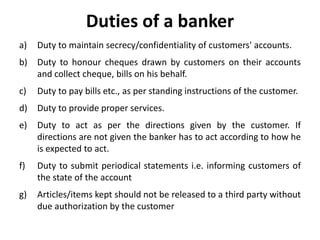

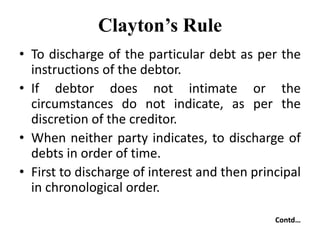

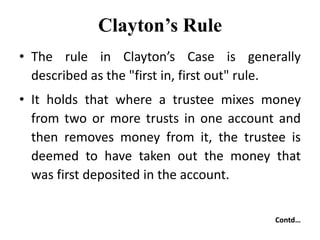

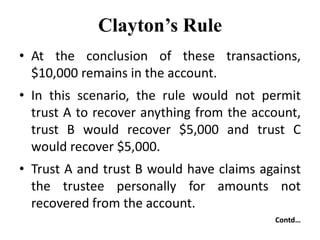

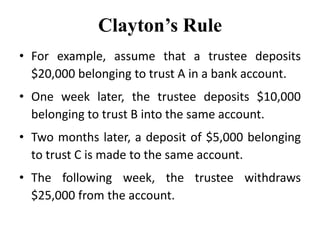

The document outlines the duties of bankers, including maintaining customer confidentiality, honoring cheques, and providing accurate account statements. It explains Clayton's Rule, guiding the discharge of debts when multiple trusts' funds are mixed, and provides detailed cheque writing guidelines to prevent fraud and errors. Additionally, it describes the Banking Ombudsman Scheme, which offers customers a platform to resolve banking complaints without incurring costs.