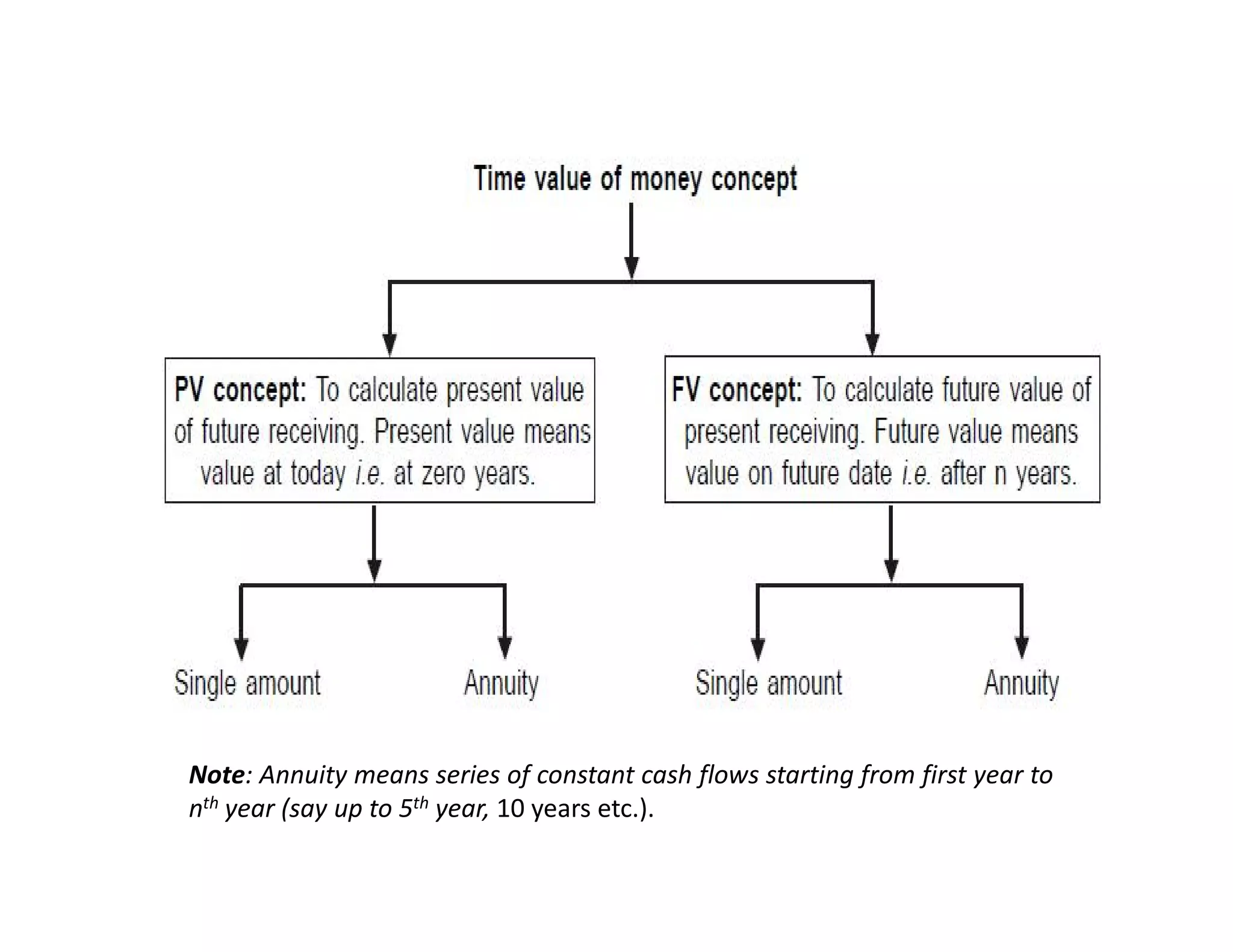

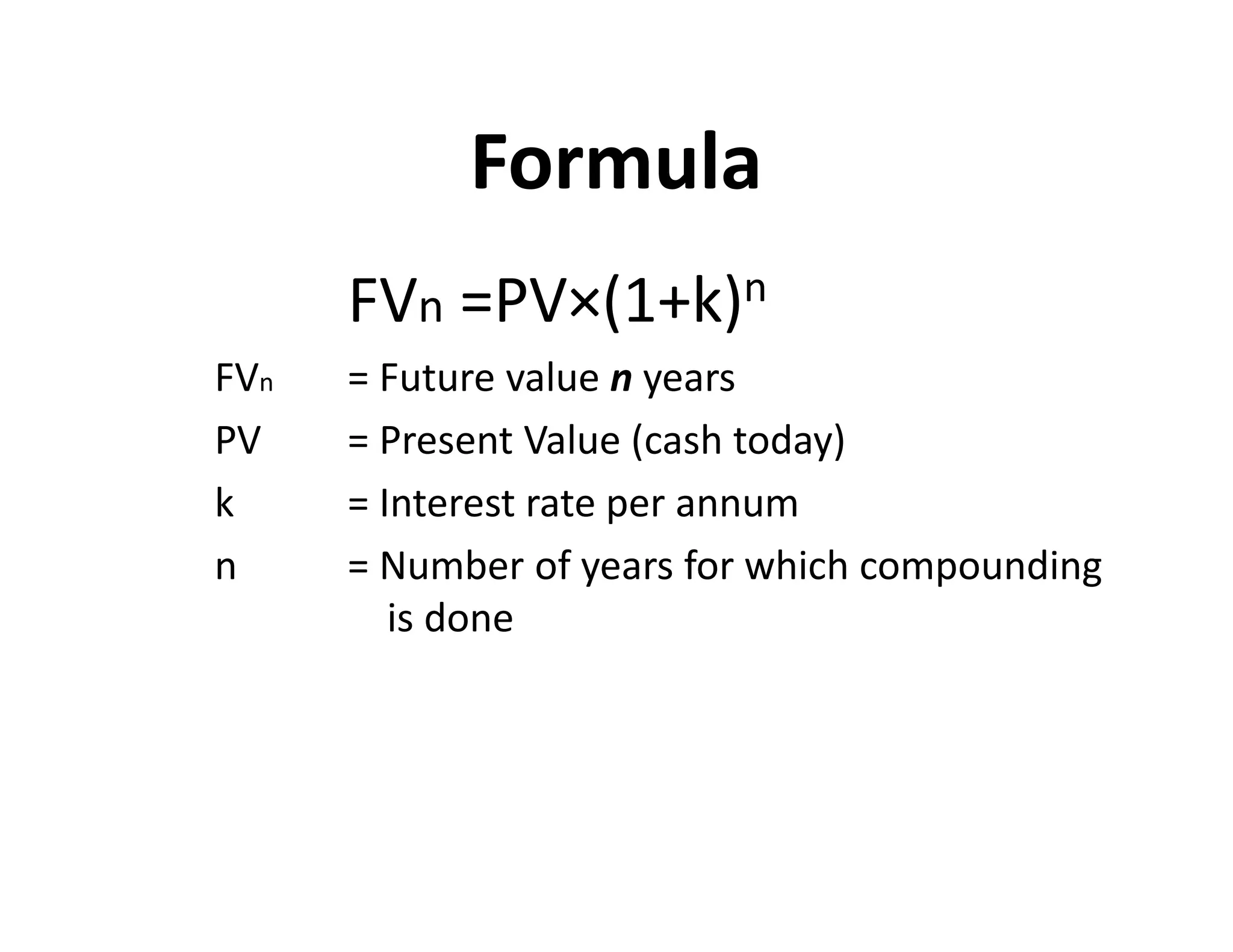

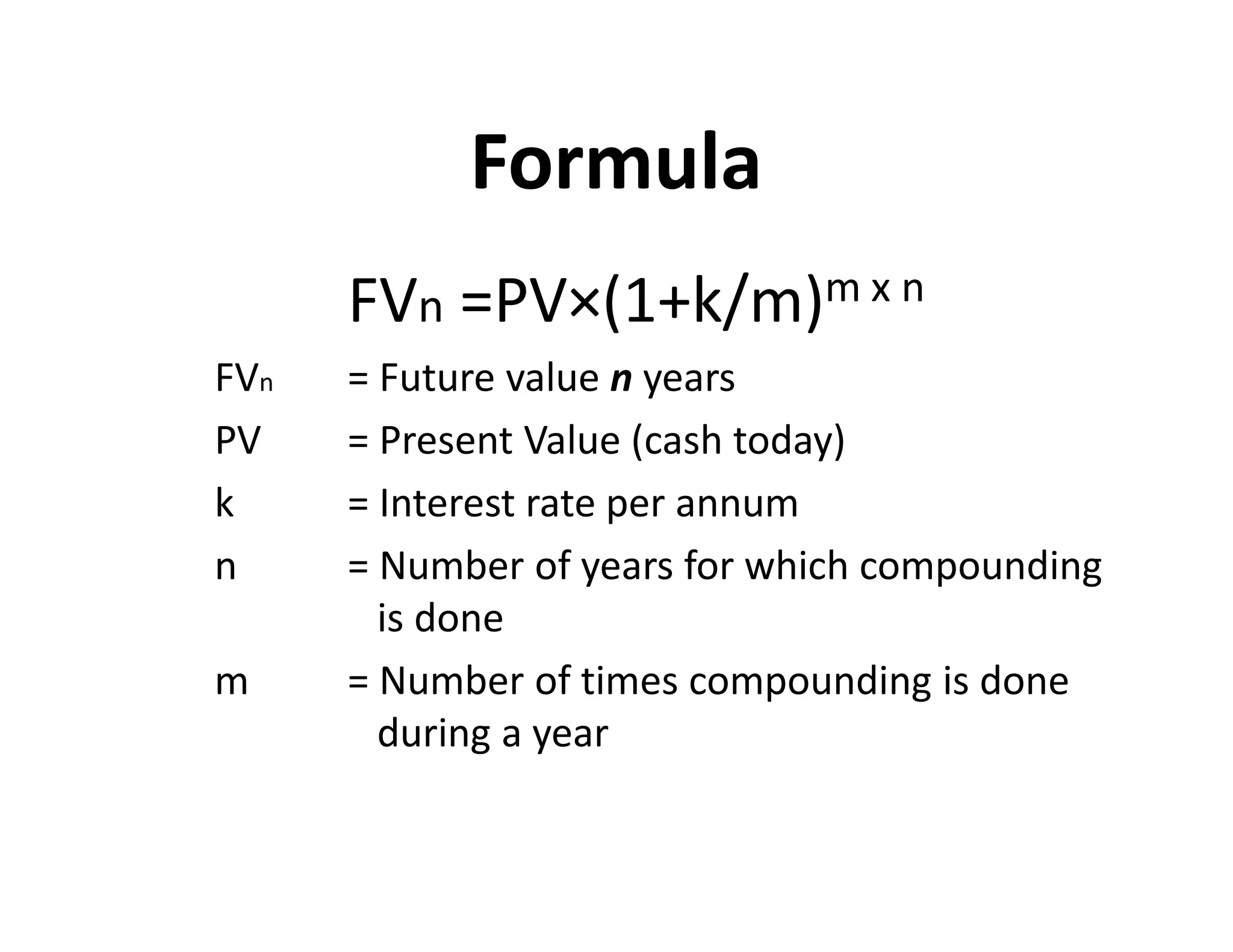

