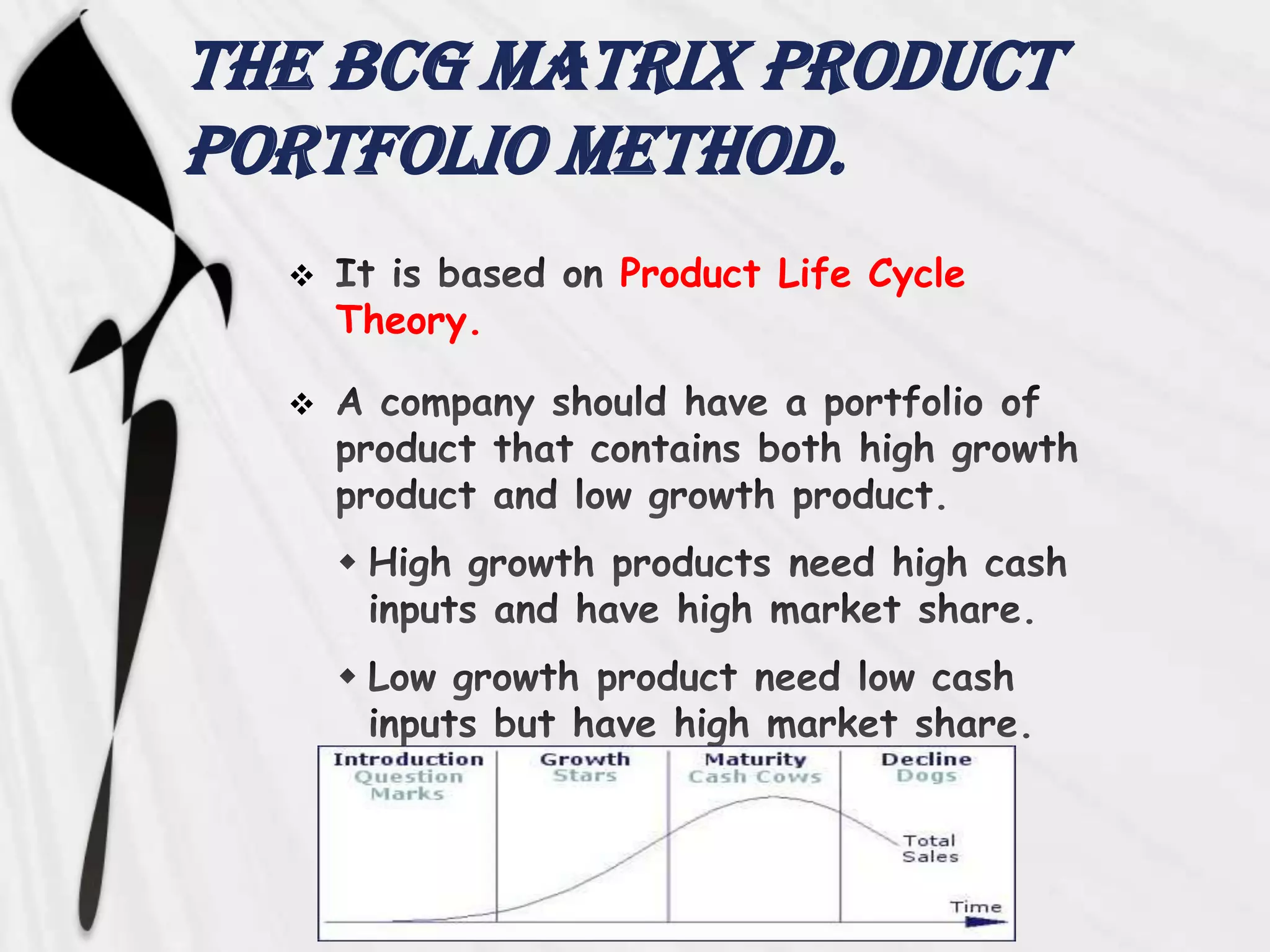

The document discusses portfolio analysis techniques, specifically the BCG growth-share matrix. It explains that the BCG matrix classifies products in a company's portfolio into four categories based on their market growth rate and relative market share: stars, question marks, cash cows, and dogs. Stars have high growth and share; cash cows have low growth but high share. Question marks and dogs have respectively high and low growth and share. The document provides guidelines for how companies should manage products in each BCG category and notes some limitations of the BCG matrix approach.