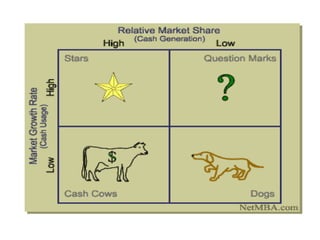

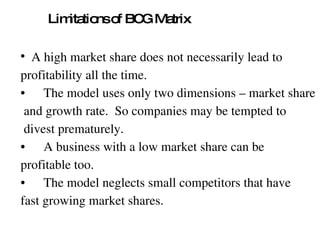

The document summarizes the Boston Consulting Group (BCG) matrix, a portfolio management tool developed in the 1970s. The BCG matrix evaluates products based on their market share and market growth. It categorizes products as Stars, Cash Cows, Question Marks or Dogs. Stars are high growth, high share products that require investment. Cash Cows are low growth, high share products that generate cash. Question Marks have high growth but low share, requiring investment. Dogs have low growth and share and should be avoided or harvested. The matrix helps companies allocate resources but has limitations like neglecting synergies between units.