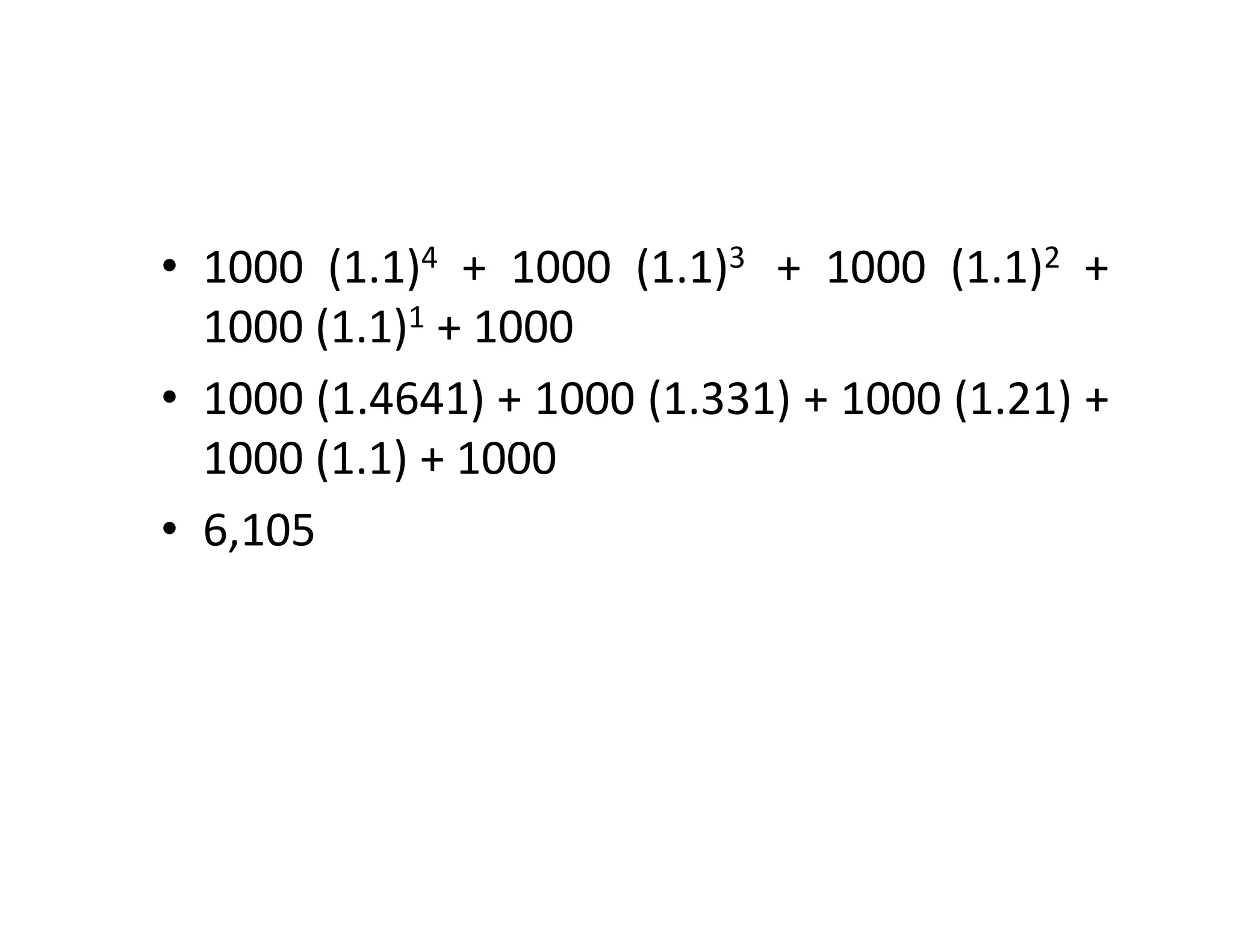

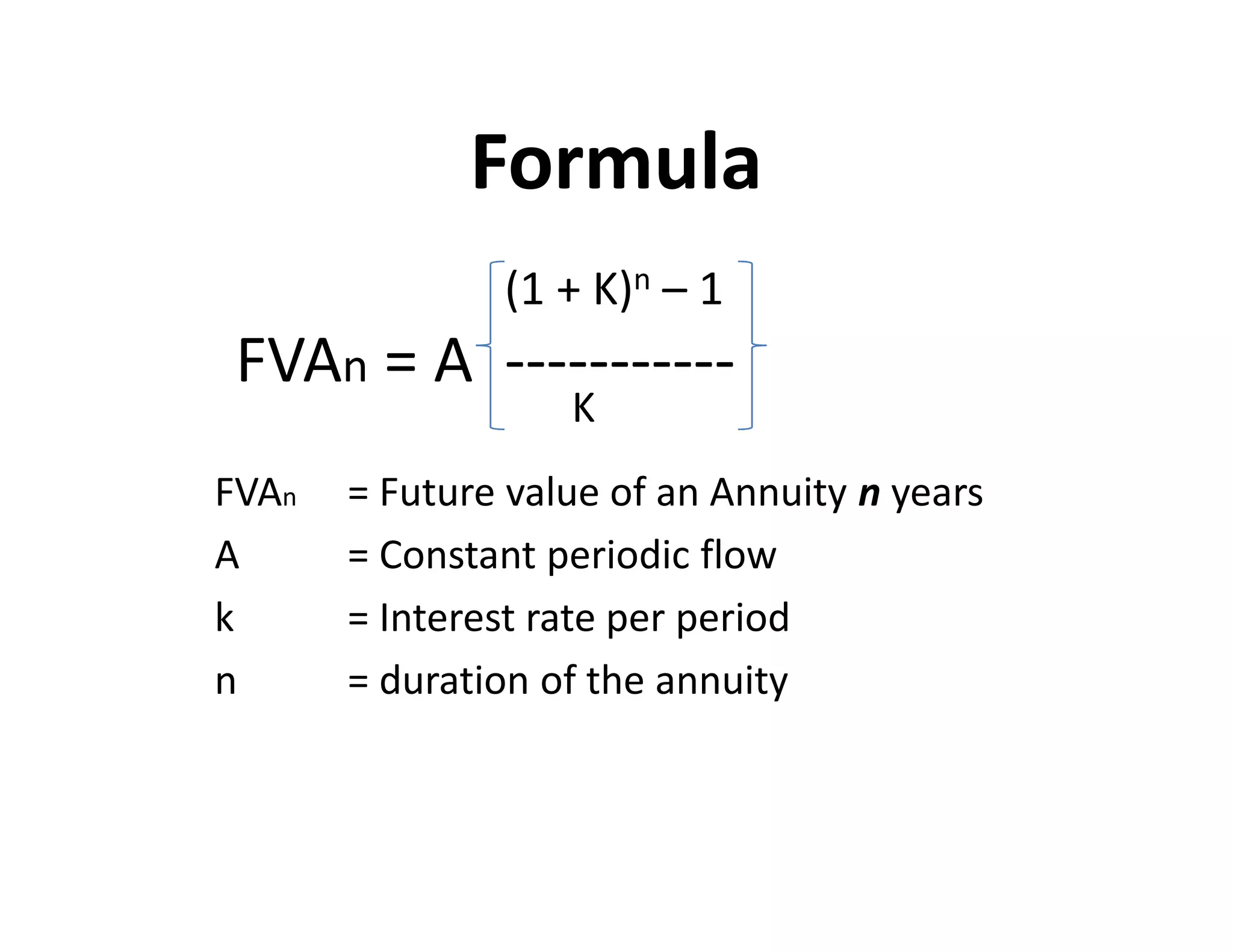

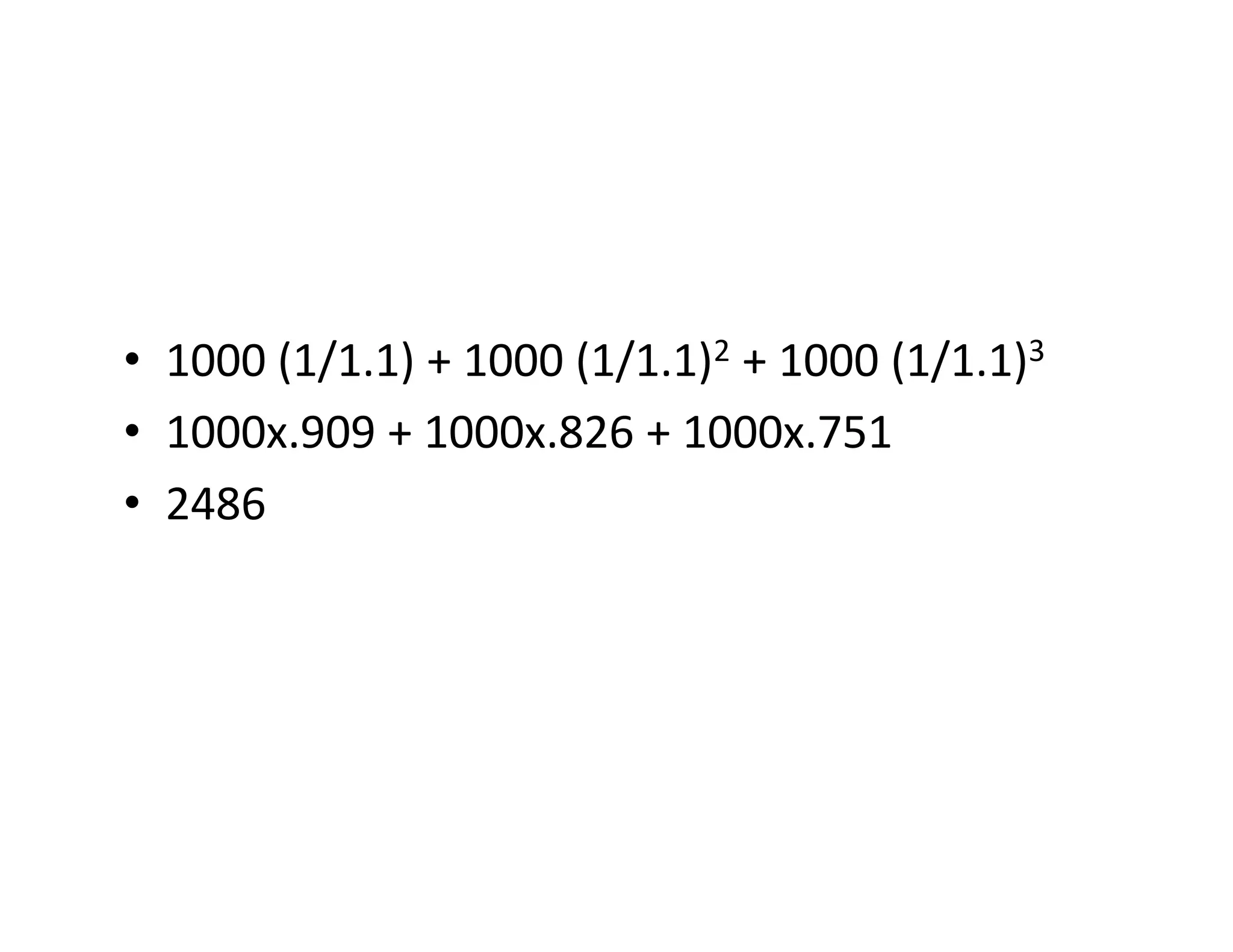

The document explains the concepts of the time value of money, emphasizing that money received today is worth more than the same amount received in the future due to factors like interest rates and compounding. It covers the definitions of present and future values, different types of interest (simple vs. compounding), and formulas for calculating the future and present values of single amounts and annuities. Additionally, it discusses rules for estimating the doubling period of investments and the effects of multiple compounding periods and effective vs. nominal interest rates.