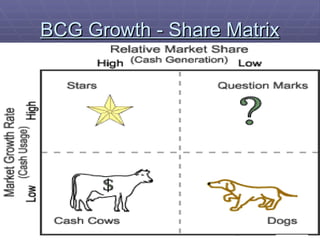

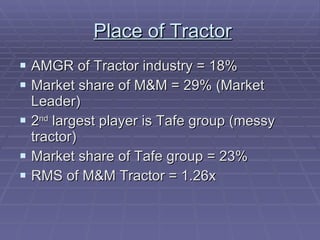

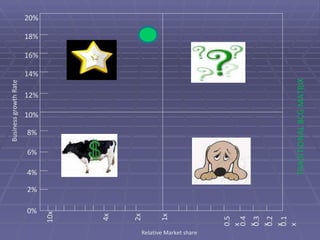

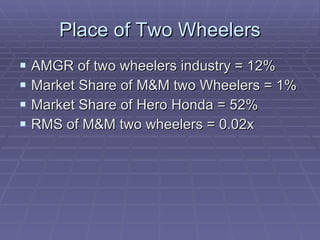

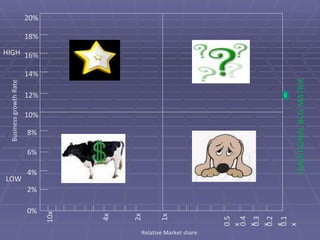

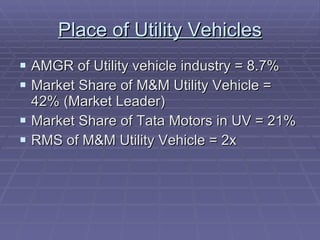

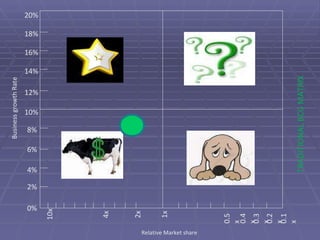

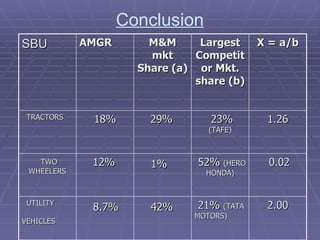

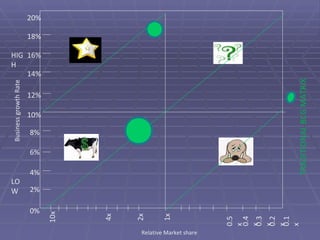

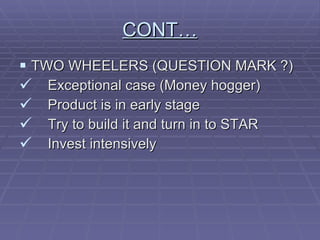

This document discusses the BCG matrix, a tool used to evaluate business units based on market share and market growth rate. It provides an overview of the four categories in the BCG matrix - stars, cash cows, question marks, and dogs. It then applies the BCG matrix to analyze different strategic business units within Mahindra & Mahindra, including tractors, two-wheelers, and utility vehicles. Based on their placement in the matrix, it recommends appropriate strategies for each unit, such as investing to protect stars or investing intensively in question marks.