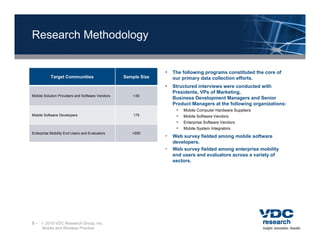

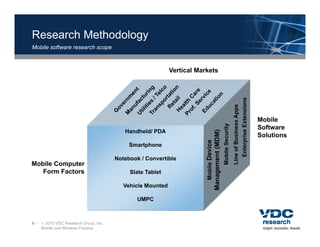

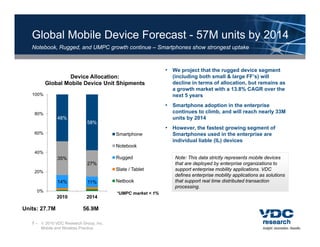

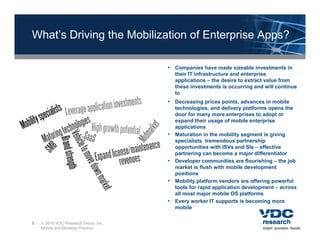

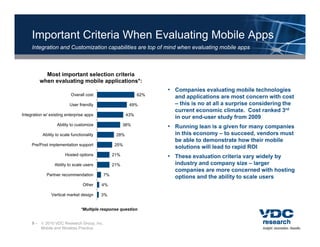

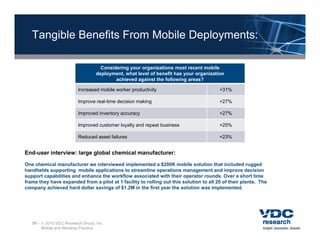

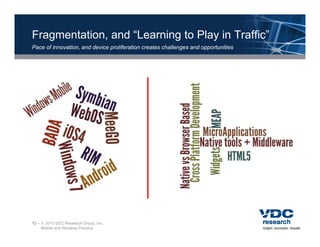

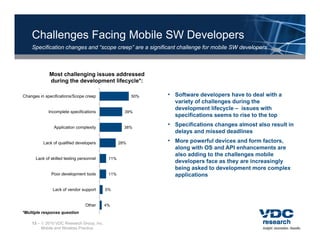

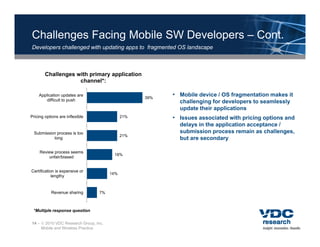

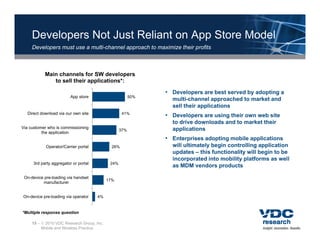

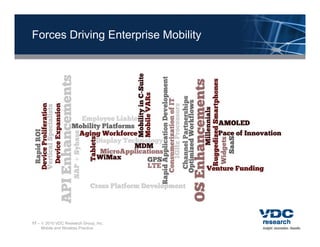

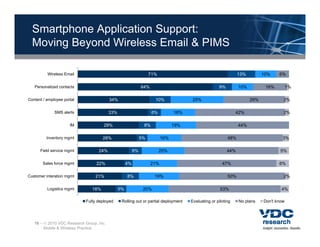

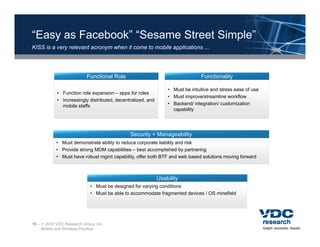

This document summarizes a webcast from VDC Research on enterprise application mobilization. The webcast featured two speakers, Eric Klein and David Krebs from VDC Research, and covered topics including the proliferation of mobile devices and opportunities for apps and developers, forces driving enterprise mobility, and conclusions about the future of the market. It provided an overview of VDC Research's methodology, discussed challenges for mobile software developers, and noted that Microsoft's Windows OS remains dominant in the rugged handheld space.