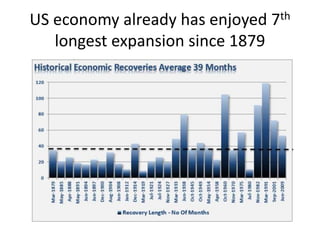

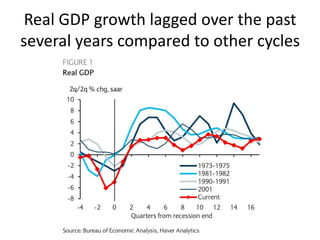

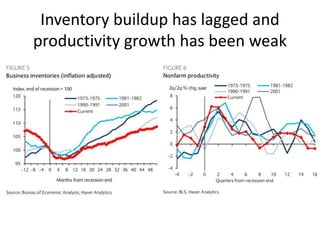

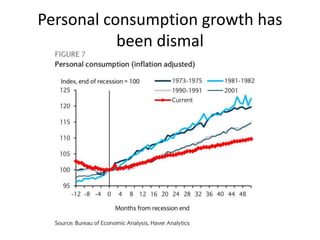

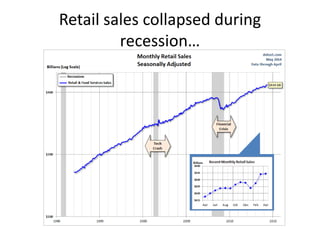

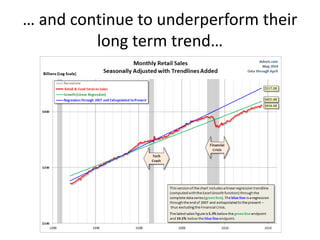

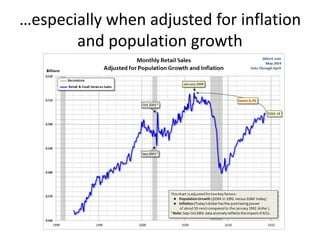

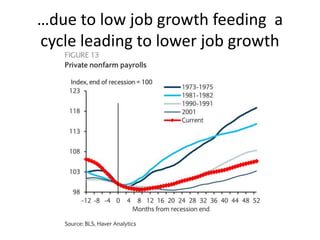

2) Previous tapers have weakened the economy, pushing interest rates lower, and ending quantitative easing and zero interest rate policies may end the long but fragile economic expansion.

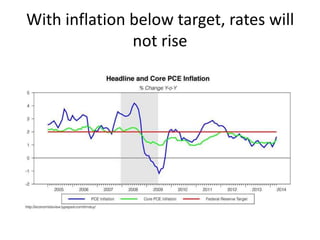

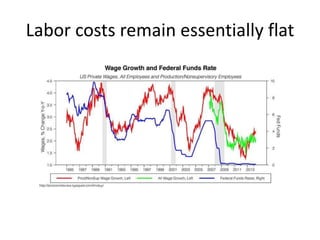

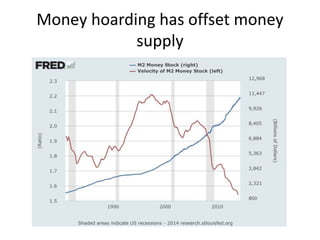

3) Interest rates will remain low due to disinflationary forces like low wage growth and money hoarding offsetting increases to the money supply.

4) The document predicts the Fed's balance sheet will remain above 2011 levels until 2020 and policy rates will