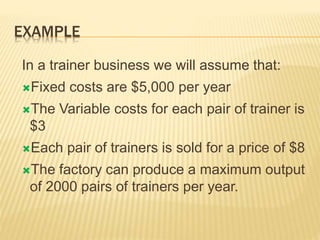

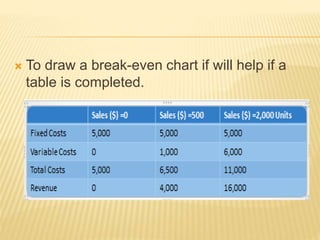

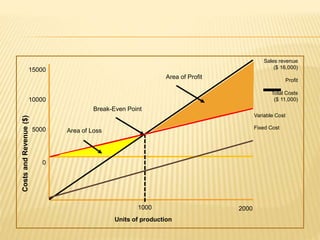

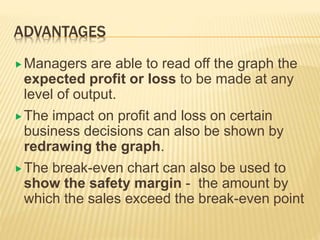

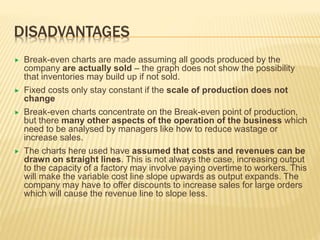

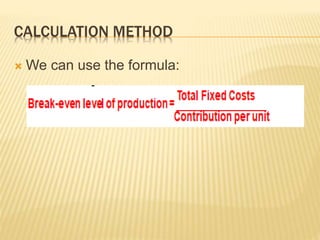

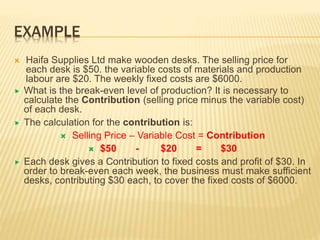

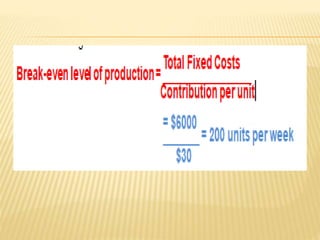

This document discusses break-even analysis, which is used to determine the minimum level of sales or output needed for a business to cover its total costs. It provides an example of calculating break-even point for a trainer business with fixed costs of $5,000, variable costs of $3 per unit, and selling price of $8 per unit. The break-even point is calculated to be 100 units, which is the point where total revenue and total costs intersect. A break-even chart is presented to visually illustrate the areas of loss and profit depending on production levels. Advantages and disadvantages of break-even analysis are also summarized.