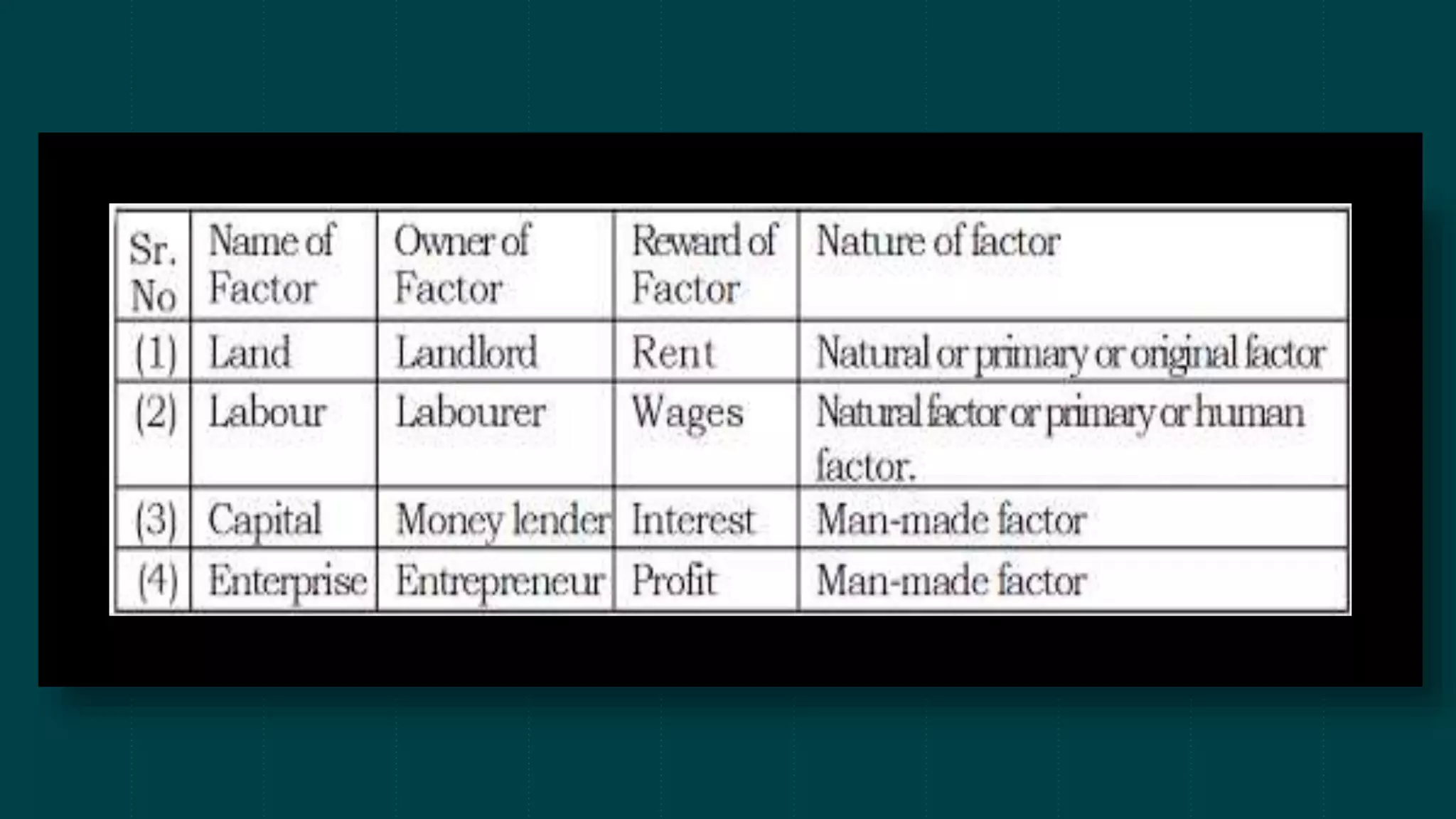

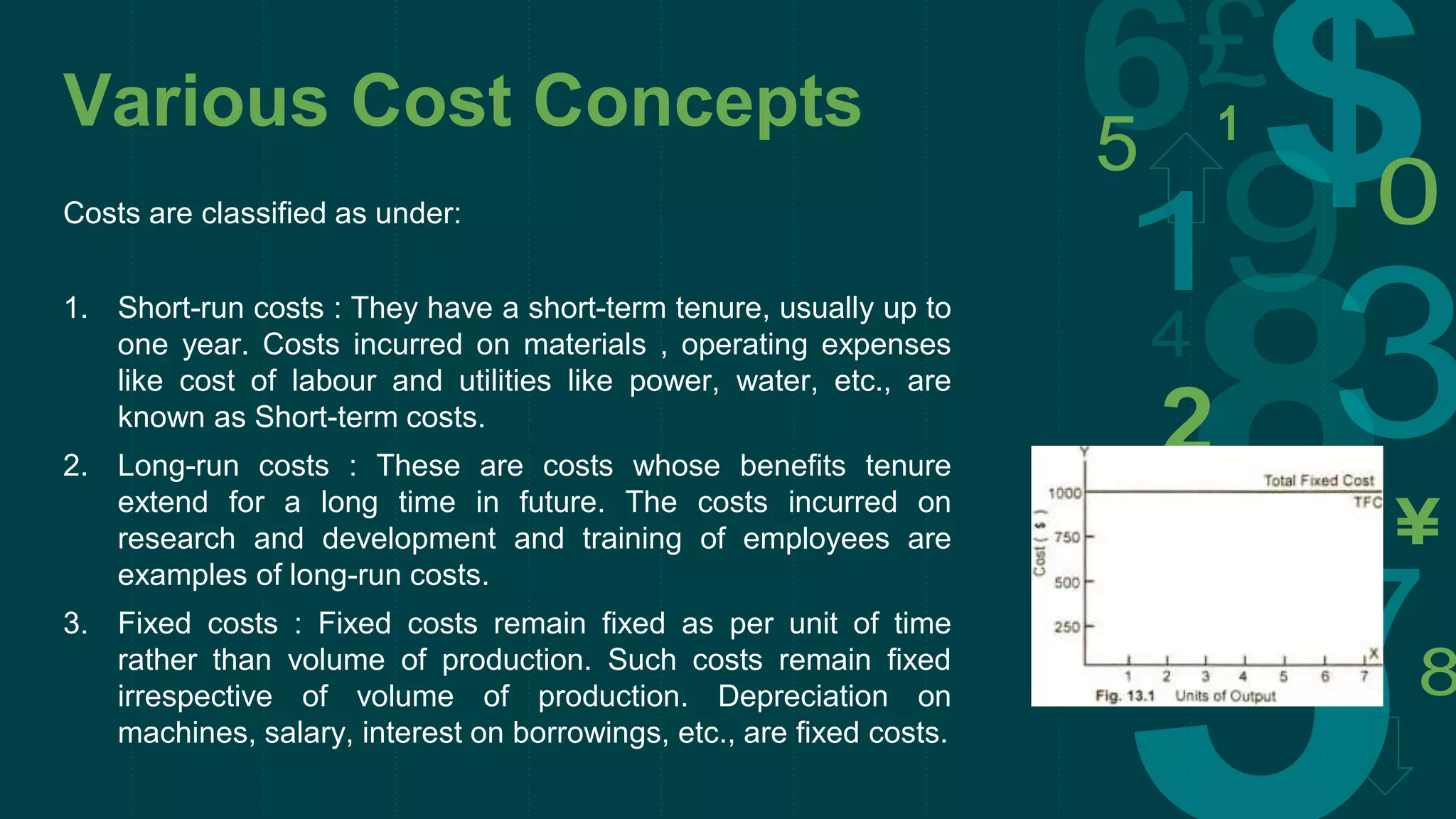

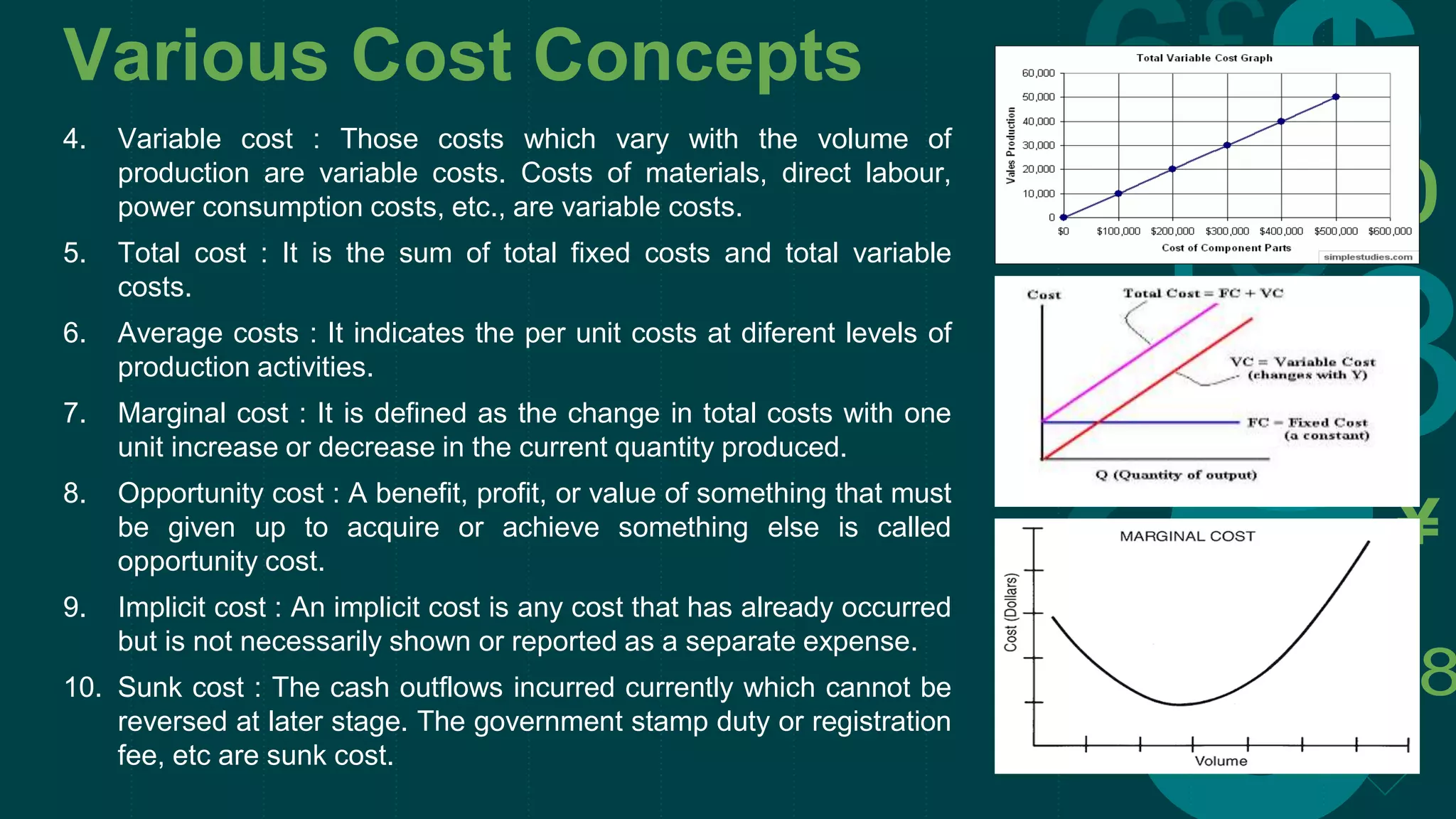

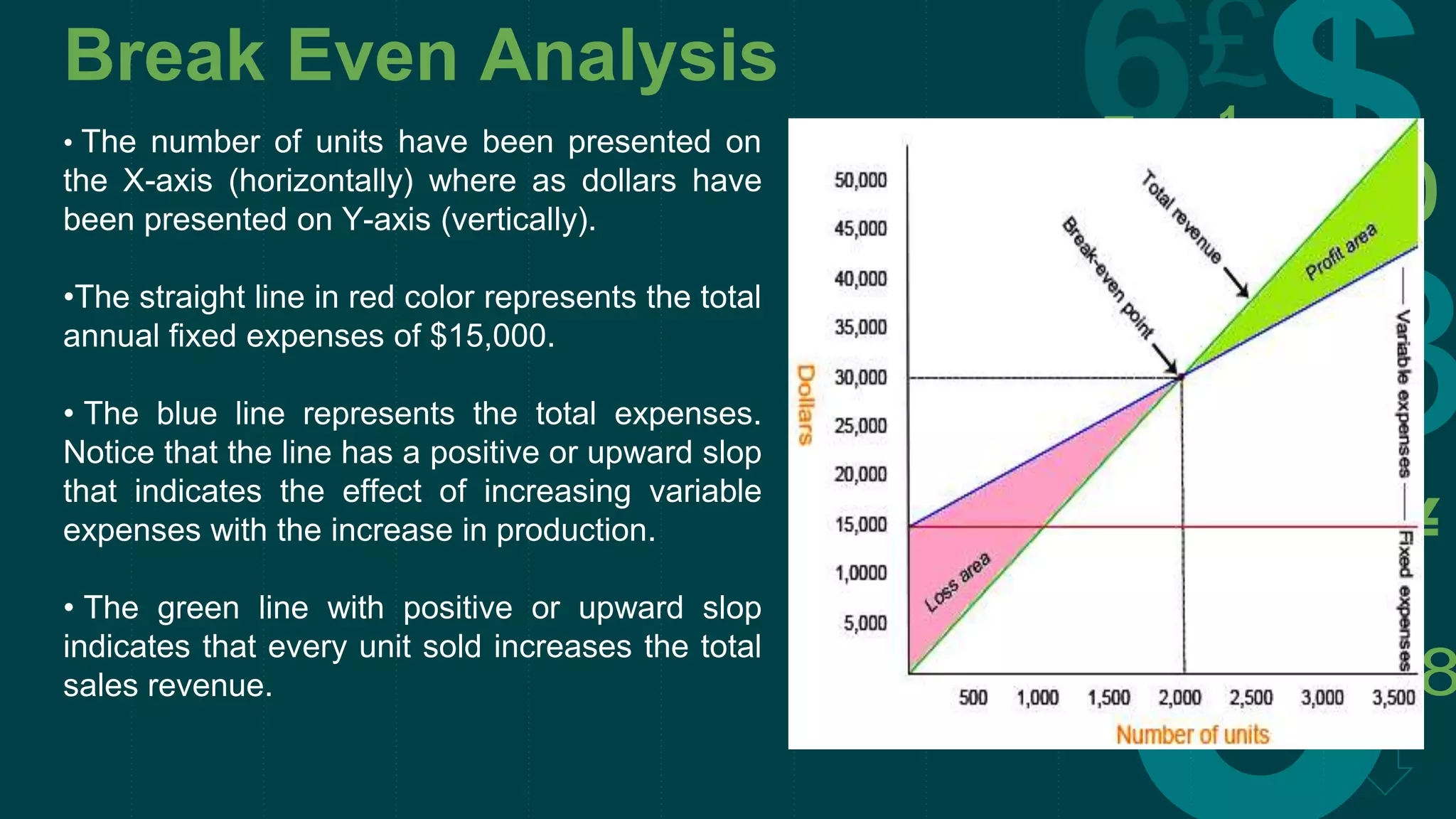

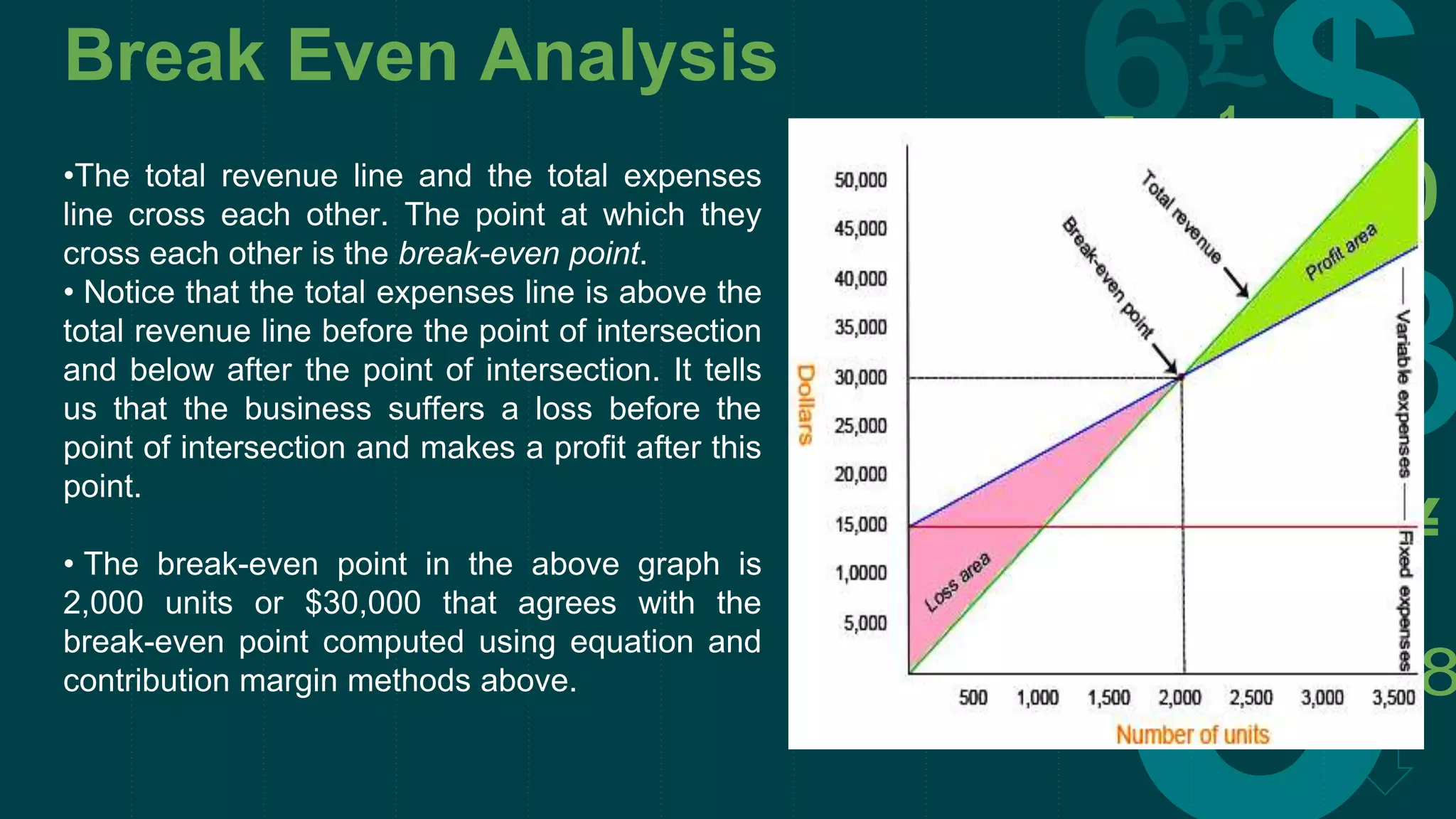

