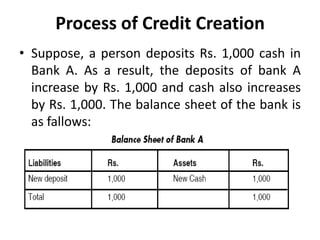

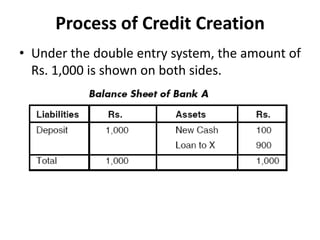

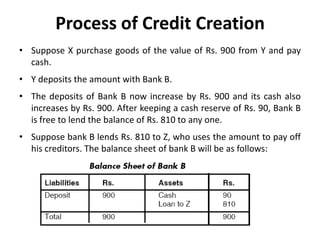

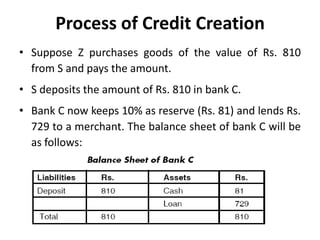

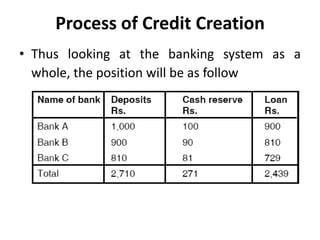

Commercial banks are able to lend out more money than they hold in deposits through the process of credit creation. When a customer deposits money in a bank, the bank records this as a primary deposit and is able to lend out a portion of it, creating a derivative deposit. This process of lending out a portion of deposits and those loans subsequently being deposited can be repeated across multiple banks, allowing for the multiple expansion of credit throughout the banking system. However, banks must maintain minimum cash reserves and there are other factors that place limitations on the total amount of credit that can be created.