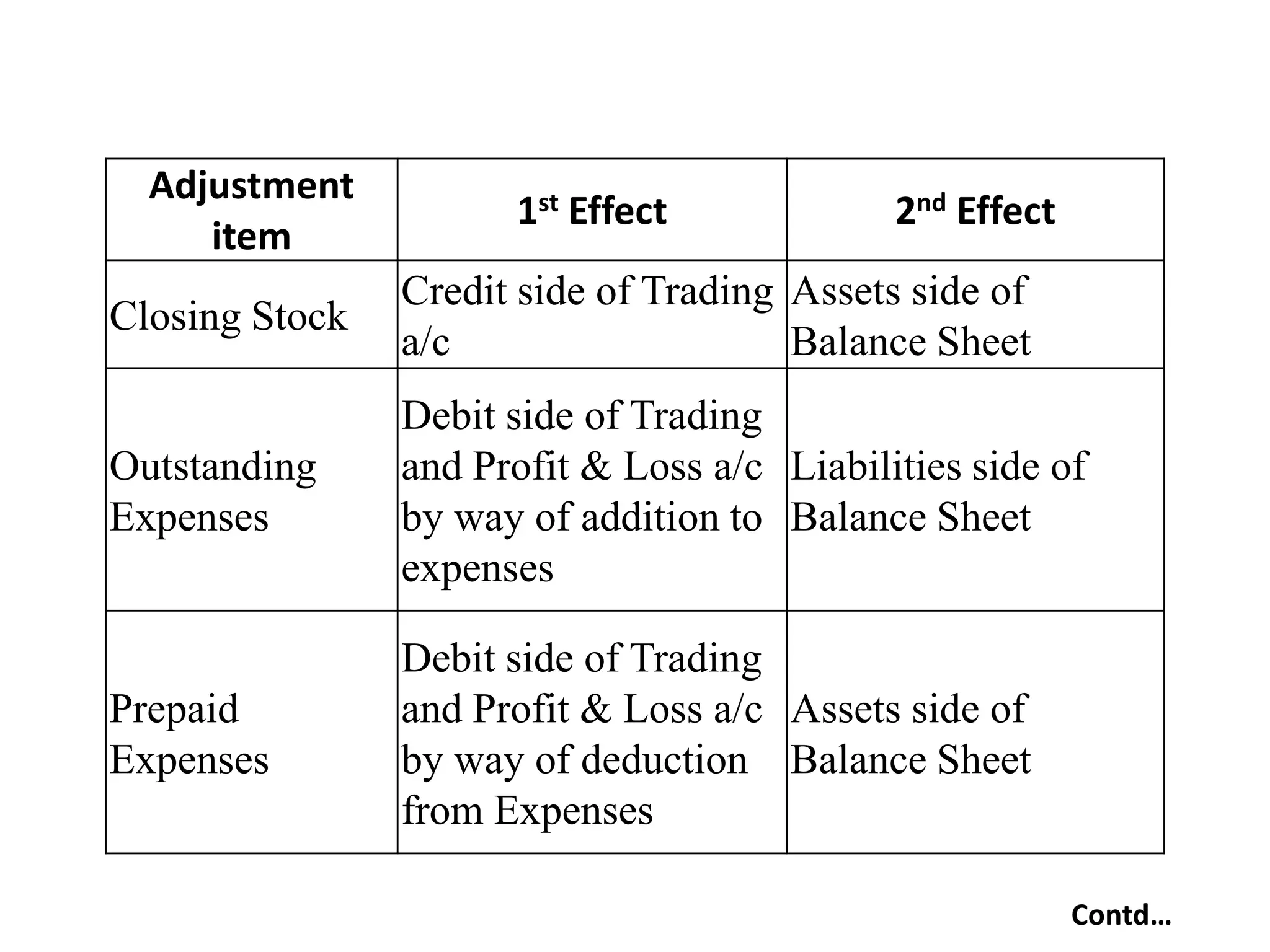

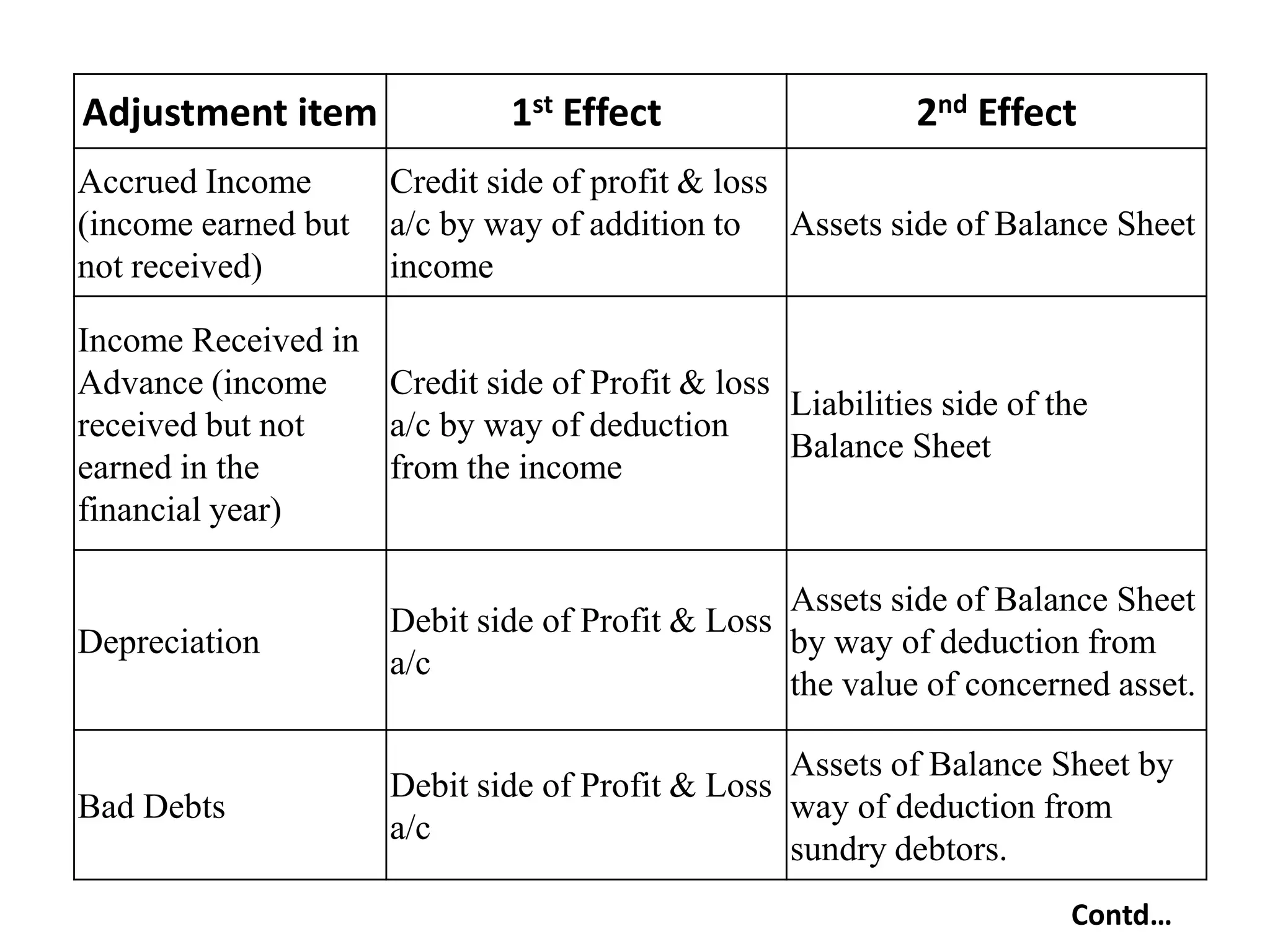

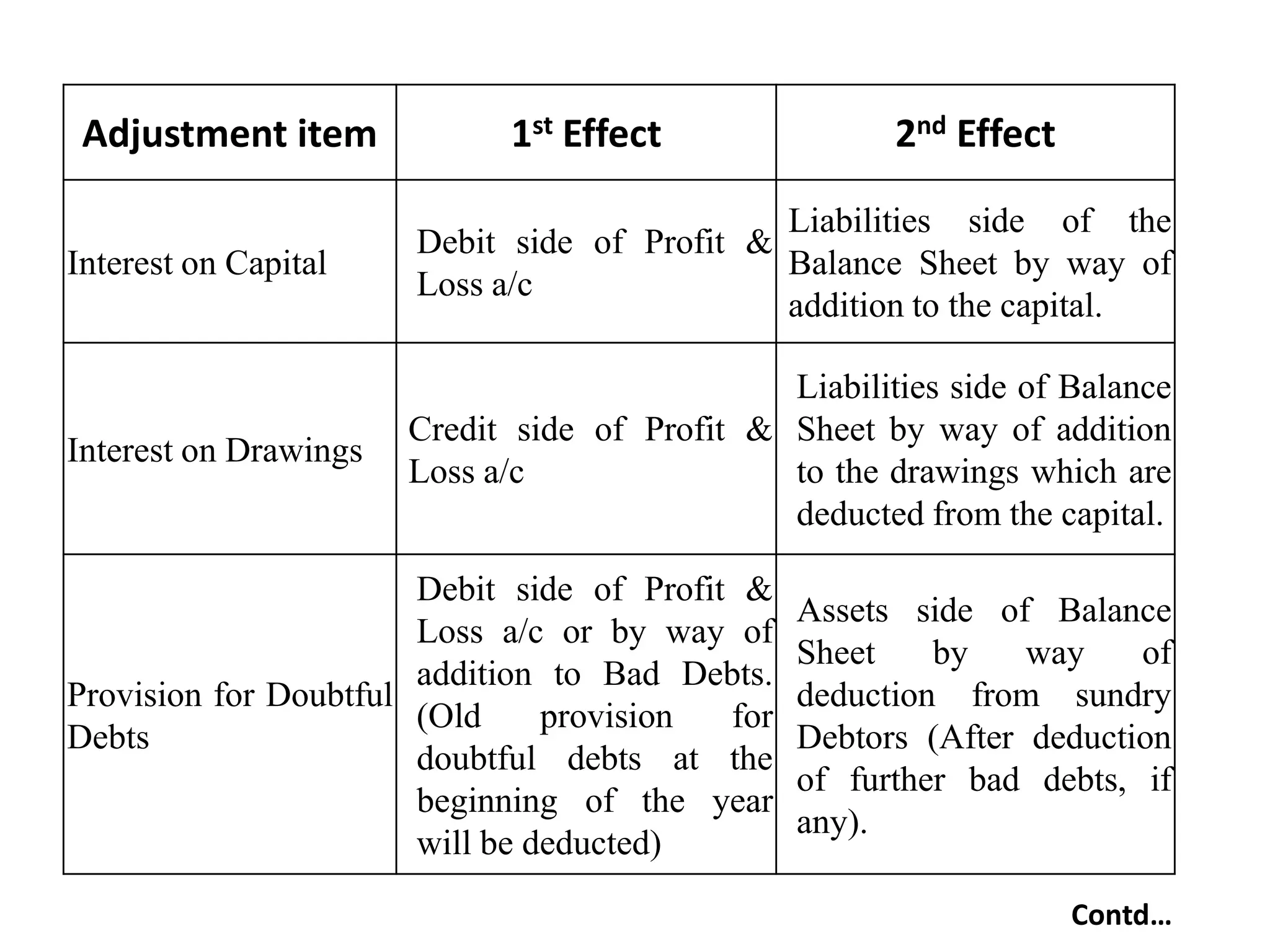

