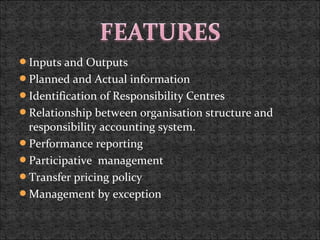

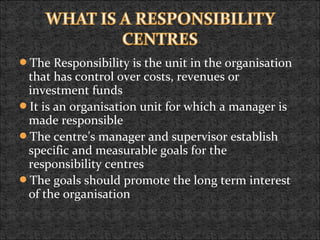

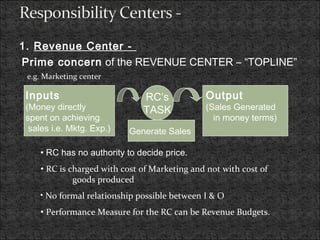

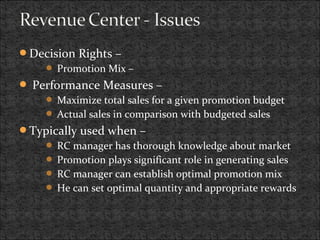

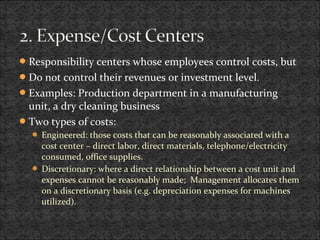

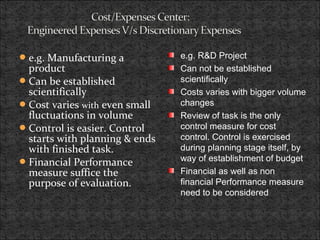

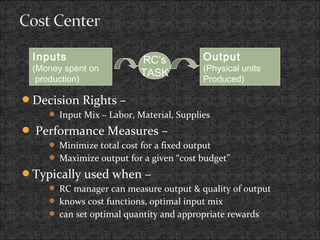

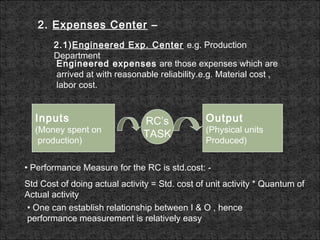

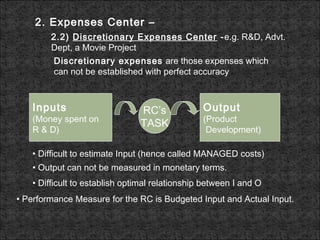

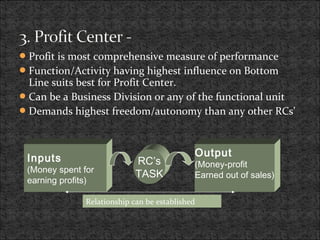

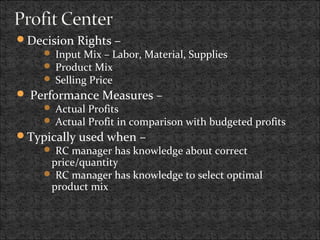

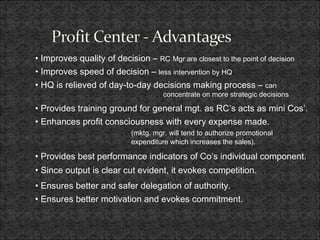

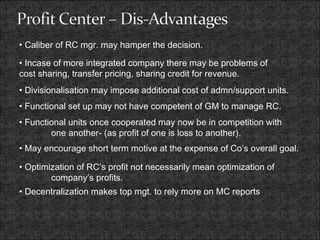

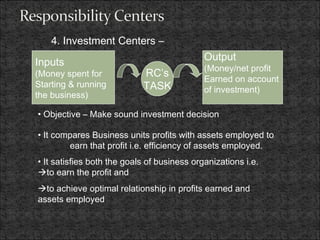

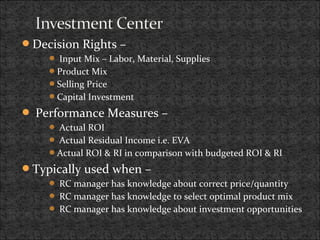

This document discusses responsibility accounting. It defines responsibility accounting as a system that collects planned and actual accounting information for responsibility centers. Responsibility centers are organizational units for which a manager is responsible for costs, revenues, or investment funds. There are four main types of responsibility centers: cost centers, revenue centers, profit centers, and investment centers. Responsibility accounting improves decision making, speed, and motivation by assigning accountability to managers of responsibility centers.