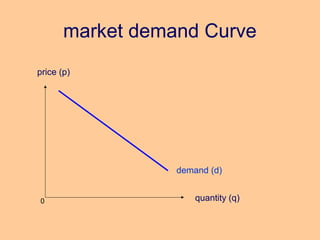

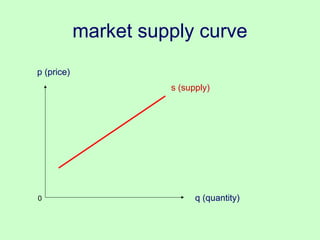

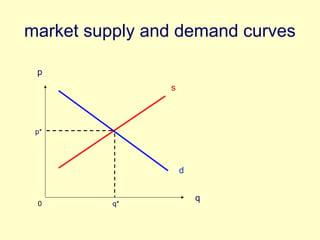

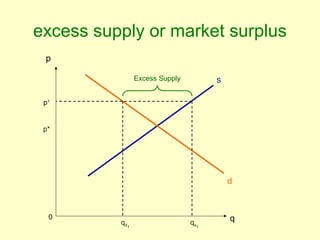

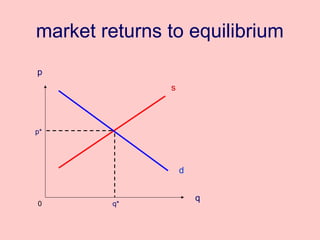

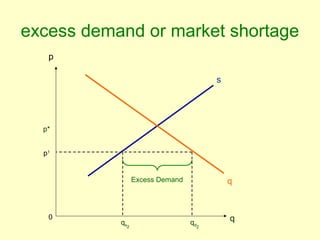

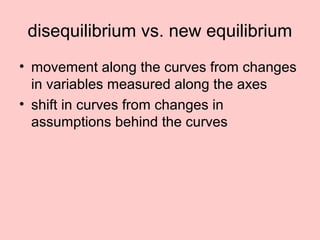

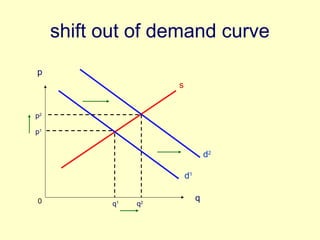

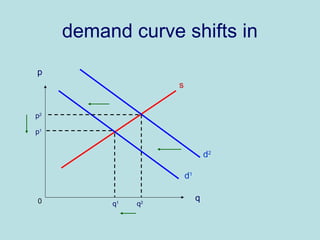

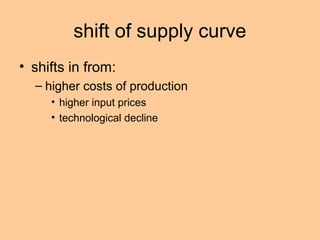

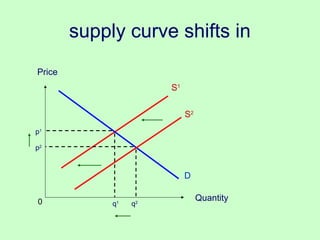

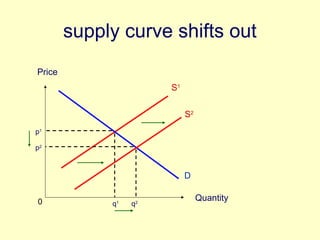

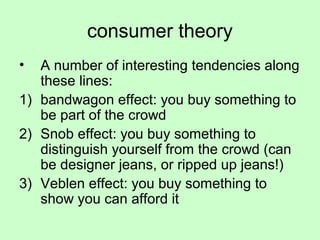

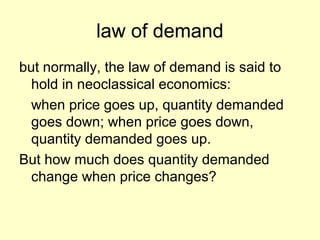

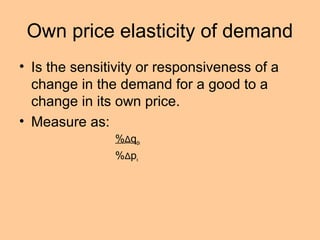

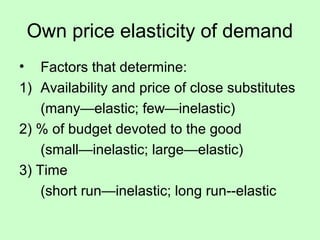

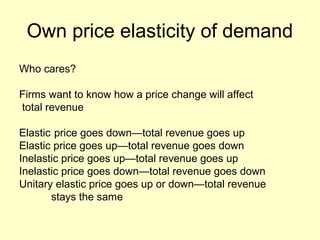

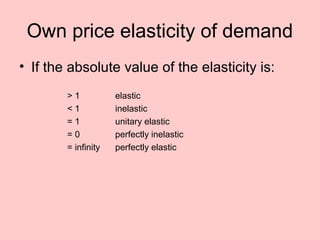

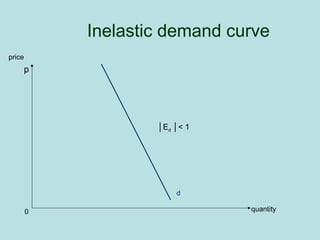

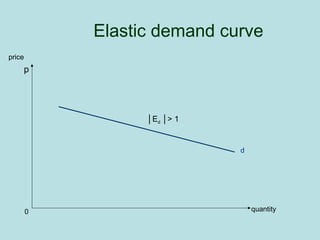

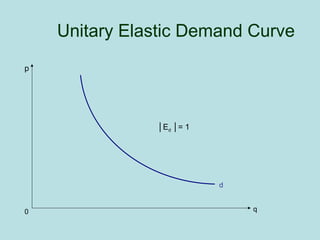

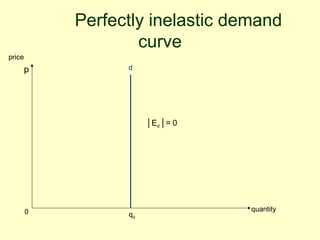

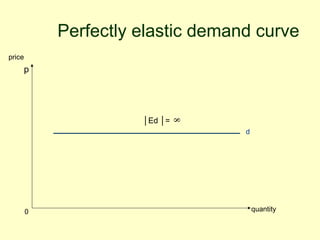

