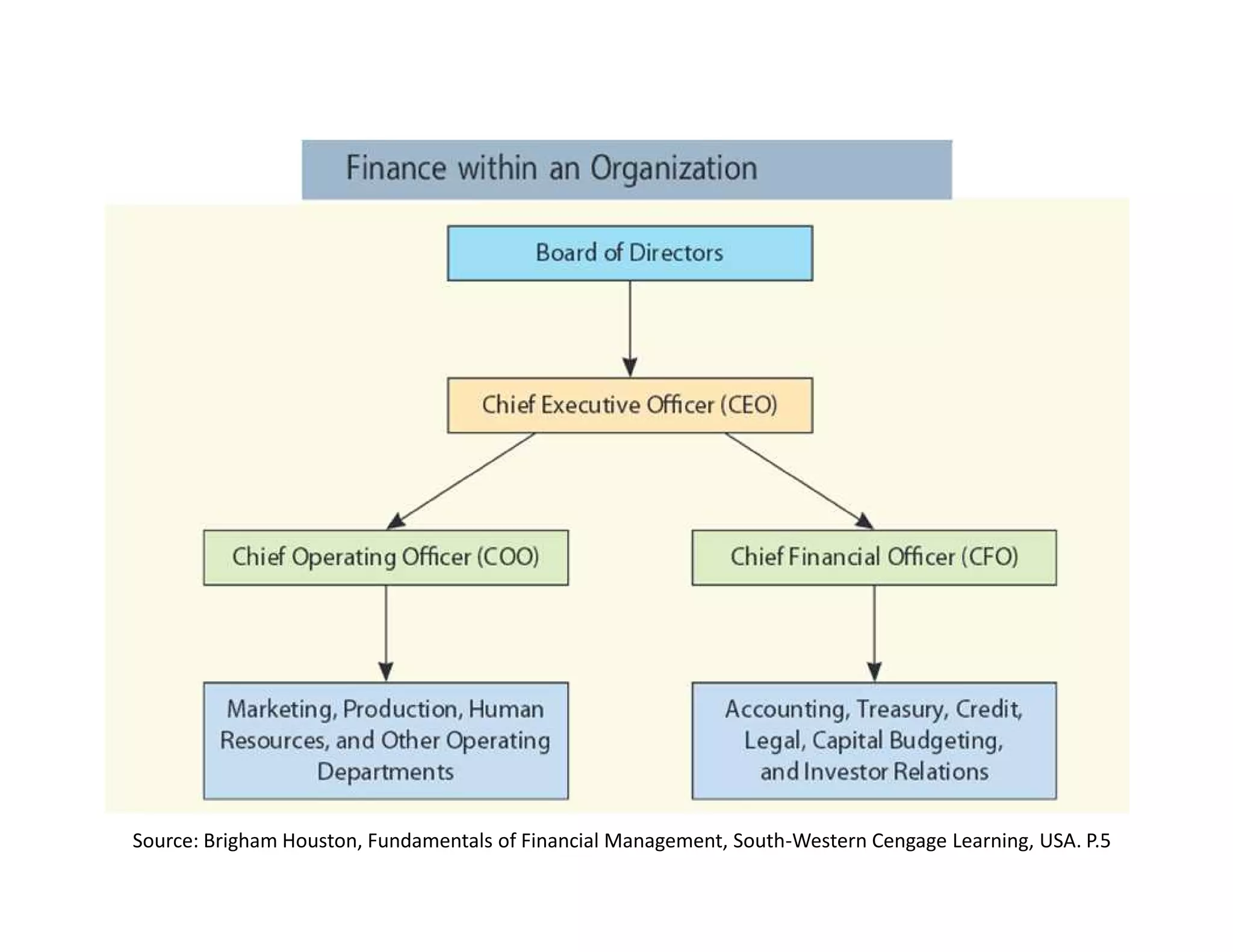

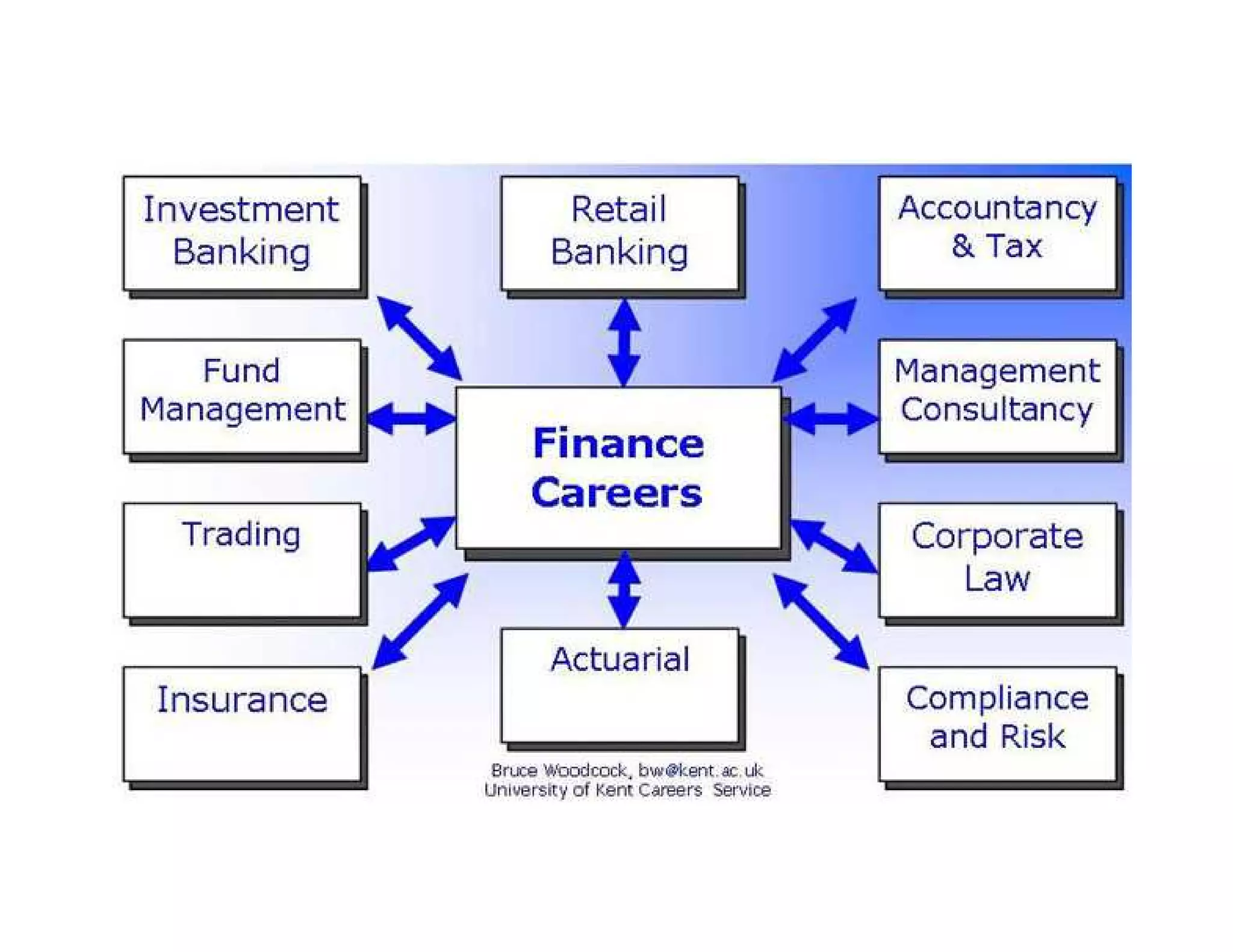

Finance involves managing money and making decisions about assets and investments. It includes financial management, capital markets, and investments. Financial management involves acquiring funds, investment decisions about long-term projects, capital structure decisions about debt vs equity, dividend payout policies, and working capital management. Capital markets determine interest rates and prices of stocks and bonds. Investments analyze individual securities, construct portfolios, and evaluate market conditions. The finance function involves procuring funds and allocating them optimally through investment, financing, dividend, and working capital decisions. These decisions balance the interests of stakeholders under uncertainty.