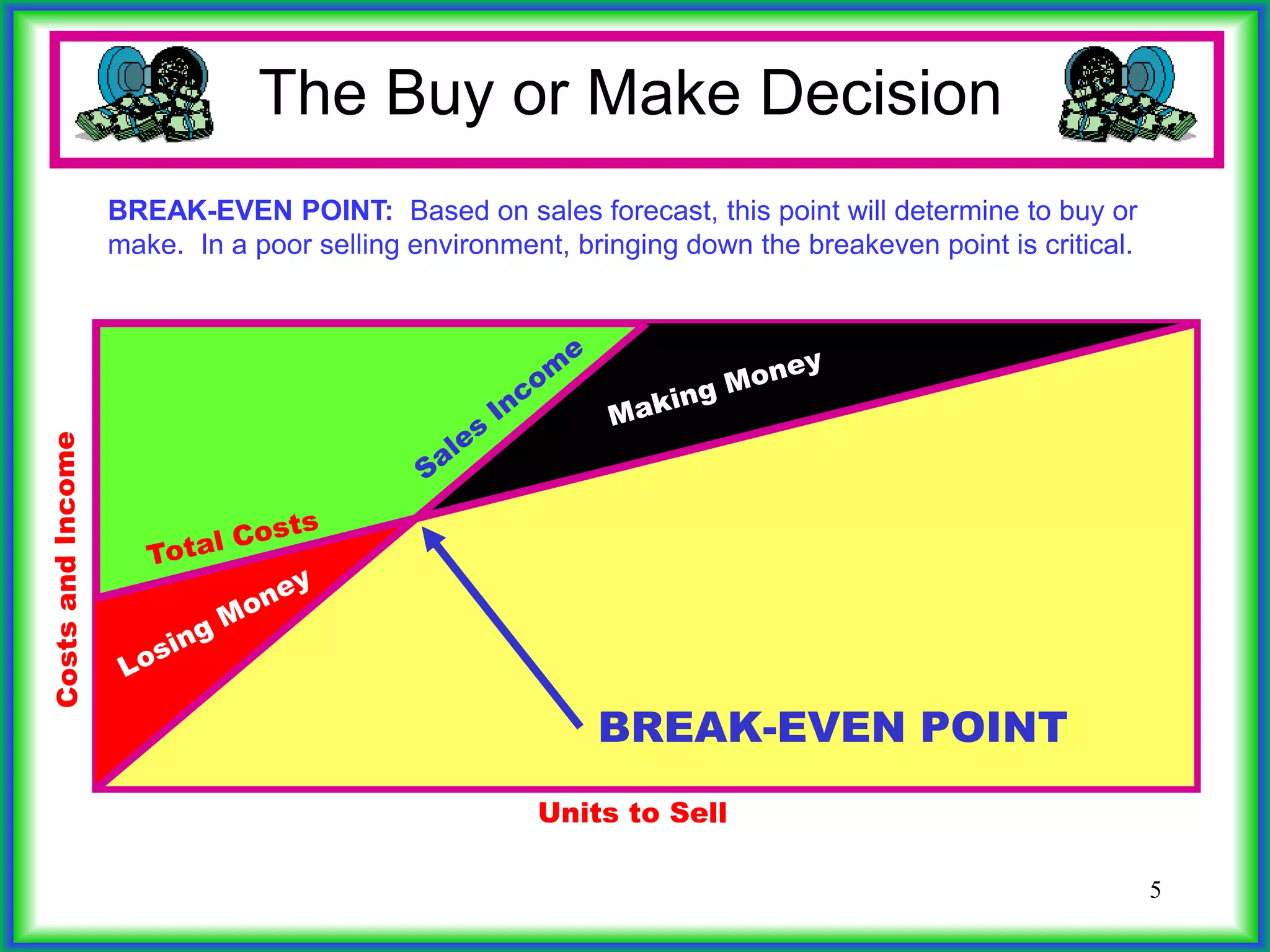

The document discusses the buy or make decision in production, analyzing the implications of purchasing versus manufacturing goods. It highlights the importance of fixed and variable costs, break-even points, and scenarios based on sales forecasts to guide decision-making. Additionally, it emphasizes evaluating supplier options and managing investments to minimize risks and maximize profits.