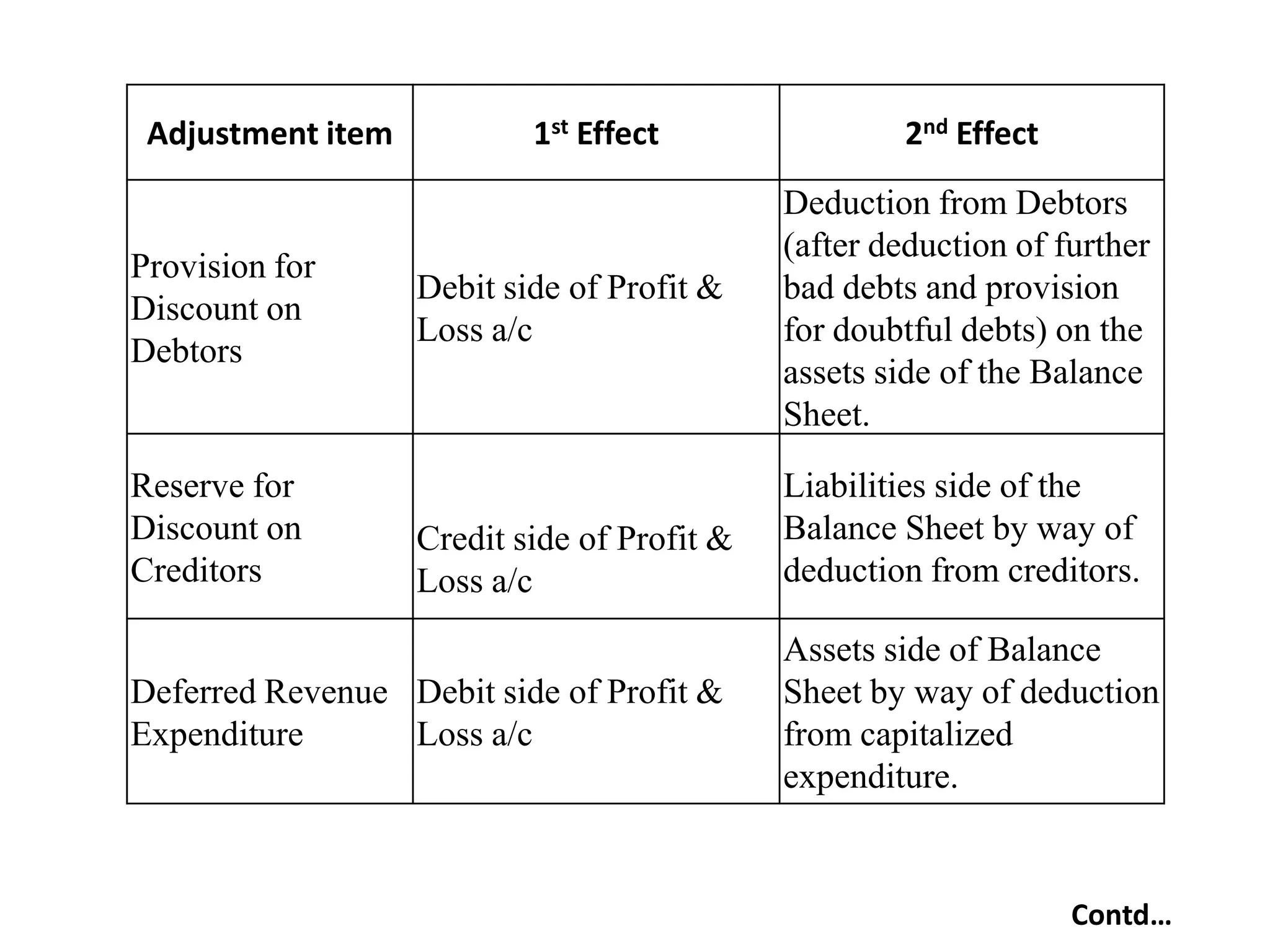

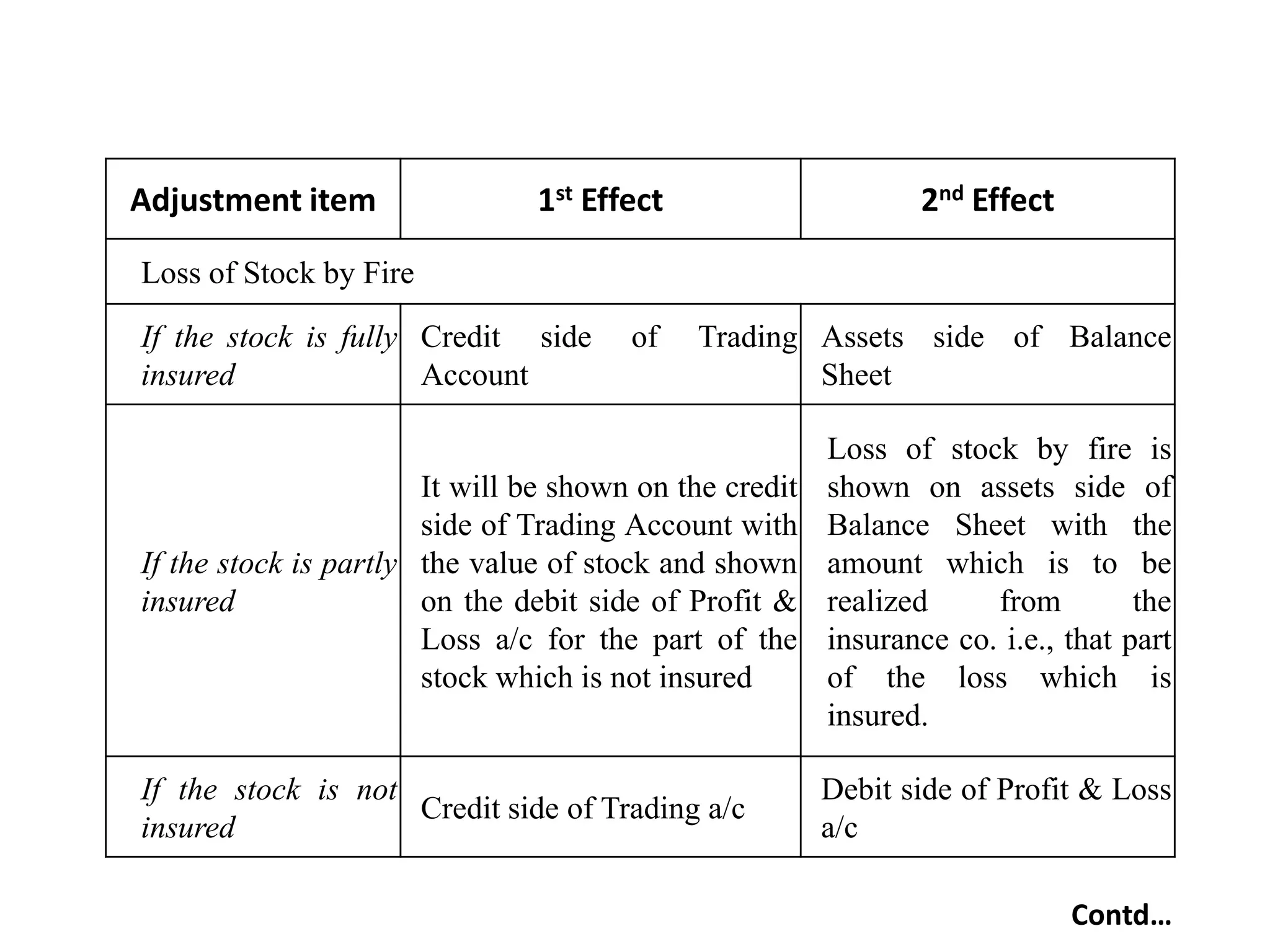