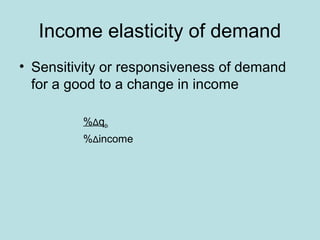

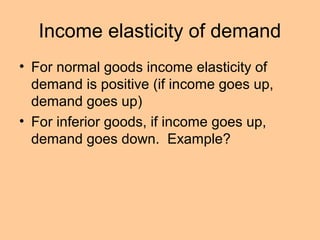

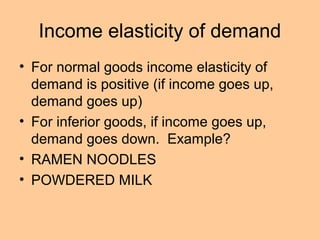

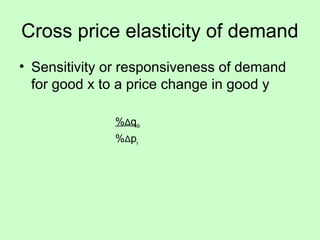

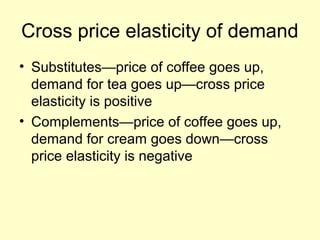

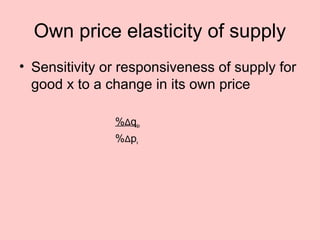

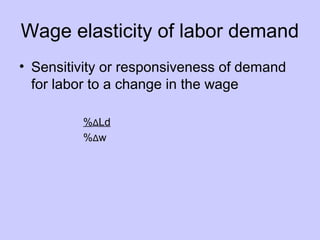

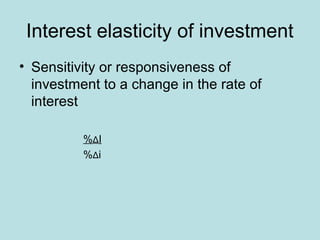

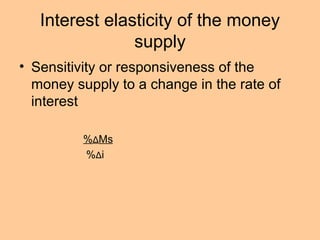

The document discusses the concepts of supply, demand, and market equilibrium, outlining the laws of supply and demand, as well as the theory of supply and demand that explains how these forces determine prices. It explains how market demand and supply depend on factors like willingness and ability to buy or sell, the role of competition, and various shifts that can occur in demand and supply curves. Additionally, it covers elasticity, detailing how demand and supply respond to changes in price and income, and includes examples like Giffen goods and Veblen effects.