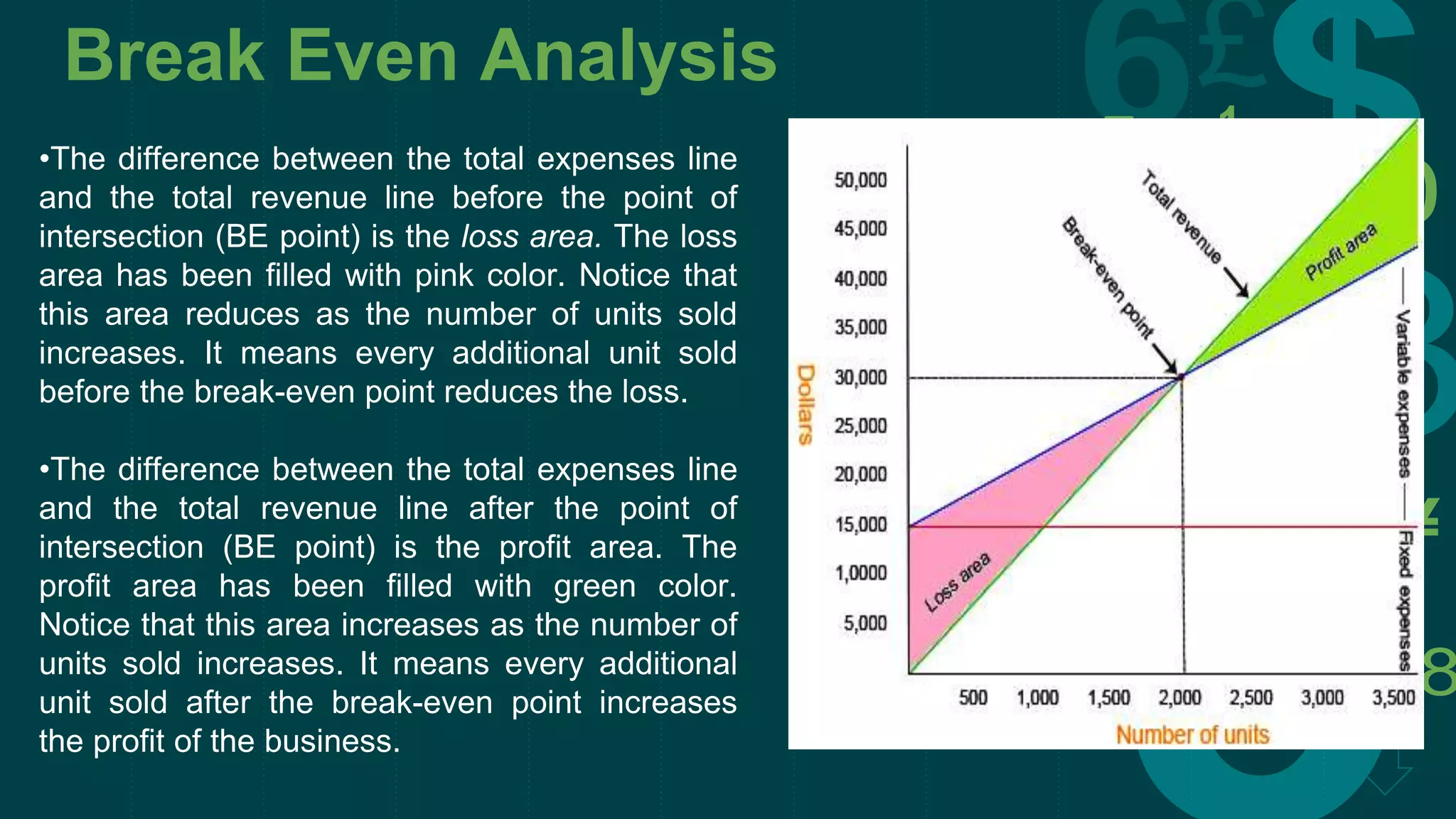

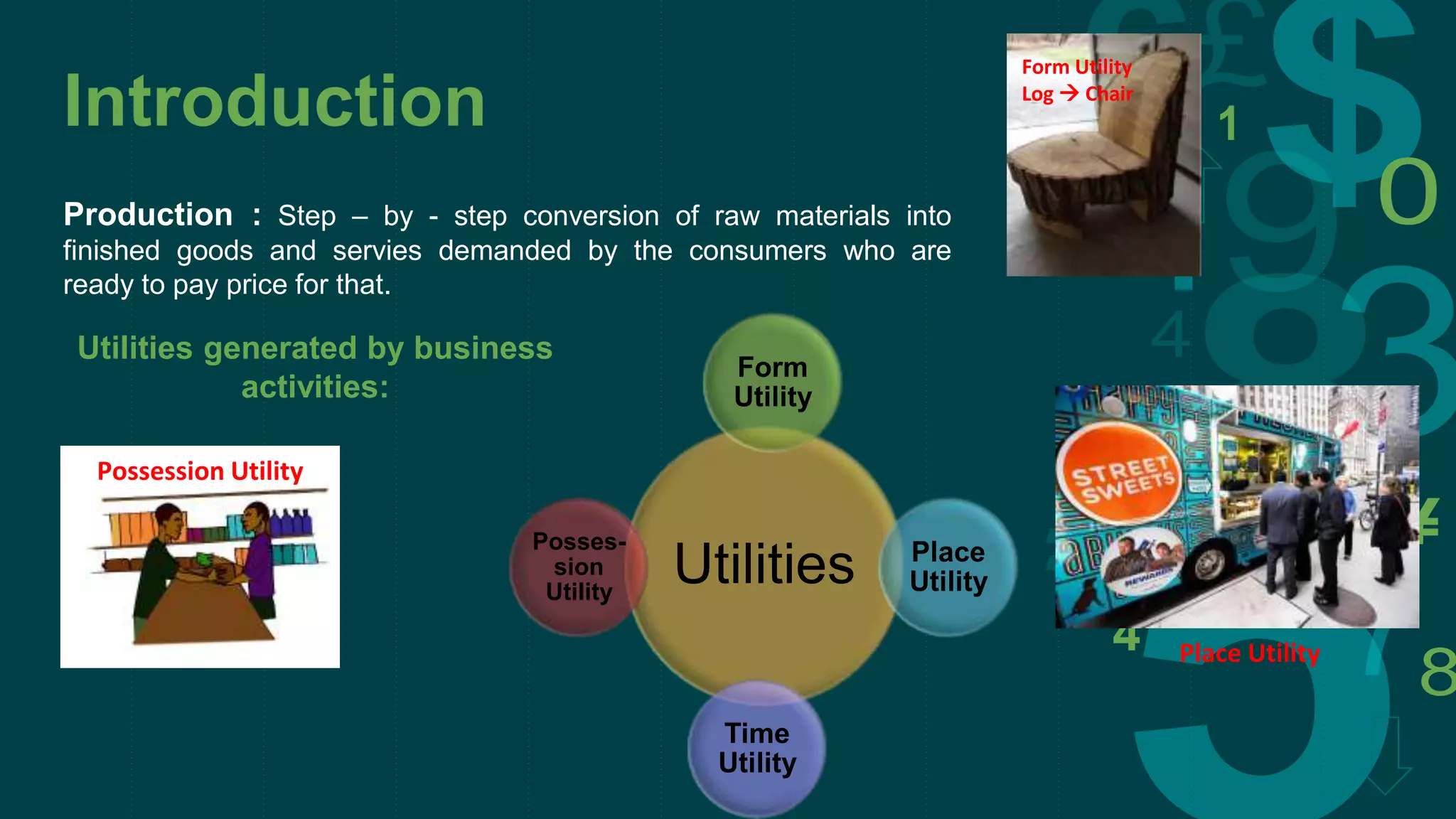

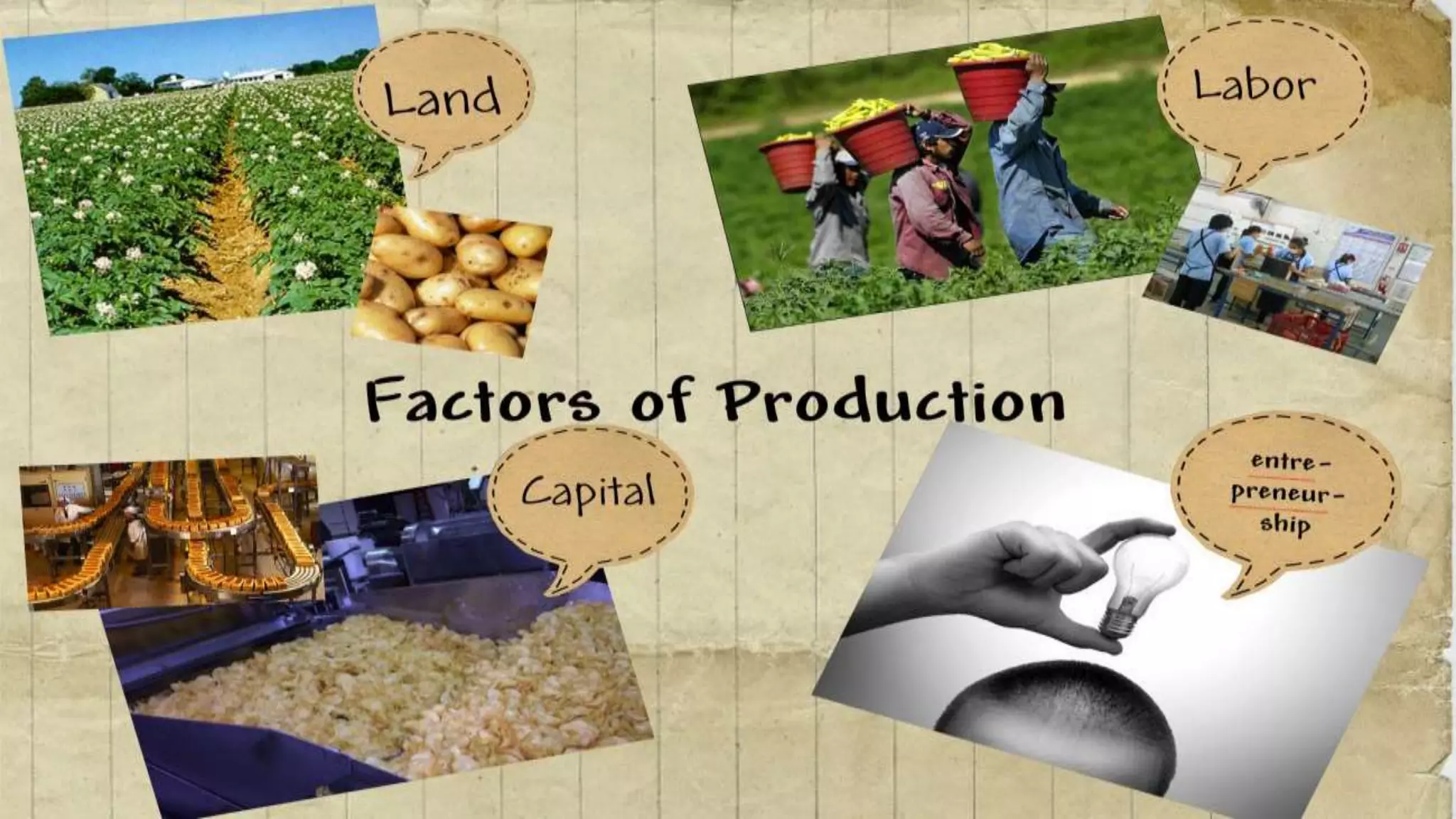

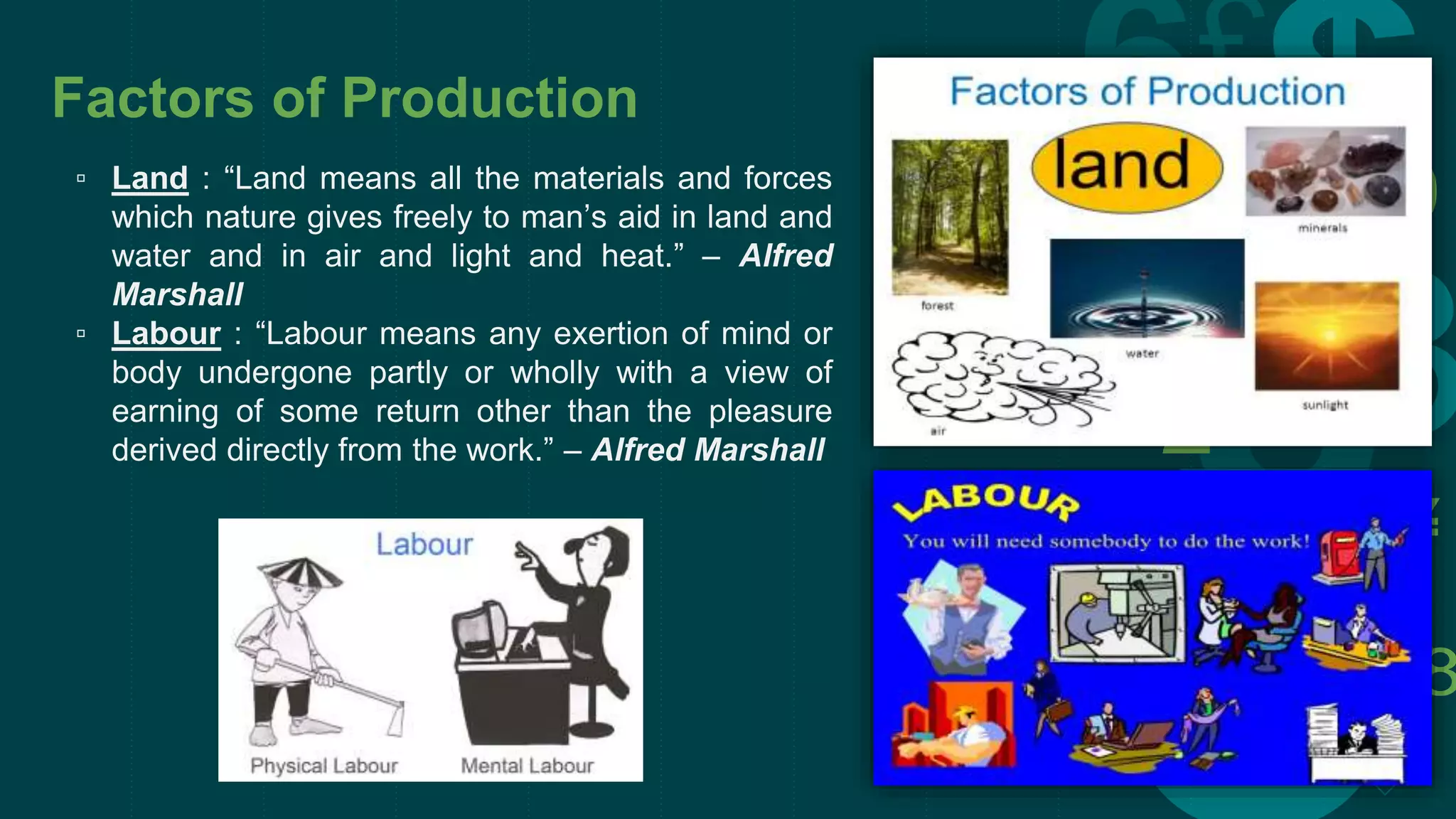

This document discusses theories of production and cost concepts. It defines production as the conversion of raw materials into goods and services to satisfy consumer demand. It identifies the four factors of production as land, labor, capital, and entrepreneurship. It then explains various cost concepts like fixed, variable, total, average, and marginal costs. Finally, it describes break-even analysis, including how to calculate the break-even point using graphs and equations. It shows the break-even point as the level of output where total revenue and total costs are equal.

![Factors of Production

▫ Capital : “Refers to stock of assets at a particular

point time which is used to generate a stream of

income over the life span of the business.”

[OR]

▫ “Capital represents the total capitalization of a

business represented by owner’s equity funds and

outside debt funds.”

▫ Entrepreneur : “An entrepreuner is an economic

agent who unites all the means of production.” –

J.B. Say

[OR]

▫ “An entrepreneur is a person who assumes risk of

mobilizing resources for the wealth generation.”](https://image.slidesharecdn.com/eemppt-170507162255/75/Theory-of-Production-and-Costs-Cost-Concepts-8-2048.jpg)