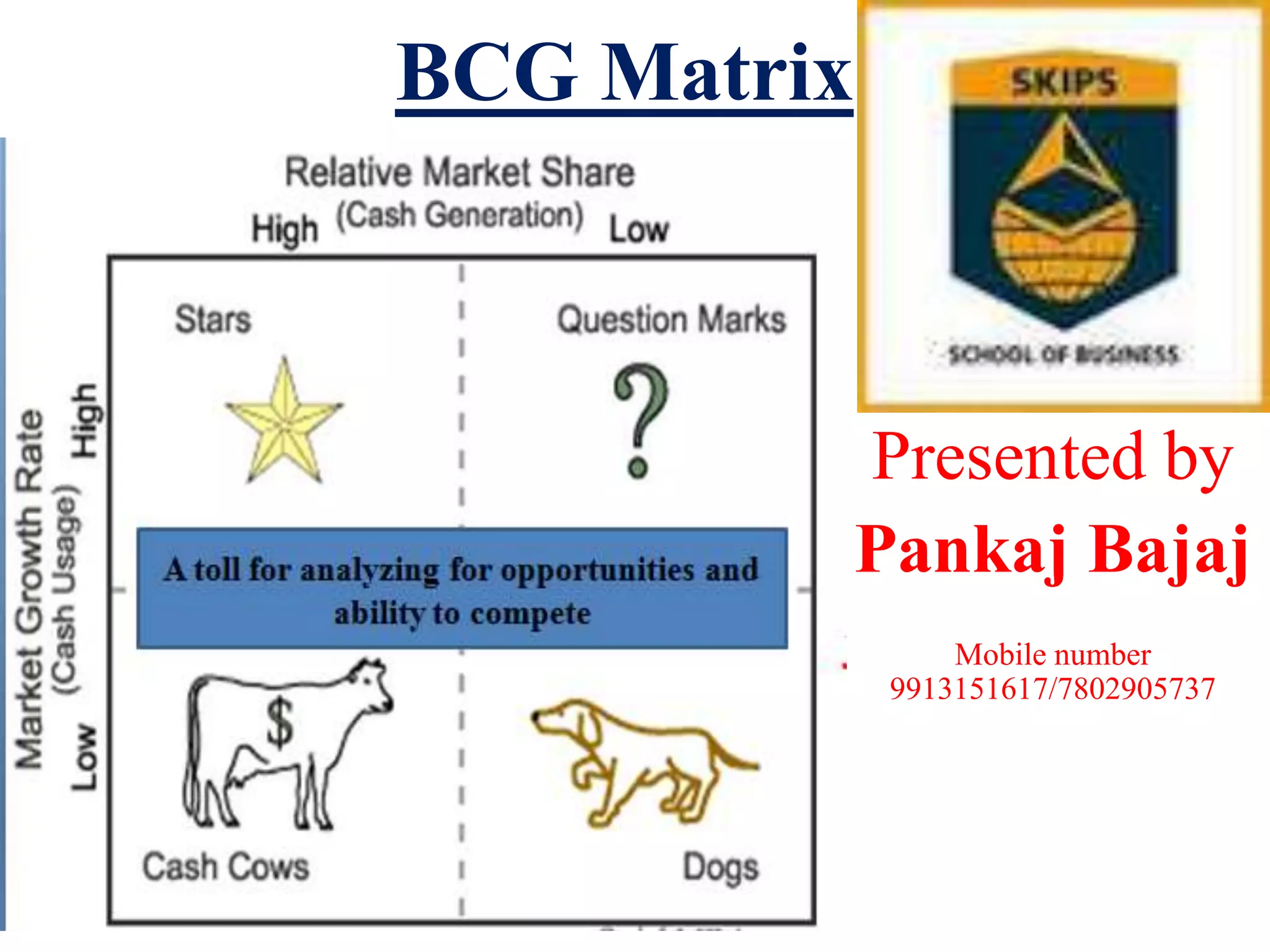

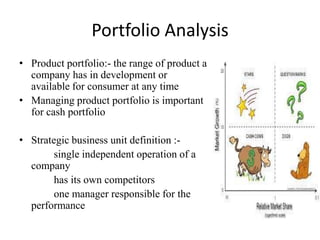

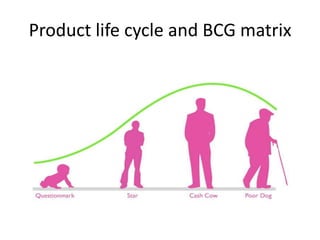

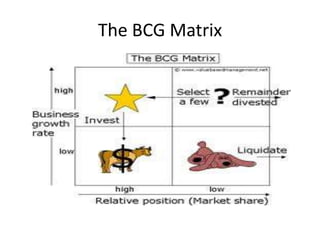

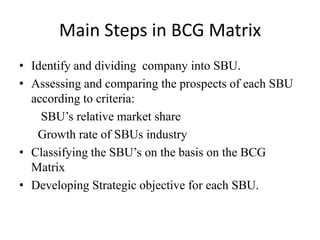

The document provides an overview of the BCG matrix, a portfolio analysis tool developed by the Boston Consulting Group in the 1970s. It outlines the history of BCG, defines key terms like market share and growth rate, describes the four categories in the BCG matrix (Stars, Question Marks, Cash Cows, and Dogs), and evaluates the benefits and limitations of using the BCG matrix to analyze a company's product portfolio.