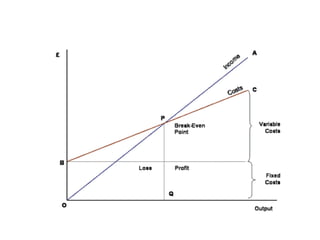

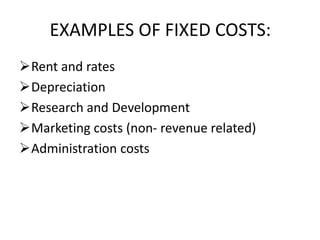

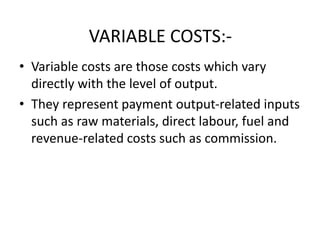

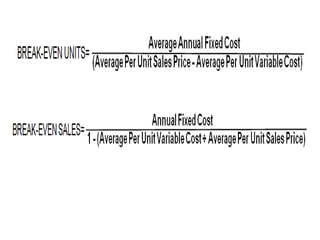

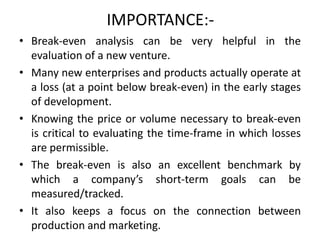

Fixed costs remain constant regardless of production levels, while variable costs change with production. The break-even point is where total revenue equals total costs, indicating no profit or loss. Break-even analysis determines the sales or production volume needed to cover total costs and calculates fixed and variable costs to evaluate new ventures and products, set goals, and understand the relationship between production and marketing.