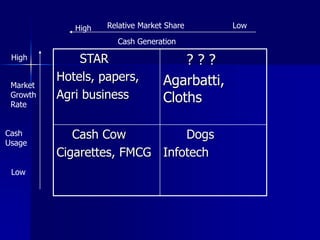

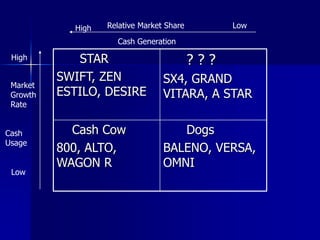

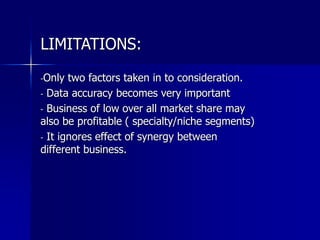

This document discusses portfolio analysis using the Boston Consulting Group (BCG) matrix. It begins by explaining the product life cycle and components of the BCG matrix including stars, cash cows, dogs, and question marks. It then provides examples of how the BCG matrix can be applied to analyze the product portfolios of ITC Ltd. and Maruti Suzuki. The document concludes by noting some limitations of only considering market growth rate and relative market share in the BCG matrix.