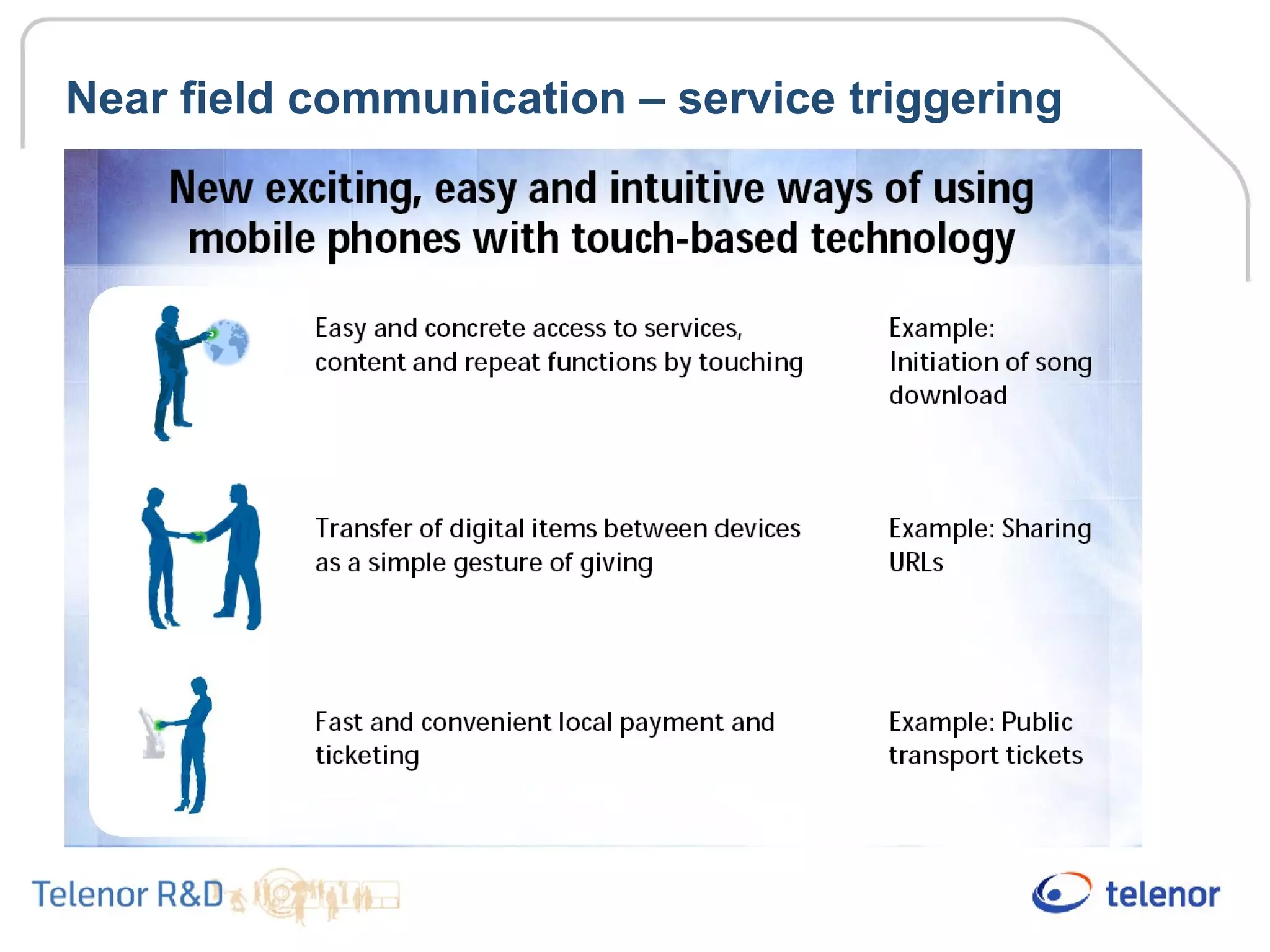

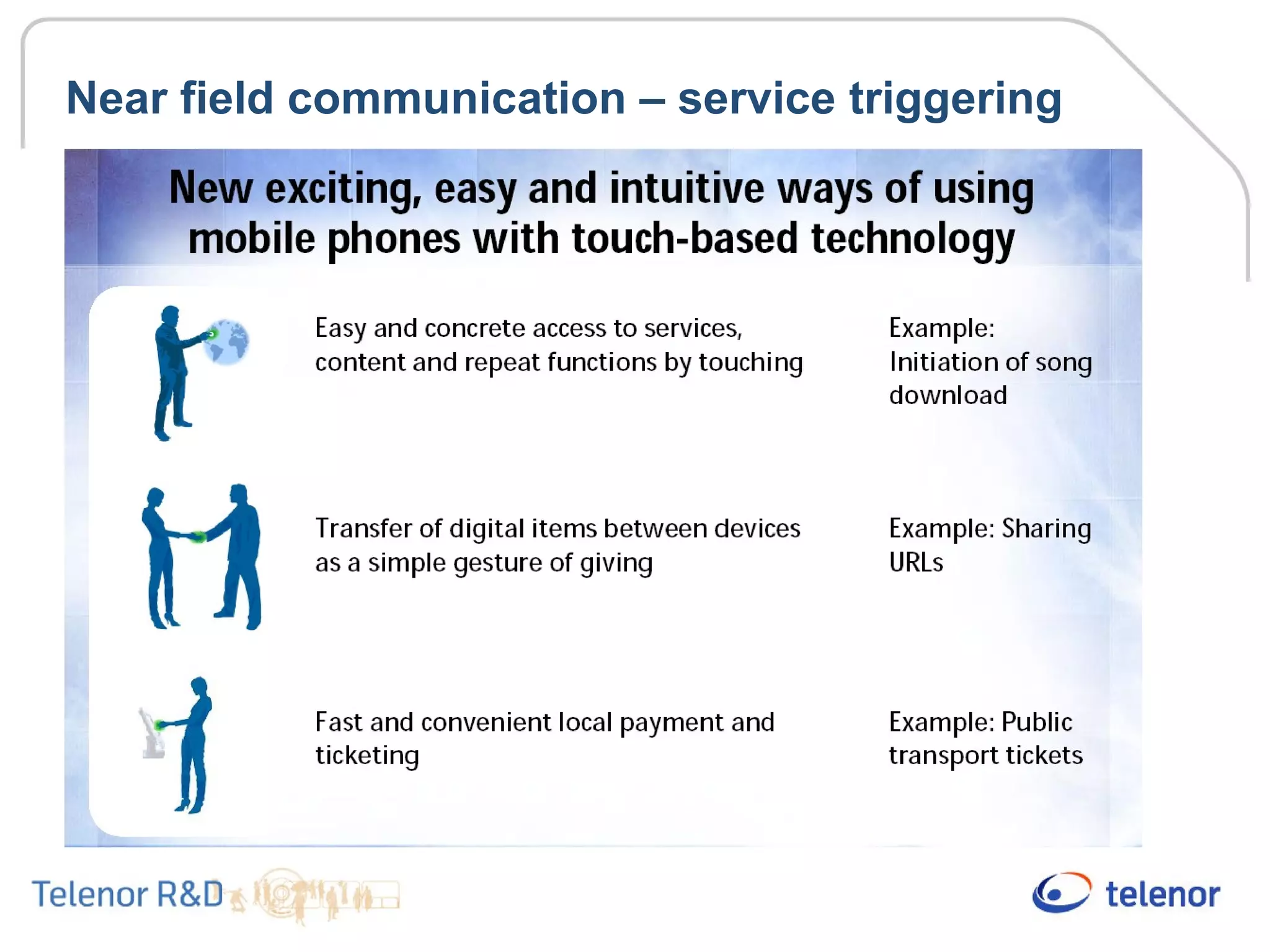

The document discusses key trends in the mobile industry including emerging mobile technologies and opportunities. It covers accelerating handset performance, new infrastructure like 3G and WiFi, ultra-low cost devices, standardization efforts through OMTP, and Microsoft's strategy to dominate the mobile platform through integration with corporate software like Exchange. New services discussed include mobile email, SAP access on phones, and proximity-based service triggering using near field communication.

![Microsoft

“We are going to invest and invest and invest to get the most

popular software platform because we believe in these [kinds of

mobile and wireless] scenarios” – Bill Gates, MS developers conference 2003

A force to be reckoned with

Won all battles so far (Windows, IE, MS Office, Windows

Media player(?), Exchange (?))

Main strength is the link between the pc / servers and the handset

(Active Sync, Exchange)

Nokia licensing of Active Sync

Potential body blow to Microsoft argues analysts

But it is not only about the sync protocol – more important

is the consistency of data structures on both sides of the

wireless / wired link.](https://image.slidesharecdn.com/mobilephonedevelopmentifi-180530143331/75/Mobile-phone-development-ifi-9-2048.jpg)