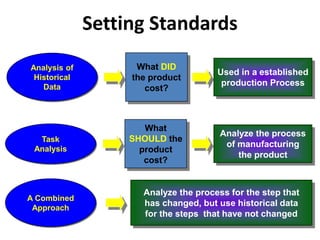

Standard costing involves establishing predetermined estimates of the costs of products or services, collecting actual costs, and comparing actual costs to the estimates. Standards are set for materials, labor, overhead, and selling prices/margins based on historical data, task analysis, and production process analysis. Material and labor standards consider factors like supplier prices, wage rates, and efficiency levels. Overhead standards may be based on a rate per labor hour. Comparing actuals to standards highlights variances that need management attention to control costs.