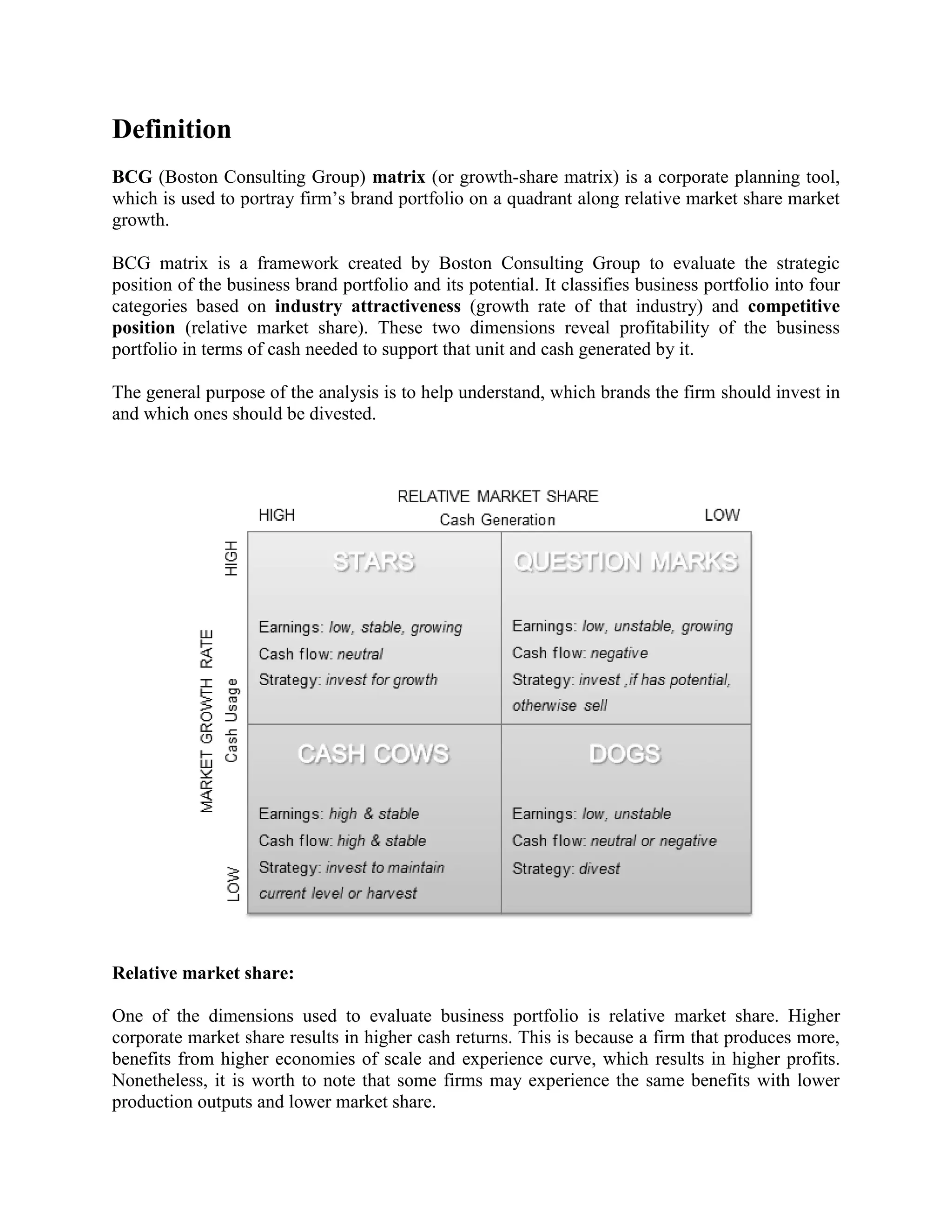

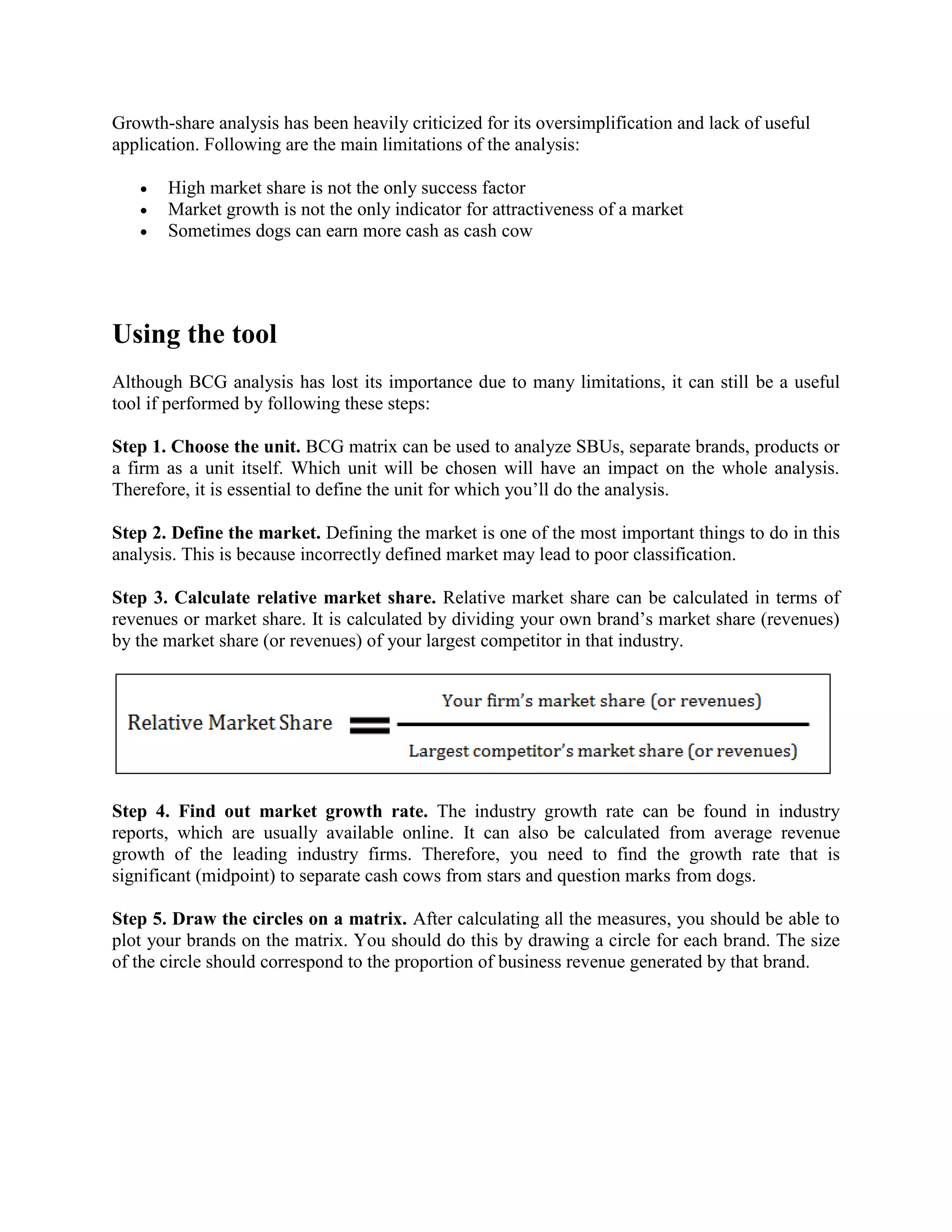

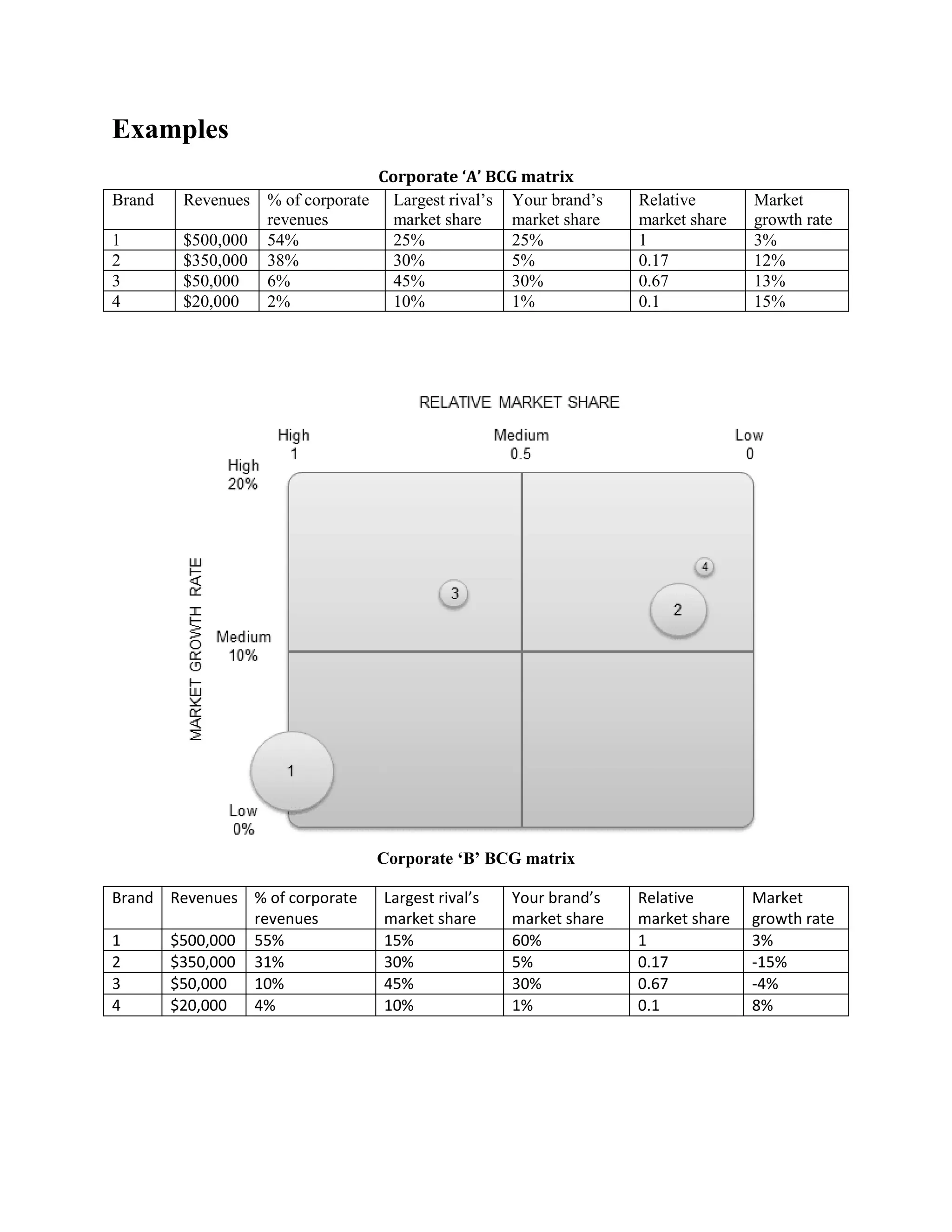

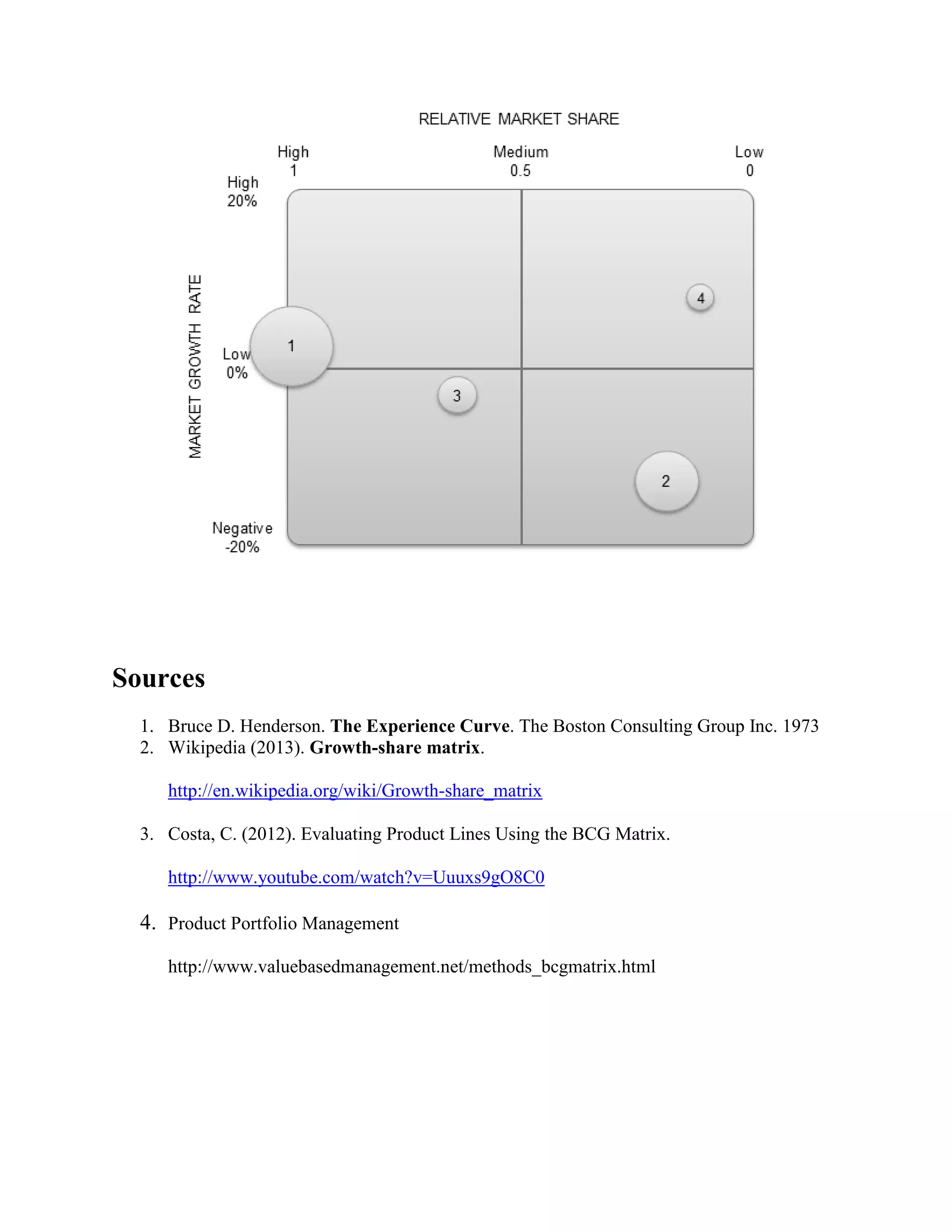

The BCG matrix is a tool used to evaluate a firm's portfolio of business units based on their relative market share and market growth rate. It categorizes units as stars, cash cows, question marks, or dogs. Stars have high market share in high growth markets and should receive investment. Cash cows have high market share in slow growth markets and generate cash. Question marks have low market share in high growth markets and require consideration. Dogs have low market share in slow growth markets and are not recommended for investment. The matrix is useful but overly simplistic, as market share and growth are not the only factors of attractiveness. It provides an initial framework but requires further analysis.