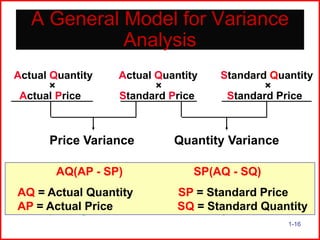

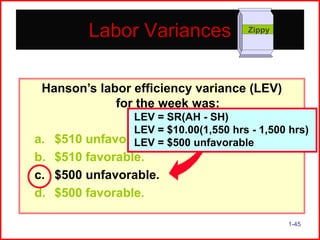

Here are the steps to calculate direct labor variances for Hanson Inc:

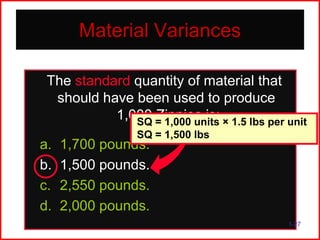

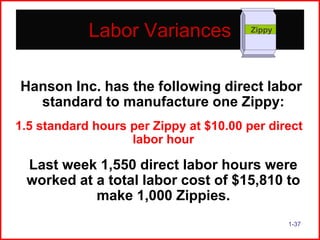

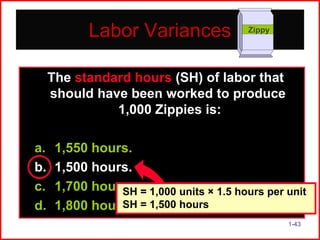

1. Standard hours to produce 1,000 Zippies = 1,000 x 1.5 = 1,500 hours

2. Standard direct labor cost = Standard hours x Standard rate

= 1,500 hours x $10/hour = $15,000

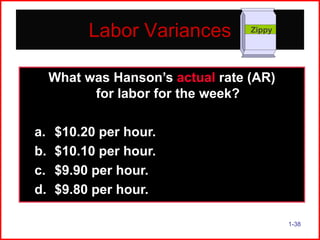

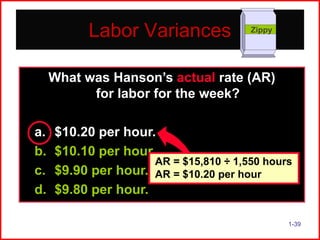

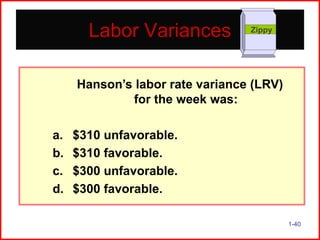

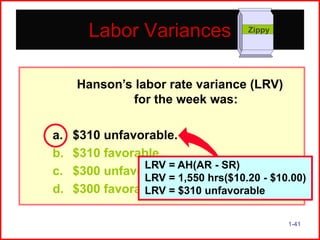

3. Actual direct labor hours worked last week = 1,550 hours

4. Actual direct labor cost = Actual hours x Actual rate

= Let's assume the actual rate is $10/hour

= 1,550 hours x $10/hour = $15,500

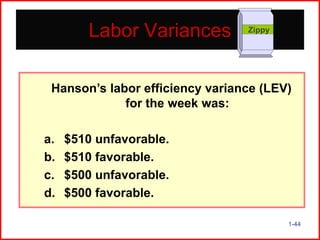

5. Labor efficiency variance = Standard hours - Actual hours

= 1,500 -