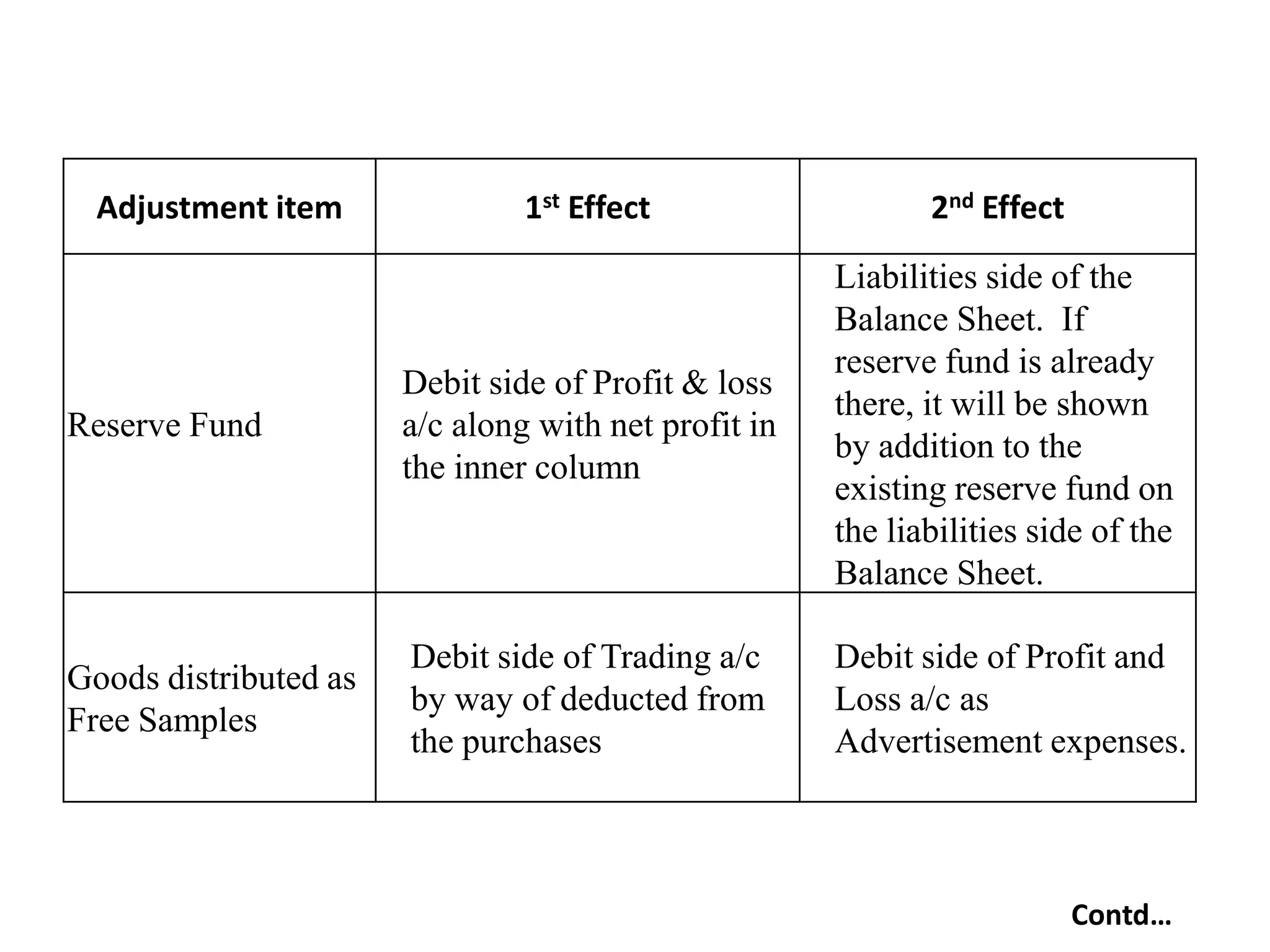

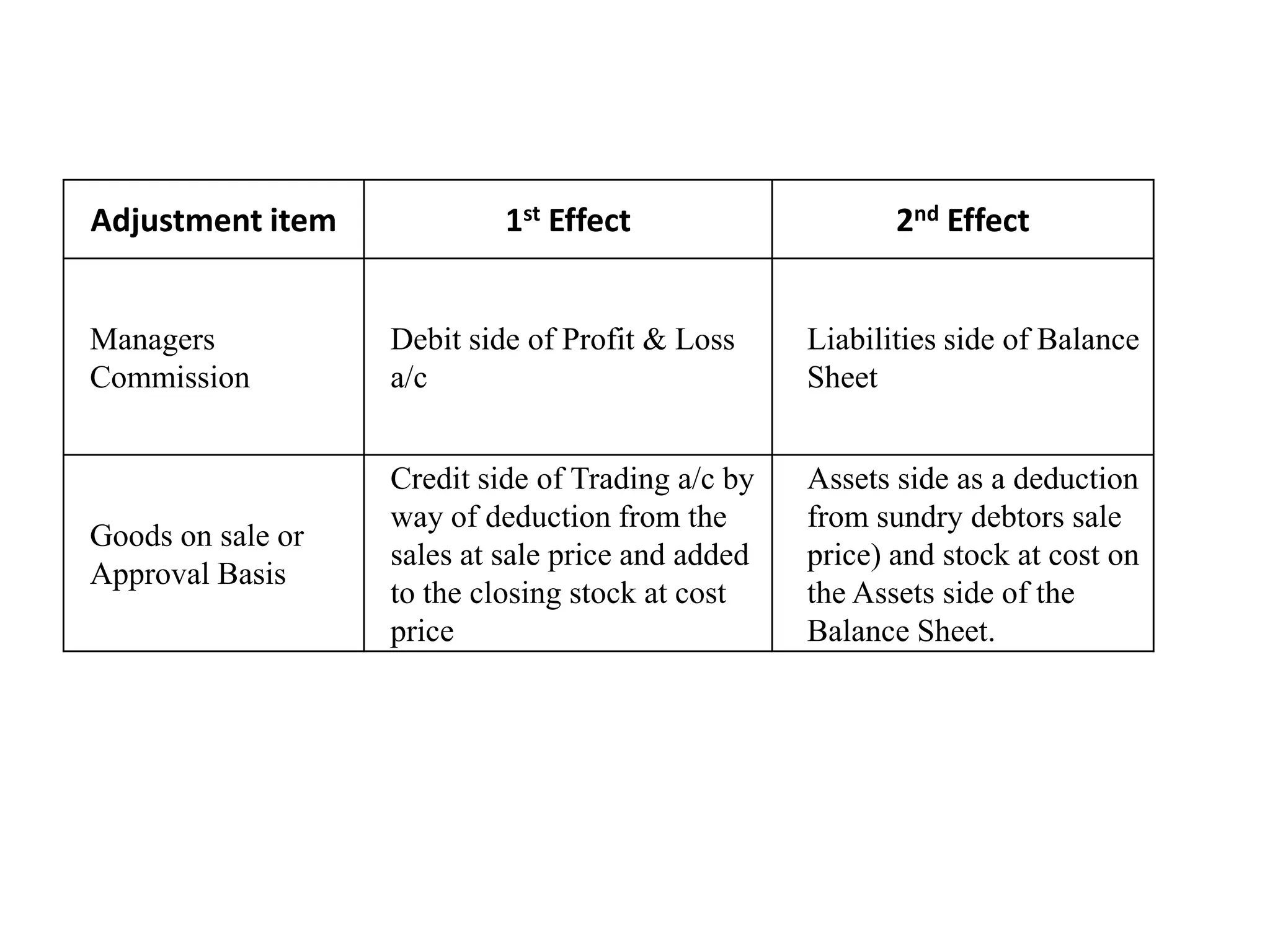

This document outlines various accounting adjustments that may be needed when preparing final accounts, including the first and second effects of each adjustment. Some key adjustments include closing stock, which credits trading and assets the balance sheet; outstanding expenses, which debits trading/profit & loss and liabilities the balance sheet; and depreciation, which debits profit & loss and assets the balance sheet by deducting from the asset value.