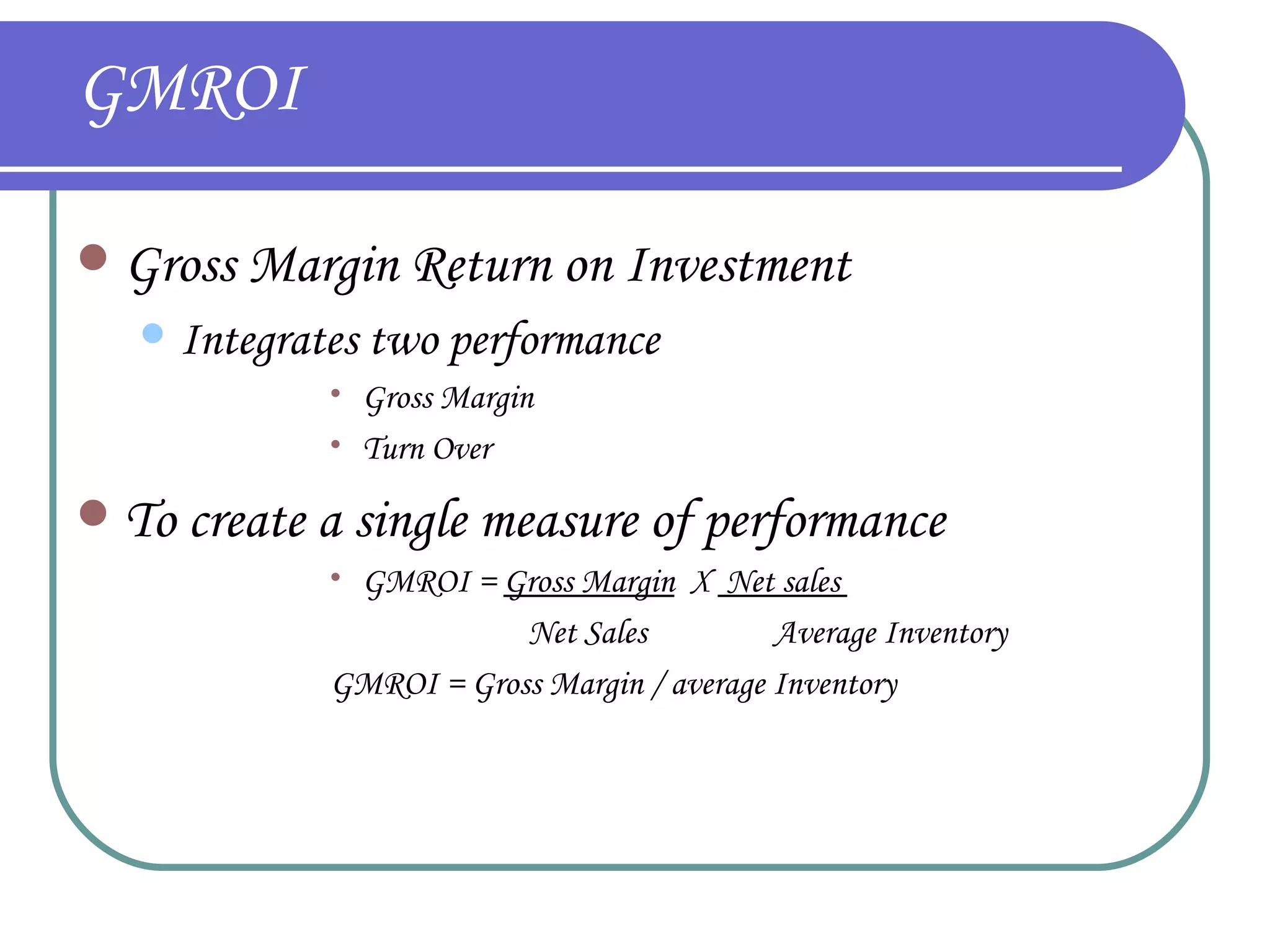

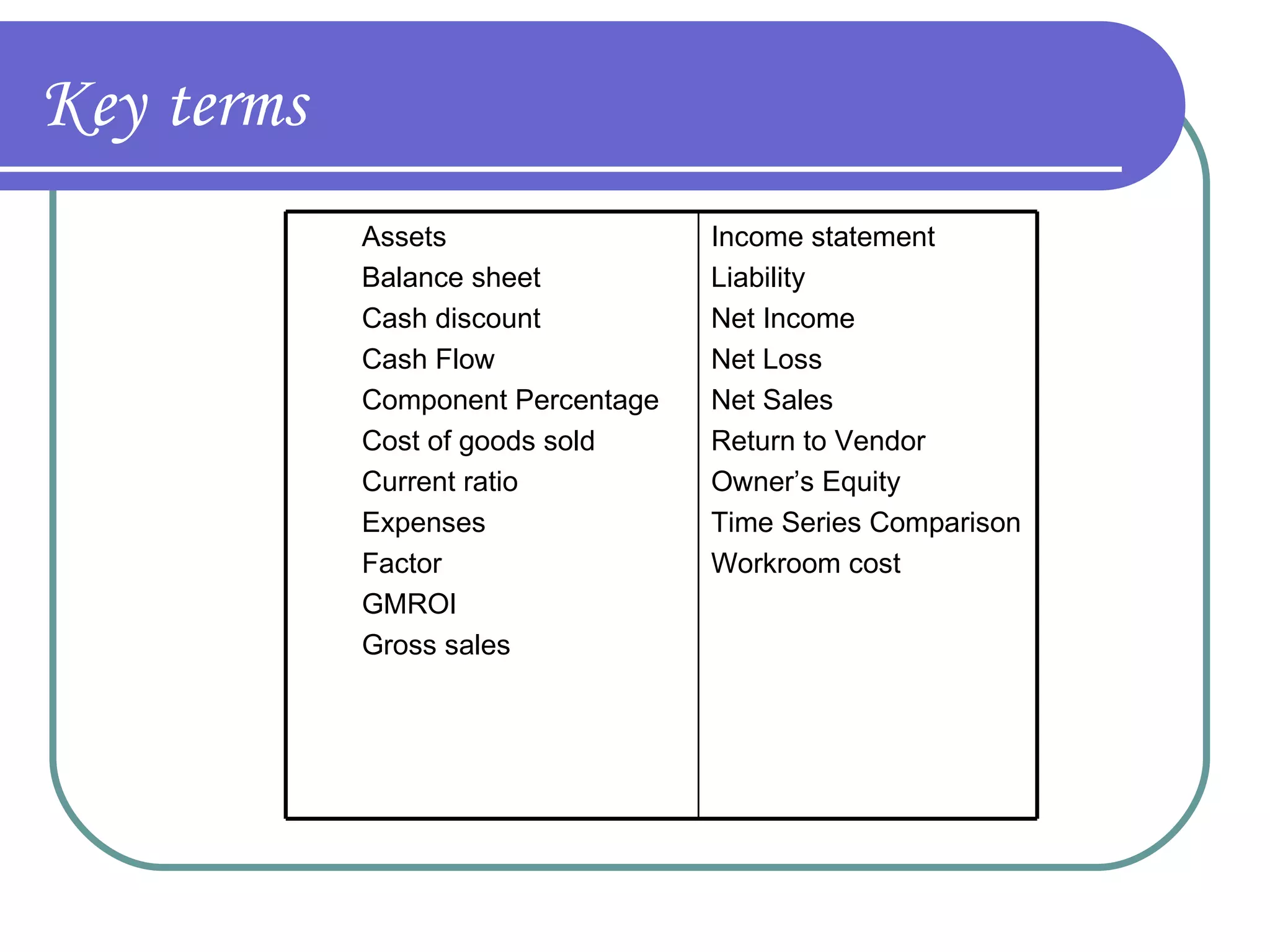

The document discusses key concepts in retail merchandising including defining merchandising, roles of merchandisers, developing sales forecasts and merchandise requirements, basics of merchandise accounting, and key metrics like gross margin and return on investment. It outlines considerations for devising merchandise plans, category management, and buying organization formats. Key terms covered include assets, liabilities, income statement, cash flow, cost of goods sold, expenses, gross margin, and return on investment.